A) Fixed asset turnover

B) Net profit margin

C) Inventory turnover

D) Earnings per share

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Company A has a receivables turnover of 8.0.Company B has a receivables turnover of 10.0.Which of the following statements is correct?

A) Company A collects its receivables faster than Company B.

B) Company B collects its receivables faster than Company A.

C) Company A makes more sales on account than Company B.

D) Company B makes more sales on account than Company A.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which events may indicate going-concern problems?

A) An increase in research and development costs

B) A decrease in barriers to expansion

C) Additions of patents

D) Loss of a key supplier or customer

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is calculated by dividing cost of goods sold by average inventory and then dividing this result into 365 days?

A) Inventory turnover

B) Current ratio

C) Days to collect ratio

D) Days to sell ratio

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a profitability ratio?

A) Return on equity

B) Times interest earned

C) Inventory turnover

D) Receivables turnover

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The ratio that measures the percentage of financing from creditors is the:

A) current ratio.

B) times interest earned ratio.

C) debt-to-assets ratio.

D) Price/Earnings ratio.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

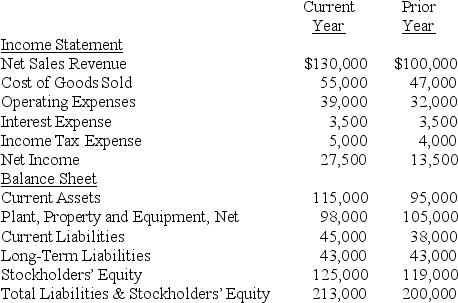

The comparative financial statements of B.Darin include the following data:

-Use the information above to answer the following question.The fixed asset turnover ratio for the current year is closest to:

-Use the information above to answer the following question.The fixed asset turnover ratio for the current year is closest to:

A) 1.28.

B) 1.24.

C) 0.75.

D) 1.64.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following factors would cause the least amount of concern about a company's ability to continue as a going-concern?

A) Excessive reliance on debt financing

B) Loss of key personnel without comparable replacement

C) Inadequate maintenance of long-lived assets

D) Declining profit margins

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If the debt-to-assets ratio is 0.63,it means that 37% of the company's financing has been provided by stockholders' equity.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company's sales are $285,000 and $200,000 during the current and prior years,respectively.The percentage change is:

A) 42.5%.

B) 70%.

C) 29.8%.

D) 130%.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If net income is rising,but net sales revenue and the gross profit percentage remain the same,then:

A) operating expenses are falling.

B) operating expenses are rising.

C) cost of goods sold is falling.

D) cost of goods sold is rising.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the measures below is used to measure liquidity?

A) Current ratio

B) Debt-to-assets ratio

C) Price ÷ Earnings ratio

D) Times interest earned

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is calculated by dividing net income by revenues?

A) Gross profit margin

B) Current ratio

C) Net profit margin

D) Asset turnover

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company has earnings per share of $1.20,it paid a dividend of $.50 per share,and the market price of the company's stock is $45 per share.The price/earnings ratio is closest to:

A) 37.50.

B) 64.29.

C) 2.40.

D) 2.0.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company has $72,500 in inventory at the beginning of the accounting period and $65,500 at the end of the accounting period.Sales revenue is $986,400,cost of goods sold is $572,700,and net income is $124,200 for the accounting period.On average,the number of days to sell inventory is approximately:

A) 203.

B) 44.

C) 61.

D) 26.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of these is not one of the categories of ratio analysis?

A) Profitability

B) Liquidity

C) Solvency

D) Probability

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which type of analysis could reveal that a company is relying heavily on debt financing?

A) Common size statements

B) Horizontal analysis

C) The fixed asset turnover ratio

D) Trend analysis

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following ratios is calculated by dividing net income by revenues?

A) Return on equity ratio

B) Net profit margin ratio

C) Current ratio

D) Fixed asset turnover ratio

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Vertical analysis:

A) identifies the relative contribution made by each financial statement line item.

B) identifies trends over time .

C) provides an understanding of the relationships among various items on financial statements by expressing the differences in terms of dollars.

D) involves comparing amounts across different financial statements.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company's comparative balance sheet show total assets of $990,000 and $900,000,for the current and prior years,respectively.The percentage change to be reported in the horizontal analysis is an increase of:

A) 10%.

B) 9%.

C) 5%.

D) 4%.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 170

Related Exams