A) 3.81 years

B) 3.98 years

C) 5.57years

D) 5.92 years

E) The project never pays back.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

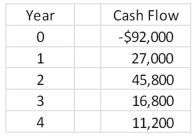

A project has the following cash flows.What is the internal rate of return?

A) 8.26 percent

B) 9.11 percent

C) 10.58 percent

D) 11.23 percent

E) 12.18 percent

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the net present value of the following cash flows if the relevant discount rate is 9.0 percent?

A) $3,374.11

B) $5,006.19

C) $8,215.46

D) $13,058.39

E) $18,519.71

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following analytical methods is based on net income?

A) Profitability index

B) Internal rate of return

C) Average accounting return

D) Modified internal rate of return

E) Payback

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The reinvestment approach to the modified internal rate of return:

A) individually discounts each separate cash flow back to the present.

B) reinvests all the cash flows, including the initial cash flow, to the end of the project.

C) discounts all negative cash flows to the present and compounds all positive cash flows to the end of the project.

D) discounts all negative cash flows back to the present and combines them with the initial cost.

E) compounds all of the cash flows, except for the initial cash flow, to the end of the project.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

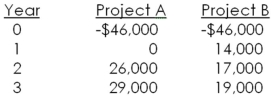

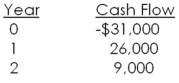

You are considering the following two mutually exclusive projects.What is the crossover point?

A) 10.76

B) 13.72

C) 15.89

D) 18.79

E) 22.56

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are considering an investment for which you require a 14 percent rate of return.The investment costs $61,900 and will produce cash inflows of $26,000 for three years.Should you accept this project based on its internal rate of return? Why or why not?

A) Yes, because the IRR is 12.51 percent

B) Yes, because the IRR is 13.65 percent

C) Yes, because the IRR is 13.67 percent

D) No, because the IRR is 12.51 percent

E) No, because the IRR is 13.65 percent

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Tool Box needs to purchase a new machine costing $1.46 million.Management is estimating the machine will generate cash inflows of $223,000 the first year and $600,000 for the following three years.If management requires a minimum 12 percent rate of return,should the firm purchase this particular machine? Why or why not?

A) Yes, because the IRR is 10.75 percent

B) Yes, because the IRR is 12.74 percent

C) No, because the IRR is 10.75 percent

D) No, because the IRR is 12.74 percent

E) The answer cannot be determined as there are multiple IRRs

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

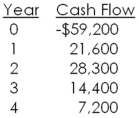

What is the net present value of a project with the following cash flows if the discount rate is 15 percent?

A) -$8,406.11

B) -$5,433.67

C) -$3,089.16

D) $1,407.92

E) $5,433.67

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An investment has conventional cash flows and a profitability index of 1.0.Given this,which one of the following must be true?

A) The internal rate of return exceeds the required rate of return.

B) The investment never pays back.

C) The net present value is equal to zero.

D) The average accounting return is 1.0.

E) The net present value is greater than 1.0.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Services United is considering a new project that requires an initial cash investment of $78,000.The project will generate cash inflows of $29,500,$32,700,$18,500,and $10,000 over each of the next four years,respectively.How long will it take to recover the initial investment?

A) 2.74 years

B) 2.85 years

C) 2.99 years

D) 3.27 years

E) 3.68 years

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Both Projects A and B are acceptable as independent projects.However,the selection of either one of these projects eliminates the option of selecting the other project.Which one of the following terms best describes the relationship between Project A and Project B?

A) Mutually exclusive

B) Conventional

C) Multiple choice

D) Dual return

E) Crosswise

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following statements is correct?

A) The internal rate of return is the most reliable method of analysis for any type of investment decision.

B) The payback method is biased toward short-term projects.

C) The modified internal rate of return is most useful when projects are mutually exclusive.

D) The average accounting return is the most difficult method of analysis to compute.

E) The net present value method is applicable only if a project has conventional cash flows.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

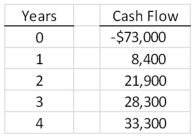

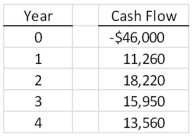

A project has the following cash flows.What is the payback period?

A) 2.48 years

B) 2.59 years

C) 2.96 years

D) 3.21 years

E) 3.43 years

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following can be defined as a benefit-cost ratio?

A) Net present value

B) Internal rate of return

C) Profitability index

D) Accounting rate of return

E) Modified internal rate of return

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following indicates that a project is definitely acceptable?

A) Profitability index greater than 1.0

B) Negative net present value

C) Modified internal rate return that is lower than the requirement

D) Zero internal rate of return

E) Positive average accounting return

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Soft and Cuddly is considering a new toy that will produce the following cash flows.Should the company produce this toy if the firm requires a 15 percent rate of return?

A) Yes, because the project's rate of return is 10.21 percent

B) Yes, because the project's rate of return is 11.47 percent

C) No, because the project's rate of return is 10.21 percent

D) No, because the project's rate of return is 11.47 percent

E) No, because the internal rate of return is zero percent

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is most closely related to the net present value profile?

A) Internal rate of return

B) Average accounting return

C) Profitability index

D) Payback

E) Discounted payback

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

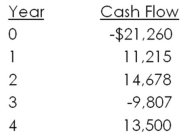

A project has the following cash flows.What is the internal rate of return?

A) 10.53 percent

B) 10.58 percent

C) 10.60 percent

D) 10.67 percent

E) 11.10 percent

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The profitability index reflects the value created per dollar:

A) invested.

B) of sales.

C) of net income.

D) of taxable income.

E) of shareholders' equity.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 113

Related Exams