A) small.

B) medium.

C) med.-large.

D) large.

E) ex-largE.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

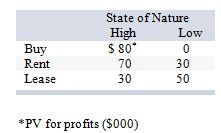

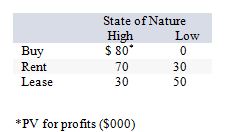

Consider the following decision scenario:  The maximax strategy would be:

The maximax strategy would be:

A) buy.

B) lease.

C) rent.

D) high.

E) low.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Among decision environments, uncertainty implies that states of nature have wide-ranging probabilities associated with them.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

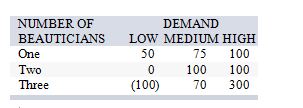

The new owner of a beauty shop is trying to decide whether to hire one, two, or three beauticians. She estimates that profits next year (in thousands of dollars) will vary with demand for her services, and she has estimated demand in three categories, low, medium, and high.

If she feels the chances of low, medium, and high demand are 50 percent, 20 percent, and 30 percent respectively, what is her expected value of perfect information?

A) $54,000

B) $65,000

C) $70,000

D) $80,000

E) $135,000

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

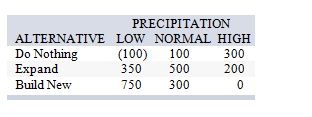

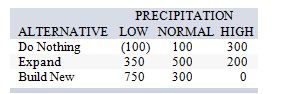

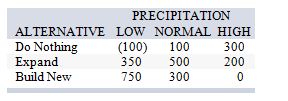

The operations manager for a well-drilling company must recommend whether to build a new facility, expand his existing one, or do nothing. He estimates that long-run profits (in $000) will vary with the amount of precipitation (rainfall) as follows:  If he uses the Laplace criterion, which alternative will he decide to select?

If he uses the Laplace criterion, which alternative will he decide to select?

A) do nothing

B) expand

C) build new

D) either do nothing or expand

E) either expand or build new

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

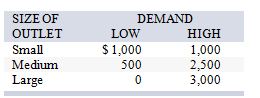

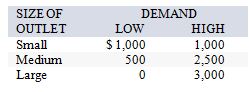

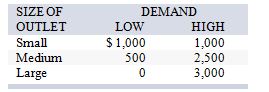

The owner of Tastee Cookies needs to decide whether to lease a small, medium, or large new retail outlet. She estimates that monthly profits will vary with demand for her cookies as follows:  For what range of probability that demand will be high, will she decide to lease the large facility?

For what range of probability that demand will be high, will she decide to lease the large facility?

A) 0-.25

B) 0-.33

C) .25-.5

D) .33-1

E) .5-1

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

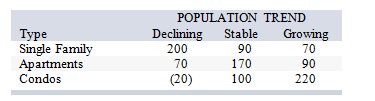

The construction manager for Acme Construction, Inc., must decide whether to build single-family homes, apartments, or condominiums. He estimates annual profits (in $000) will vary with the population trend as follows:  If he uses the Laplace criterion, which kind of dwellings will he decide to build?

If he uses the Laplace criterion, which kind of dwellings will he decide to build?

A) single family

B) apartments

C) condos

D) either single family or apartments

E) either apartments or condos

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The owner of Tastee Cookies needs to decide whether to lease a small, medium, or large new retail outlet. She estimates that monthly profits will vary with demand for her cookies as follows:  For what range of probability that demand will be high, will she decide to lease the small facility?

For what range of probability that demand will be high, will she decide to lease the small facility?

A) 0-.25

B) 0-.33

C) .25-.5

D) .33-1

E) .5-1

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The operations manager for a well-drilling company must recommend whether to build a new facility, expand his existing one, or do nothing. He estimates that long-run profits (in $000) will vary with the amount of precipitation (rainfall) as follows:  If he uses the maximax criterion, which alternative will he decide to select?

If he uses the maximax criterion, which alternative will he decide to select?

A) do nothing

B) expand

C) build new

D) either do nothing or expand

E) either expand or build new

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of these is not used in decision making under risk?

A) EVPI

B) EMV

C) decision trees

D) minimax regret

E) All are used for risk situations.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

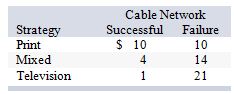

The advertising manager for Roadside Restaurants, Inc., needs to decide whether to spend this month's budget for advertising on print media, television, or a mixture of the two. She estimates that the cost per thousand "hits" (readers or viewers) will vary depending upon the success of the new cable television network she plans to use, as follows:  If she uses the maximax criterion, which advertising strategy will she use?

If she uses the maximax criterion, which advertising strategy will she use?

A) print

B) mixed

C) television

D) either print or mixed

E) either mixed or television

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following characterizes decision making under uncertainty?

A) Decision makers must rely on probabilities in assessing outcomes.

B) The likelihood of possible future events is unknown.

C) Relevant parameters have known values.

D) Certain parameters have probabilistic outcomes.

E) Lack of knowledge about how risk-averse the decision maker is.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The operations manager for a local bus company wants to decide whether he should purchase a small, medium, or large new bus for his company. He estimates that the annual profits (in $000) will vary depending upon whether passenger demand is low, medium, or high, as follows: If he uses the maximin criterion, which size bus will he decide to purchase?

A) small

B) medium

C) large

D) either small or medium

E) either medium or large

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The difference between expected payoff under certainty and expected payoff under risk is the expected:

A) monetary value.

B) value of perfect information.

C) net present value.

D) rate of return.

E) profit.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider the following decision scenario:  The maximin strategy would be:

The maximin strategy would be:

A) buy.

B) lease.

C) rent.

D) rent or leasE.

E) buy low.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One local hospital has just enough space and funds currently available to start either a cancer or heart research lab. If administration decides on the cancer lab, there is a 20 percent chance of getting $100,000 in outside funding from the American Cancer Society next year, and an 80 percent chance of getting nothing. If the cancer research lab is funded the first year, no additional outside funding will be available the second year. However, if it is not funded the first year, then management estimates the chances are 50 percent it will get $100,000 the following year, and 50 percent that it will get nothing again. If, however, the hospital's management decides to go with the heart lab, then there is a 50 percent chance of getting $50,000 in outside funding from the American Heart Association the first year and a 50 percent chance of getting nothing. If the heart lab is funded the first year, management estimates a 40 percent chance of getting another $50,000 and a 60 percent chance of getting nothing additional the second year. If it is not funded the first year, then management estimates a 60 percent chance for getting $50,000 and a 40 percent chance for getting nothing in the following year. For both the cancer and heart research labs, no further possible funding is anticipated beyond the first two years. What would be the total payoff if the heart lab were funded in both the first and second years?

A) $100,000

B) $60,000

C) $50,000

D) $40,000

E) $20,000

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The owner of Tastee Cookies needs to decide whether to lease a small, medium, or large new retail outlet. She estimates that monthly profits will vary with demand for her cookies as follows:  If she feels there is a 30 percent chance that demand will be high, what is her expected payoff under certainty?

If she feels there is a 30 percent chance that demand will be high, what is her expected payoff under certainty?

A) $1,600

B) $1,100

C) $1,000

D) $900

E) $500

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tabular presentation that shows the outcome for each decision alternative under the various possible states of nature is called a:

A) payoff tablE.

B) feasible region.

C) Laplace table.

D) decision tree.

E) payback period matrix.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

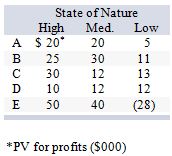

Consider the following decision scenario:  The maximax strategy would be:

The maximax strategy would be:

A) A.

B) B.

C) C.

D) D.

E) E.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The operations manager for a well-drilling company must recommend whether to build a new facility, expand his existing one, or do nothing. He estimates that long-run profits (in $000) will vary with the amount of precipitation (rainfall) as follows:  If he feels the chances of low, normal, and high precipitation are 30 percent, 20 percent, and 50 percent respectively, what is his expected value of perfect information?

If he feels the chances of low, normal, and high precipitation are 30 percent, 20 percent, and 50 percent respectively, what is his expected value of perfect information?

A) $140,000

B) $170,000

C) $285,000

D) $305,000

E) $475,000

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 114

Related Exams