A) Turkish

B) U.S.

C) Indonesian

D) U.K.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

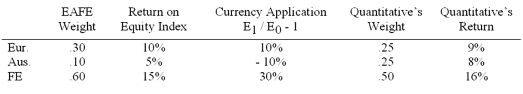

The manager of Quantitative International Fund uses EAFE as a benchmark.Last year's performance for the fund and the benchmark were as follows:  Calculate Quantitative's currency selection return contribution.

Calculate Quantitative's currency selection return contribution.

A) +20%

B) -5%

C) +15%

D) +5%

E) -10%

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the 1-year risk-free rate of return in the U.S.is 4% and the 1-year risk-free rate of return in Britain is 7%.The current exchange rate is 1 pound = U.S.$1.65.A 1-year future exchange rate of __________ for the pound would make a U.S.investor indifferent between investing in the U.S.security and investing in the British security.

A) 1.6037

B) 2.0411

C) 1.7500

D) 2.3369

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Exchange rate risk

A) results from changes in the exchange rates between the currency of the investor and the country in which the investment is made.

B) can be hedged by using a forward or futures contract in foreign exchange.

C) cannot be eliminated.

D) results from changes in the exchange rates between the currency of the investor and the country in which the investment is made and cannot be eliminated.

E) results from changes in the exchange rates between the currency of the investor and the country in which the investment is made and can be hedged by using a forward or futures contract in foreign exchange.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The developed country with the lowest average local-currency equity-market excess return between 2002-2011 is

A) Greece.

B) Korea.

C) U.K.

D) U.S.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume there is a fixed exchange rate between the Canadian and U.S.dollar.The expected return and standard deviation of return on the U.S.stock market are 18% and 15%, respectively.The expected return and standard deviation on the Canadian stock market are 13% and 20%, respectively.The covariance of returns between the U.S.and Canadian stock markets is 1.5%. If you invested 50% of your money in the Canadian stock market and 50% in the U.S.stock market, the standard deviation of return of your portfolio would be

A) 12.53%.

B) 15.21%.

C) 17.50%.

D) 18.75%.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The emerging market country with the highest average local-currency equity-market excess return between 2002-2011 is

A) China.

B) Colombia.

C) Poland.

D) Turkey.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The __________ index is a widely used index of non-U.S.stocks.

A) CBOE

B) Dow Jones

C) EAFE

D) All of the options

E) None of the options

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

__________ refers to the possibility of expropriation of assets, changes in tax policy, and the possibility of restrictions on foreign exchange transactions.

A) Default risk

B) Foreign exchange risk

C) Market risk

D) Political risk

E) None of the options

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The developed country with the highest average U.S.dollar equity-market excess return between 2002-2011 is

A) Japan.

B) Norway.

C) Austria.

D) U.S.

F) All of the above

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

The developed country with the highest average local-currency equity-market excess return between 2002-2011 is

A) Japan.

B) Norway.

C) U.K.

D) U.S.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The __________ equity market had the lowest average local currency excess return between 2002-2011.

A) Colombian

B) Greece

C) U.K.

D) U.S.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The __________ equity market had the lowest average local currency standard deviation of excess returns between 2002-2011.

A) Turkish

B) Finnish

C) Indonesian

D) Australia

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The major concern that has been raised with respect to the weighting of countries within the EAFE index is

A) currency volatilities are not considered in the weighting.

B) cross-correlations are not considered in the weighting.

C) inflation is not represented in the weighting.

D) the weights are not proportional to the asset bases of the respective countries.

E) None of the options

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

__________ are mutual funds that invest in one country only.

A) ADRs

B) ECUs

C) Single-country funds

D) All of the options

E) None of the options

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

WEBS portfolios

A) are passively managed.

B) are shares that can be sold by investors.

C) are free from brokerage commissions.

D) are passively managed and are shares that can be sold by investors.

E) All of the options.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The average country equity market share is

A) less than 2%.

B) between 3% and 4%.

C) between 5% and 7%.

D) between 7% and 8%.

E) greater than 8%.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The performance of an internationally diversified portfolio may be affected by

A) country selection.

B) currency selection.

C) stock selection.

D) All of the options

E) None of the options

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following countries has an equity index that lies on the efficient frontier generated by allowing international diversification

A) The United States

B) The United Kingdom

C) Japan

D) Norway

E) None of the options-each of these countries' indexes fall inside the efficient frontier.

G) A) and B)

Correct Answer

verified

E

Correct Answer

verified

Multiple Choice

Suppose the 1-year risk-free rate of return in the U.S.is 5%.The current exchange rate is 1 pound = U.S.$1.60.The 1-year forward rate is 1 pound = $1.57.What is the minimum yield on a 1-year risk-free security in Britain that would induce a U.S.investor to invest in the British security

A) 2.44%

B) 2.50%

C) 7.00%

D) 7.62%

E) None of the options

G) B) and C)

Correct Answer

verified

C

Correct Answer

verified

Showing 1 - 20 of 52

Related Exams