A) 1.20

B) 1.26

C) 1.32

D) 1.39

E) 1.46

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Accelerated depreciation has an advantage for profitable firms in that it moves some cash flows forward,thus increasing their present value.On the other hand,using accelerated depreciation generally lowers the reported current year's profits because of the higher depreciation expenses.However,the reported profits problem can be solved by using different depreciation methods for tax and stockholder reporting purposes.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Since the focus of capital budgeting is on cash flows rather than on net income,changes in noncash balance sheet accounts such as inventory are not included in a capital budgeting analysis.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fitzgerald Computers is considering a new project whose data are shown below.The required equipment has a 3-year tax life,after which it will be worthless,and it will be depreciated by the straight-line method over 3 years.Revenues and other operating costs are expected to be constant over the project's 3-year life.What is the project's Year 1 cash flow?

A) $28,115

B) $28,836

C) $29,575

D) $30,333

E) $31,092

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Garden-Grow Products is considering a new investment whose data are shown below.The equipment would be depreciated on a straight-line basis over the project's 3-year life,would have a zero salvage value,and would require some additional working capital that would be recovered at the end of the project's life.Revenues and other operating costs are expected to be constant over the project's life.What is the project's NPV? (Hint: Cash flows are constant in Years 1 to 3.)

A) $23,852

B) $25,045

C) $26,297

D) $27,612

E) $28,993

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Sunk costs must be considered if the IRR method is used but not if the firm relies on the NPV method.

B) A good example of a sunk cost is a situation where a bank opens a new office, and that new office leads to a decline in deposits of the bank's other offices.

C) A good example of a sunk cost is money that a banking corporation spent last year to investigate the site for a new office, then expensed that cost for tax purposes, and now is deciding whether to go forward with the project.

D) If sunk costs are considered and reflected in a project's cash flows, then the project's calculated NPV will be higher than it otherwise would be.

E) An example of a sunk cost is the cost associated with restoring the site of a strip mine once the ore has been depleted.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

VR Corporation has the opportunity to invest in a new project,the details of which are shown below.What is the Year 1 cash flow for the project?

A) $16,351

B) $17,212

C) $18,118

D) $19,071

E) $20,075

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The two cardinal rules that financial analysts should follow to avoid capital budgeting errors are: (1)in the NPV equation,the numerator should use income calculated in accordance with generally accepted accounting principles,and (2)all incremental cash flows should be considered when making accept/reject decisions.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

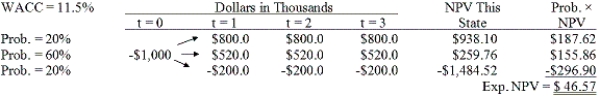

Brandt Enterprises is considering a new project that has a cost of $1,000,000,and the CFO set up the following simple decision tree to show its three most likely scenarios.The firm could arrange with its work force and suppliers to cease operations at the end of Year 1 should it choose to do so,but to obtain this abandonment option,it would have to make a payment to those parties.How much is the option to abandon worth to the firm?

A) $55.08

B) $57.98

C) $61.03

D) $64.08

E) $67.29

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Whitestone Products is considering a new project whose data are shown below.The required equipment has a 3-year tax life,and the accelerated rates for such property are 33.33%,44.45%,14.81%,and 7.41% for Years 1 through 4.Revenues and other operating costs are expected to be constant over the project's 10-year expected operating life.What is the project's Year 4 cash flow? Equipment cost (depreciable basis) Sales revenues, each year Operating costs (excl. deprec.) Tax rate

A) $11,904

B) $12,531

C) $13,190

D) $13,850

E) $14,542

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Because of improvements in forecasting techniques,estimating the cash flows associated with a project has become the easiest step in the capital budgeting process.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following procedures best accounts for the relative risk of a proposed project?

A) Adjusting the discount rate downward if the project is judged to have above-average risk.

B) Reducing the NPV by 10% for risky projects.

C) Picking a risk factor equal to the average discount rate.

D) Ignoring risk because project risk cannot be measured accurately.

E) Adjusting the discount rate upward if the project is judged to have above-average risk.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) An example of an externality is a situation where a bank opens a new office, and that new office causes deposits in the bank's other offices to decline.

B) The NPV method automatically deals correctly with externalities, even if the externalities are not specifically identified, but the IRR method does not. This is another reason to favor the NPV.

C) Both the NPV and IRR methods deal correctly with externalities, even if the externalities are not specifically identified. However, the payback method does not.

D) Identifying an externality can never lead to an increase in the calculated NPV.

E) An externality is a situation where a project would have an adverse effect on some other part of the firm's overall operations. If the project would have a favorable effect on other operations, then this is not an externality.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sylvester Media is analyzing an average-risk project,and the following data have been developed.Unit sales will be constant,but the sales price should increase with inflation.Fixed costs will also be constant,but variable costs should rise with inflation.The project should last for 3 years,it will be depreciated on a straight-line basis,and there will be no salvage value.This is just one of many projects for the firm,so any losses can be used to offset gains on other firm projects.The marketing manager does not think it is necessary to adjust for inflation since both the sales price and the variable costs will rise at the same rate,but the CFO thinks an adjustment is required.What is the difference in the expected NPV if the inflation adjustment is made vs.if it is not made?

A) $13,286

B) $13,985

C) $14,721

D) $15,457

E) $16,230

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Opportunity costs include those cash inflows that could be generated from assets the firm already owns if those assets are not used for the project being evaluated.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a firm's projects differ in risk,then one way of handling this problem is to evaluate each project with the appropriate risk-adjusted discount rate.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The primary advantage to using accelerated rather than straight-line depreciation is that with accelerated depreciation the present value of the tax savings provided by depreciation will be higher,other things held constant.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Collins Inc.is investigating whether to develop a new product.In evaluating whether to go ahead with the project,which of the following items should NOT be explicitly considered when cash flows are estimated?

A) The project will utilize some equipment the company currently owns but is not now using. A used equipment dealer has offered to buy the equipment.

B) The company has spent and expensed for tax purposes $3 million on research related to the new detergent. These funds cannot be recovered, but the research may benefit other projects that might be proposed in the future.

C) The new product will cut into sales of some of the firm's other products.

D) If the project is accepted, the company must invest $2 million in working capital. However, all of these funds will be recovered at the end of the project's life.

E) The company will produce the new product in a vacant building that was used to produce another product until last year. The building could be sold, leased to another company, or used in the future to produce another of the firm's products.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

McPherson Company must purchase a new milling machine.The purchase price is $50,000,including installation.The machine has a tax life of 5 years,and it can be depreciated according to the following rates.The firm expects to operate the machine for 4 years and then to sell it for $12,500.If the marginal tax rate is 40%,what will the after-tax salvage value be when the machine is sold at the end of Year 4?

A) $8,878

B) $9,345

C) $9,837

D) $10,355

E) $10,900

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The coefficient of variation,calculated as the standard deviation of expected returns divided by the expected return,is a standardized measure of the risk per unit of expected return.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 78

Related Exams