A) 13.53 percent

B) 13.59 percent

C) 13.96 percent

D) 14.07 percent

E) 14.10 percent

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hughes Motors will sell you a $15,000 car for $380 a month for 48 months.What is the interest rate?

A) 9.28 percent

B) 9.35 percent

C) 9.53 percent

D) 9.86 percent

E) 9.94 percent

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Travis is buying a car and will finance it with a loan that requires monthly payments of $265 for the next four years.His car payments can be described by which one of the following terms?

A) Perpetuity

B) Annuity

C) Consol

D) Lump sum

E) Factor

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Janice plans to save $75 a month,starting today,for 20 years.Kate plans to save $80 a month for 20 years,starting one month from today.Both Janice and Kate expect to earn an average return of 5.5 percent on their savings.At the end of the 20 years,Kate will have approximately _____ more than Janice.

A) $2,028.39

B) $2,066.67

C) $2,091.50

D) $2,178.14

E) $2,189.12

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kristina started setting aside funds three years ago to save for a down payment on a house.She has saved $900 each quarter and earned an average rate of return of 4.8 percent.How much money does she currently have saved for her down payment?

A) $11,542.10

B) $12,388.19

C) $15,209.80

D) $15,366.67

E) $16,023.13

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A new financial services company just opened in your town.To attract customers,it is offering a "9-11" loan special.The company will lend $9 today in exchange for a payment of $11 one year from today.What is the APR on this loan?

A) 20.00 percent

B) 20.76 percent

C) 21.84 percent

D) 22.22 percent

E) 23.08 percent

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A perpetuity in Canada is frequently referred to as which one of the following?

A) Consul

B) Infinity

C) Forever cash

D) Dowry

E) Forevermore

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cindy is taking out a loan today.The cash amount that she will receive today is equal to the present value of the lump sum payment that she will be required to pay two years from today.Which type of loan is this?

A) Principal-only

B) Amortized

C) Interest-only

D) Compound

E) Pure discount

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Wesson Metals has an outstanding loan that calls for equal annual payments of $9,768.46 over the life of the loan.The original loan amount was $50,000 at an APR of 8.5 percent.How much of the second loan payment is interest?

A) $3,525.61

B) $3,780.93

C) $4,250.00

D) $5,409.16

E) $5,987.53

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Men's Warehouse charges 1.6 percent interest per month.What rate of interest are its credit customers actually paying?

A) 18.00 percent

B) 18.92 percent

C) 19.26 percent

D) 19.31 percent

E) 20.98 percent

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

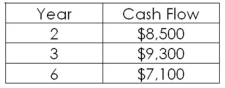

If today is year 0,what is the future value of the following cash flows 10 years from now? Assume an interest rate of 7.8 percent per year.

A) $35,211.57

B) $37,235.16

C) $40,822.55

D) $42,321.68

E) $44,564.54

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

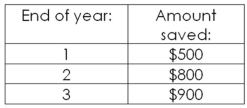

Rick is planning to invest the following amounts at 6 percent interest.How much money will he have saved at the end of year 3?

A) $2,200.00

B) $2,238.47

C) $2,309.80

D) $2,309.16

E) $2,402.19

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Townhouse Galleries offers credit to its customers at a rate of 1.6 percent per month.What is the effective annual rate of this credit offer?

A) 18.45 percent

B) 19.09 percent

C) 19.41 percent

D) 20.04 percent

E) 20.98 percent

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Karl can afford car payments of $235 a month for 48 months.The bank will lend him money to buy a car at 7.75 percent interest.How much money can he afford to borrow?

A) $9,672.48

B) $9,734.95

C) $9,899.60

D) $10,022.15

E) $10,422.09

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A preferred stock pays an annual dividend of $6.What is one share of this stock worth to you today if you require a 12 percent rate of return?

A) $6.14

B) $7.98

C) $43.00

D) $50.00

E) $98.00

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Christie is buying a new car today and is paying a $500 cash down payment.She will finance the balance at 7.25 percent interest.Her loan requires 36 equal monthly payments of $450 each with the first payment due 30 days from today.Which one of the following statements is correct concerning this purchase?

A) The present value of the car is equal to $500 + (36 × $450) .

B) The $500 is the present value of the purchase.

C) The car loan is an annuity due.

D) To compute the initial loan amount, you must use a monthly interest rate.

E) The future value of the loan is equal to 36 × $450.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cromwell Enterprises is acquiring Athens,Inc.for $899,000.Athens has agreed to accept annual payments of $210,000 at an interest rate of 8.5 percent.How many years will it take Cromwell Enterprises to pay for this purchase?

A) 5.00 years

B) 5.18 years

C) 5.55 years

D) 5.47 years

E) 5.80 years

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are comparing three investments,all of which pay $100 a month and have an 8 percent interest rate.One is ordinary annuity,one is an annuity due,and the third investment is a perpetuity.Which one of the following statements is correct given these three investment options?

A) To be the perpetuity, the payments must occur on the first day of each monthly period.

B) The ordinary annuity would be more valuable than the annuity due if both had a life of 10 years.

C) The present value of the perpetuity has to be higher than the present value of either the ordinary annuity or the annuity due.

D) The future value of all three investments must be equal.

E) The present value of all three investments must be equal.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You have just won the lottery! You can either receive $5,000 a year for 15 years or $50,000 as a lump sum payment today.What is the interest rate on the annuity option?

A) 5.56 percent

B) 5.68 percent

C) 6.20 percent

D) 6.39 percent

E) 6.50 percent

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The stated interest rate is the interest rate expressed:

A) as if it were compounded one time per year.

B) as the quoted rate compounded by 12 periods per year.

C) in terms of the rate charged per day.

D) in terms of the interest payment made each period.

E) in terms of an effective rate.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 123

Related Exams