B) False

Correct Answer

verified

Correct Answer

verified

True/False

A tax on buyers increases the size of a market.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When a free market for a good reaches equilibrium, anyone who is willing and able to pay the market price can buy the good.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

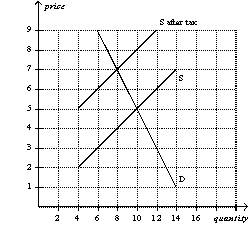

Figure 6-19  -Refer to Figure 6-19. Which of the following is correct?

-Refer to Figure 6-19. Which of the following is correct?

A) One-fourth of the burden of the tax falls on buyers, and three-fourths of the burden of the tax falls on sellers.

B) One-third of the burden of the tax falls on buyers, and two-thirds of the burden of the tax falls on sellers.

C) One-half of the burden of the tax falls on buyers, and one-half of the burden of the tax falls on sellers.

D) Two-thirds of the burden of the tax falls on buyers, and one-third of the burden of the tax falls on sellers.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax on sellers will shift the

A) demand curve upward by the amount of the tax.

B) demand curve downward by the amount of the tax.

C) supply curve upward by the amount of the tax.

D) supply curve downward by the amount of the tax.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The price paid by buyers in a market will increase if the government (i) Increases a binding price floor in that market.(ii) Increases a binding price ceiling in that market.(iii) Decreases a tax on the good sold in that market.

A) (ii) only

B) (iii) only

C) (i) and (ii) only

D) (i) , (ii) , and (iii)

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Regardless of whether a tax is levied on sellers or buyers, taxes encourage market activity.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

One common example of a price ceiling is rent control.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following causes a shortage of a good?

A) a binding price floor

B) a binding price ceiling

C) a tax on the good

D) None of the above is correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a tax is levied on sellers of tea,

A) the well-being of both sellers and buyers of tea is unaffected.

B) sellers of tea are made worse off, and the well-being of buyers is unaffected.

C) sellers of tea are made worse off, and buyers of tea are made better off.

D) both sellers and buyers of tea are made worse off.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

A price ceiling set above the equilibrium price causes a surplus in the market.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The burden that results from a tax on yachts falls more heavily on the buyers of yachts than on the sellers of yachts.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

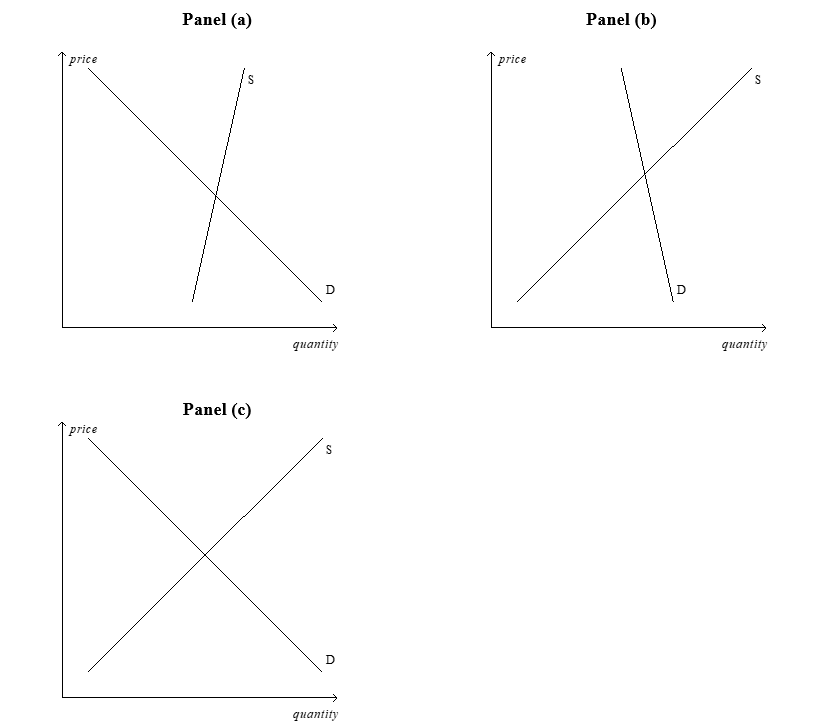

Figure 6-25

-Refer to Figure 6-25. In which market will the tax burden be most equally divided between buyers and sellers?

-Refer to Figure 6-25. In which market will the tax burden be most equally divided between buyers and sellers?

A) market (a)

B) market (b)

C) market (c)

D) All of the above are correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

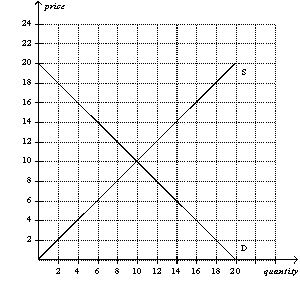

Figure 6-10  -Refer to Figure 6-10. A price ceiling set at

-Refer to Figure 6-10. A price ceiling set at

A) $6 will be binding and will result in a shortage of 8 units.

B) $6 will be binding and will result in a shortage of 4 units.

C) $16 will be binding and will result in a shortage of 12 units.

D) $16 will be binding and will result in a shortage of 6 units.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A price ceiling is binding when it is set

A) above the equilibrium price, causing a shortage.

B) above the equilibrium price, causing a surplus.

C) below the equilibrium price, causing a shortage.

D) below the equilibrium price, causing a surplus.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a tax is placed on the buyers of tennis racquets, the size of the tennis racquet market

A) and the price paid by buyers both decrease.

B) decreases, but the price paid by buyers increases.

C) increases, but the price paid by buyers decreases.

D) and the price paid by buyers both increase.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The minimum wage was instituted to ensure workers

A) a middle-class standard of living.

B) employment.

C) a minimally adequate standard of living.

D) unemployment compensation.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One economist has argued that rent control is "the best way to destroy a city, other than bombing." Why would an economist say this?

A) He fears that low rents will cause low-income people to move into the city, reducing the quality of life for other people.

B) He fears that rent control will benefit landlords at the expense of tenants, increasing inequality in the city.

C) He fears that rent controls will cause a construction boom, which will make the city crowded and more polluted.

D) He fears that rent control will eliminate the incentive to maintain buildings, leading to a deterioration of the city.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

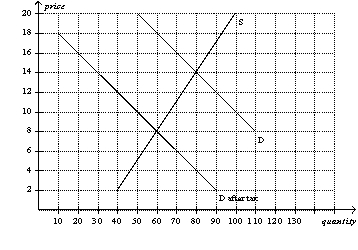

Figure 6-23  -Refer to Figure 6-23. The per-unit burden of the tax is

-Refer to Figure 6-23. The per-unit burden of the tax is

A) $4 for buyers and $6 for sellers.

B) $5 for buyers and $5 for sellers.

C) $6 for buyers and $4 for sellers.

D) $10 for buyers and $0 for sellers.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A price ceiling will be binding only if it is set

A) equal to the equilibrium price.

B) above the equilibrium price.

C) below the equilibrium price.

D) either above or below the equilibrium price.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 201 - 220 of 556

Related Exams