A) larger

B) unchanged

C) smaller

D) The answer cannot be determined from the information given.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Immunization of coupon-paying bonds does not imply that the portfolio manager is inactive because: I. The portfolio must be rebalanced every time interest rates change. II. The portfolio must be rebalanced over time even if interest rates don't change. III. Convexity implies duration-based immunization strategies don't work.

A) I only

B) I and II only

C) II only

D) I, II, and III

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The exchange of one bond for a bond that has similar attributes but is more attractively priced is called ________.

A) a substitution swap

B) an intermarket spread swap

C) a rate anticipation swap

D) a pure yield pickup swap

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When bonds sell above par, what is the relationship of price sensitivity to rising interest rates?

A) Price volatility increases at an increasing rate.

B) Price volatility increases at a decreasing rate.

C) Price volatility decreases at a decreasing rate.

D) Price volatility decreases at an increasing rate.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following statements correctly describes the weights used in the Macaulay duration calculation? The weight in year t is equal to ________.

A) the dollar amount of the investment received in year t

B) the percentage of the future value of the investment received in year t

C) the present value of the dollar amount of the investment received in year t

D) the percentage of the total present value of the investment received in year t

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Rank the interest sensitivity of the following from the most sensitive to an interest rate change to the least sensitive: I. 8% coupon, noncallable 20-year maturity par bond II. 9% coupon, currently callable 20-year maturity premium bond III. Zero-coupon 30-year maturity bond

A) I, II, III

B) II, III, I

C) III, I, II

D) III, II, I

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The duration of a 5-year zero-coupon bond is ________ years.

A) 4.5

B) 5

C) 5.5

D) 3.5

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A bond pays annual interest. Its coupon rate is 9%. Its value at maturity is $1,000. It matures in 4 years. Its yield to maturity is currently 6%. The duration of this bond is ________ years.

A) 2.44

B) 3.23

C) 3.56

D) 4.1

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

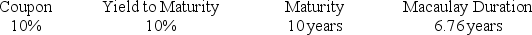

Steel Pier Company has issued bonds that pay semiannually with the following characteristics:

If the yield to maturity decreases to 8.045%, the expected percentage change in the price of the bond using modified duration would be ________.

If the yield to maturity decreases to 8.045%, the expected percentage change in the price of the bond using modified duration would be ________.

A) 11%

B) 13%

C) 12%

D) 10%

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Duration facilitates the comparison of bonds with differing ________.

A) default risks

B) conversion ratios

C) maturities

D) yields to maturity

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a type of bond swap used in active portfolio management?

A) intermarket spread swap

B) substitution swap

C) rate anticipation swap

D) asset-liability swap

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The duration of a perpetuity varies ________ with interest rates.

A) directly

B) inversely

C) convexly

D) randomly

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Duration measures

A) the effective maturity of a bond.

B) the weighted average of the time until each payment is received, with weights proportional to the present value of the payment.

C) the average maturity of the bond's promised cash flows.

D) all of the options.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An 8%, 30-year bond has a yield to maturity of 10% and a modified duration of 8 years. If the market yield drops by 15 basis points, there will be a ________ in the bond's price.

A) 1.15% decrease

B) 1.2% increase

C) 1.53% increase

D) 2.43% decrease

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A bond currently has a price of $1,050. The yield on the bond is 6%. If the yield increases 25 basis points, the price of the bond will go down to $1,030. The duration of this bond is ________ years.

A) 7.46

B) 8.08

C) 9.02

D) 10.11

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The historical yield spread between the AA bond and the AAA bond has been 25 basis points. Currently the spread is only 9 basis points. If you believe the spread will soon return to its historical levels, you should ________.

A) buy the AA and short the AAA

B) buy both the AA and the AAA

C) buy the AAA and short the AA

D) short both the AA and the AAA

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The duration rule always ________ the value of a bond following a change in its yield.

A) underestimates

B) provides an unbiased estimate of

C) overestimates

D) The estimated price may be biased either upward or downward, depending on whether the bond is trading at a discount or a premium.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A perpetuity pays $100 each and every year forever. The duration of this perpetuity will be ________ if its yield is 9%.

A) 7

B) 9

C) 9.39

D) 12.11

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is false?

A) Bond prices and yields are inversely related.

B) An increase in a bond's YTM results in a smaller price change than a decrease in yield of equal magnitude.

C) Prices of short-term bonds tend to be more sensitive to interest rate changes than prices of long-term bonds.

D) Interest rate risk is inversely related to the bond's coupon rate.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If an investment returns a higher percentage of your money back sooner, it will ________.

A) be less price-volatile

B) have a higher credit rating

C) be less liquid

D) have a higher modified duration

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 90

Related Exams