A) The revenue earned from selling sold goods in the current year to customers who have not yet paid for those goods (that is, they have promised to pay for those goods next year) .

B) The amount of cash received from customers this year as payment for goods that were sold to those customers last year.

C) The proceeds from a borrowing from the bank that was to be used to finance business activities during the current year.

D) The proceeds from the issuance of common stock to owners that was to be used to finance business activities during the current year.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of these appears on both the income statement and the statement of retained earnings?

A) Cash

B) Revenues

C) Expenses

D) Net income

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mauricio invested $30,000 in Pizza Aroma in exchange for its stock.Pizza Aroma now has:

A) a liability.

B) retained earnings.

C) common stock.

D) net income.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Universal Corp.has beginning Retained Earnings of $80,000,cash flows from operating activities during the current year of $35,000,dividends paid during the year of $5,000,net income for the current year of $50,000,and Common Stock at the end of the year of $15,000.What is the amount of its Retained Earnings at the end of the year?

A) $125,000

B) $140,000

C) $160,000

D) $175,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cash activity with stockholders and creditors,such as banks,are reported as cash flows from ______ activities on the statement of cash flows.

A) financing

B) investing

C) operating

D) managing

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following are the three basic elements of the balance sheet?

A) assets, liabilities, and retained earnings.

B) assets, liabilities, and common stock.

C) assets, liabilities, and revenues.

D) assets, liabilities, and stockholders' equity.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

You paid $10,000 to buy 1% of the stock in a corporation that is now bankrupt.The company owes $10 million dollars to its creditors.As a result of the bankruptcy,you are responsible for paying $100,000 (or $10 million × 1%)of the amount owed to the creditors.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

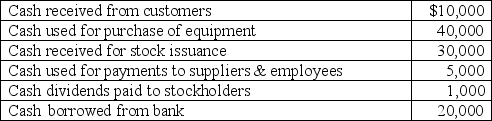

The Statement of Cash Flows for the current year contained the following:

The change in cash for the current year was an increase of $14,000.

-Use the information above to answer the following question.What is the amount of cash flows from (used in) financing activities?

The change in cash for the current year was an increase of $14,000.

-Use the information above to answer the following question.What is the amount of cash flows from (used in) financing activities?

A) ($40,000)

B) $5,000

C) $49,000

D) $10,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company started the year with the following: Assets $100,000; Liabilities $30,000; Common Stock $60,000; Retained Earnings $10,000.During the year, the company earned revenue of $5,000, all of which was received in cash, and incurred expenses of $3,000, all of which were unpaid as of the end of the year.In addition, the company paid dividends of $1,000 to owners.Assume no other activities occurred during the year. -Use the information above to answer the following question.The amount of liabilities at the end of the year is

A) $30,000.

B) $33,000.

C) $28,000.

D) $32,000.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Creditors are mainly interested in the profitability of a company.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pizza Aroma delivered $500 of pizzas to the local high school,but hasn't received payment yet.Pizza Aroma will report:

A) nothing, because payment hasn't been received yet.

B) Cash of $500, because the school will pay for the pizzas eventually.

C) Accounts payable of $500.

D) Accounts receivable of $500.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

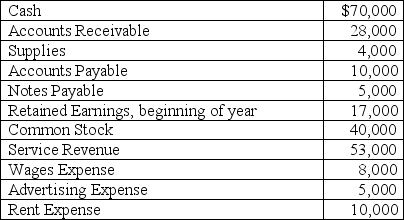

Use the following information to answer questions 130 - 132:

A company's financial records at the end of the year including the following amounts:

-Use the information above to answer the following question.What is the amount of net income on the income statement for the year?

-Use the information above to answer the following question.What is the amount of net income on the income statement for the year?

A) $30,000.

B) $38,000.

C) $88,000.

D) $47,000.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the U.S.,public companies have to be audited by independent auditors using rules approved by the:

A) International Accounting Standards Board (IASB) .

B) Public Company Accounting Oversight Board (PCAOB) .

C) Financial Accounting Standards Board (FASB) .

D) American Institute of Certified Public Accountants (AICPA) ..

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company started the current year with assets of $700,000, liabilities of $350,000 and common stock of $200,000.During the current year, assets increased by $400,000, liabilities decreased by $50,000 and common stock increased by $275,000.There was no payment of dividends to owners during the year. -Use the information above to answer the following question.What was the amount of net income for the year?

A) $225,000.

B) $275,000.

C) $175,000.

D) $450,000.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

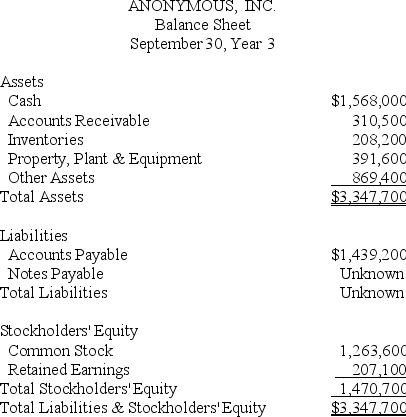

-Use the information above to answer the following question.What is the missing amount for Total Liabilities?

-Use the information above to answer the following question.What is the missing amount for Total Liabilities?

A) $3,347,700.

B) $1,439,200.

C) $1,470,700.

D) $1,877,000.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The Securities and Exchange Commission (SEC)is the government agency that has primary responsibility for setting accounting standards in the U.S.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Sarbanes-Oxley Act is a set of laws established to:

A) limit the amount of compensation received by executives in publicly traded companies.

B) strengthen corporate reporting in the United States.

C) enhance the conceptual framework of GAAP.

D) re-define the display of financial statements.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Maxine's Bakery recorded $220,000 in revenues, $165,000 in expenses, and $30,000 of dividends for the year.The company began the year with total assets of $190,000 and stockholder's equity of $87,000. -Use the information above to answer the following question.What net income (loss) was reported by Maxine's Bakery for the year?

A) $25,000

B) $63,000

C) $55,000

D) $33,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A creditor might look at a company's financial statements to determine if the:

A) company is likely to have the resources to repay its debts.

B) company's stock price is likely to fall, signaling a good time to sell.

C) company's stock price is likely to rise, signaling a good time to buy.

D) company pays a dividend.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The daily activities involved in running a business,such as buying supplies and paying salaries and wages,are classified as operating activities on the statement of cash flows.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 211

Related Exams