A) Decreasing the credit period granted to a customer

B) Decreasing the inventory turnover rate

C) Decreasing the accounts payable period

D) Decreasing the accounts receivable turnover rate

E) Increasing the receivables period

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The local video store has to restock a popular video game every five days as it completely sells out in that period of time.What is the inventory turnover rate for this game?

A) 5.00 times

B) 5.25 times

C) 57.14 times

D) 60.00 times

E) 73.00 times

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The cash cycle is equal to which one of the following?

A) Inventory period minus the accounts payable period

B) Operating cycle plus the accounts payable period

C) Operating cycle minus the accounts receivable period

D) Accounts receivable period minus the accounts payable period plus the inventory period

E) Inventory period minus the accounts receivable period minus the accounts payable period

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which type of financing is generally used by new car dealers to finance their inventories?

A) Blanket inventory lien arrangement

B) Trust receipt loans

C) Committed line of credit

D) Trade credit financing

E) Field warehousing financing

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

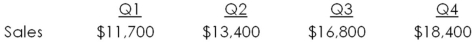

The Three Stooges has the following estimated sales.  Purchases are equal to 75 percent of the following quarter's sales.The accounts payable period is 45 days.Assume each month has 30 days.What is the estimated accounts payable balance at the end of quarter 2?

Purchases are equal to 75 percent of the following quarter's sales.The accounts payable period is 45 days.Assume each month has 30 days.What is the estimated accounts payable balance at the end of quarter 2?

A) $6,300

B) $6,520

C) $6,624

D) $4,901

E) $4,200

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following will increase the operating cycle?

A) Decreasing the days' sales in inventory

B) Decreasing the accounts payable period

C) Increasing the accounts receivable turnover rate

D) Decreasing the inventory turnover rate

E) Decreasing the accounts payable turnover rate

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

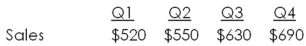

Western Feed Mills has projected the following quarterly sales amounts for the coming year.  Accounts receivable at the beginning of the year are $325.Western Feed Mills has a 60-day collection period.How much cash will the firm collect in quarter 1 and quarter 2,respectively?

Accounts receivable at the beginning of the year are $325.Western Feed Mills has a 60-day collection period.How much cash will the firm collect in quarter 1 and quarter 2,respectively?

A) $325; $498

B) $498; $347

C) $498; $530

D) $672; $367

E) $672; $540

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following statements is correct?

A) If a firm decreases its inventory period, its accounts receivable period will also decrease.

B) The longer the cash cycle, the more cash a firm typically has available to invest.

C) A firm would prefer a negative cash cycle over a positive cash cycle.

D) Decreasing the inventory period will also decrease the payables period.

E) Both the operating cycle and the cash cycle must be positive values.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Black Water Mills is operating at its optimal point.Which one of the following conditions exists given this firm's operating status?

A) Carrying costs exceed shortage costs

B) Carrying costs are equal to zero

C) Both carrying costs and shortage costs are at their minimum levels

D) Shortage costs are equal to zero

E) Shortage costs equal carrying costs

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Wage Garnishers,Inc.has sales for the year of $50,300 and cost of goods sold of $23,700.The firm carries an average inventory of $4,800 and has an average accounts payable balance of $4,400.What is the inventory period?

A) 12.39 days

B) 18.68 days

C) 31.29 days

D) 73.92 days

E) 81.36 days

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All else held constant,which one of the following statements is correct concerning the accounts payable period?

A) The accounts payable period is equal to 365/(Sales/Average accounts payable) .

B) A decrease in the accounts payable period will increase the operating cycle.

C) An increase in the accounts payable period will decrease the cash cycle.

D) A decrease in the accounts payable period will decrease the operating cycle.

E) An increase in the accounts payable turnover rate decreases the cash cycle.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is directly related to increases in a firm's current assets?

A) Reorder costs

B) Shortage costs

C) Restocking costs

D) Out-of-stock events

E) Carrying costs

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

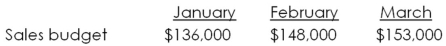

The following is the sales budget for Uptown Rentals,Inc.for the first quarter of 2013:  Credit sales are collected as follows:

60 percent in the month of sale

32 percent in the month after the sale

8 percent in the second month after the sale

The accounts receivable balance at the end of the previous quarter was $87,040 ($73,600 of which was uncollected December sales) .How much did the firm collect in the month of February?

Credit sales are collected as follows:

60 percent in the month of sale

32 percent in the month after the sale

8 percent in the second month after the sale

The accounts receivable balance at the end of the previous quarter was $87,040 ($73,600 of which was uncollected December sales) .How much did the firm collect in the month of February?

A) $118,533

B) $121,212

C) $135,208

D) $138,615

E) $147,040

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

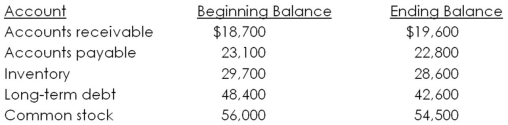

A firm has the following account balances.Which one of the following statements is correct concerning those balances?

A) Accounts receivable is a $900 source of cash.

B) Common stock is a $1,500 source of cash.

C) Net working capital, excluding cash, is a $1,500 use of cash.

D) Long-term debt is a $5,800 source of cash.

E) Total debt is a $6,100 use of cash.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Harter's Meats has an average collection period of 36 days and factors all of its receivables immediately at a 1.2 percent discount.Assume all accounts are collected in full.What is the firm's effective cost of borrowing?

A) 12.88 percent

B) 12.94 percent

C) 12.97 percent

D) 13.02 percent

E) 13.07 percent

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following industries is most apt to have the shortest operating cycle?

A) Toy store

B) Car manufacturer

C) Local restaurant

D) Furniture store

E) Plastics manufacturer

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You've worked out a line of credit arrangement that allows you to borrow up to $55 million at any time.The interest rate is 0.55 percent per month.In addition,3 percent of the amount you borrow must be deposited in a non-interest-bearing account.Assume that your bank uses compound interest on its line-of-credit loans.Suppose you need $12 million today and you repay it in six months.How much interest will you pay?

A) $387,567

B) $413,902

C) $421,028

D) $441,414

E) $442,886

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Carter's Gym currently has a 189-day operating cycle.The company is concentrating on increasing its inventory turnover rate from 8.4 to 9.5 times.What will the firm's new operating cycle be if it can effectively make this change?

A) 183.97 days

B) 183.46 days

C) 187.00 days

D) 194.03 days

E) 196.34 days

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The accounts receivable period is the time that elapses between the _____ and the ____.

A) purchase of inventory; payment to the supplier

B) purchase of inventory; collection of the receivable

C) sale of inventory; payment to supplier

D) sale of inventory; collection of the receivable

E) sale of inventory: billing to customer

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is most apt to decrease the accounts receivable period?

A) Increasing the time granted to customers to pay for purchases

B) Shortening the cash cycle

C) Increasing the discount for cash payment

D) Selling inventory slower

E) Paying suppliers faster

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 108

Related Exams