A) spot

B) forward

C) futures

D) option

E) swap

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The idea that the exchange rate adjusts to keep buying power constant among currencies is called:

A) interest rate parity.

B) uncovered interest rate parity.

C) purchasing power parity.

D) the international Fisher effect.

E) the unbiased forward rates condition.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

_____ holds because of the possibility of covered interest arbitrage.

A) Uncovered interest parity

B) Interest rate parity

C) The international Fisher effect

D) Unbiased forward rates

E) Purchasing power parity

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following are the basic kinds of swaps?

A) Interest rate.

B) Management.

C) Currency.

D) Both A and C.

E) None of the above

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The camera you want to buy costs $399 in the U.S.If absolute purchasing power parity exists,the identical camera will cost _____ in Canada if the exchange rate is C$1 = $.8349.

A) C$366.67

B) C$477.90

C) C$505.09

D) C$542.93

E) C$566.67

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You want to invest in a project in Canada.The project has an initial cost of C$1.2 million and is expected to produce cash inflows of C$600,000 a year for 3 years.The project will be worthless after the first 3 years.The expected inflation rate in Canada is 4% while it is only 3% in the U.S.The applicable interest rate in Canada is 8%.The current spot rate is C$1 = $.69.What is the net present value of this project in Canadian dollars using the foreign currency approach?

A) C$335,974

B) C$342,795

C) C$346,258

D) C$349,721

E) C$356,750

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The idea that commodities have the same value no matter where they are purchased or what currency is used is known as _____ parity.

A) uncovered interest rate

B) relative purchasing power

C) interest rate

D) absolute purchasing power

E) forward exchange rates

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The current spot rate is C$1.362 and the one-year forward rate is C$1.371.The nominal risk-free rate in Canada is 6% while it is 3.5% in the U.S.Using covered interest arbitrage you can earn an extra _____ profit over that which you would earn if you invested $1 in the U.S.

A) $.0018

B) $.0045

C) $.0120

D) $.0180

E) $.0240

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The unbiased forward rate is a:

A) condition where a future spot rate is equal to the current spot rate.

B) guarantee of a future spot rate at one point in time.

C) condition where the spot rate is expected to remain constant over a period of time.

D) relationship between the future spot rate of two currencies at an equivalent point in time.

E) predictor of the future spot rate at the equivalent point in time.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The spot rate for the British pound currently is .55 per $1.The one-year forward rate is .58 per $1.A risk-free asset in the U.S.is currently earning 2%.If interest rate parity holds,approximately what rate can you earn on a one-year risk-free British security?

A) 4.01%

B) 4.31%

C) 6.22%

D) 7.56%

E) 8.62%

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The implicit exchange rate between two currencies when both are quoted in some third currency is called a(n) :

A) open exchange rate.

B) cross-rate.

C) backward rate.

D) forward rate.

E) interest rate.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that the spot rate on the Canadian dollar is C$1.15.The risk-free nominal rate in the U.S.is 5% while it is only 4% in Canada.Which one of the following three-year forward rates best establishes the approximate interest rate parity condition?

A) C$1.116

B) C$1.125

C) C$1.132

D) C$1.146

E) C$1.159

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are planning a trip to Australia.Your hotel will cost you A$220 per night for five nights.You expect to spend another A$3,250 for meals,tours,souvenirs,and so forth.How much will this trip cost you in U.S.dollars given the following exchange rates?

A) $2,125

B) $2,248

C) $2,598

D) $2,958

E) $3,310

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

"A commodity costs the same regardless of what currency is used to purchase it." This is a statement of:

A) Absolute Purchasing Power Parity.

B) Relative Purchasing Power Parity.

C) The First Principle of International Finance.

D) The Conservation of Currency Value.

E) None of the above.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following statements is correct assuming that exchange rates are quoted as units of foreign currency per dollar?

A) The exchange rate moves opposite to the value of the dollar.

B) The exchange rate is unaffected by differences in the inflation rates of the two countries.

C) The exchange rate falls as the dollar strengthens.

D) When a foreign currency appreciates in value it strengthens relative to the dollar.

E) The exchange rate rises when the U.S.inflation rate is higher than the foreign country's.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The expected inflation rate in Finland is 2% while it is 4% in the U.S.A risk-free asset in the U.S.is yielding 5.5%.What real rate of return should you expect on a risk-free Norwegian security?

A) 2.0%

B) 2.5%

C) 3.0%

D) 3.5%

E) 4.0%

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The condition stating that the interest rate differential between two countries is equal to the percentage difference between the forward exchange rate and the spot exchange rate is called:

A) interest rate parity.

B) purchasing power parity.

C) the international Fisher effect.

D) uncovered interest rate parity.

E) the unbiased forward rates condition.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The spot rate for the Japanese yen currently is *106 per $1.The one-year forward rate is *105 per $1.A risk-free asset in Japan is currently earning 3%.If interest rate parity holds,approximately what rate can you earn on a one-year risk-free U.S.security?

A) 3.00%

B) 3.12%

C) 3.98%

D) 4.25%

E) 4.33%

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

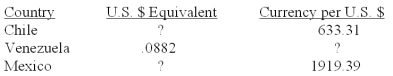

You just returned from some extensive traveling throughout the Americas.You started your trip with $10,000 in your pocket.You spent 1.4 million pesos while in Chile.You spent another 40,000 bolivars in Venezuela.Then on the way home,you spent 34,000 pesos in Mexico.How many dollars did you have left by the time you returned to the U.S.given the following exchange rates?

A) $3,887

B) $4,039

C) $4,117

D) $4,244

E) $4,299

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The foreign exchange market is where:

A) one country's stocks are exchanged for another's.

B) one country's bonds are exchanged for another's.

C) one country's currency is traded for another's.

D) international banks make loans to one another.

E) international businesses finalize import/export relationships with one another.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 96

Related Exams