A) Interest-only

B) Amortized

C) Perpetual

D) Pure discount

E) Lump sum

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your grandfather started his own business 52 years ago.He opened a savings account at the end of his third month of business and contributed $x.Every three months since then,he faithfully saved another $x.His savings account has earned an average rate of 4.5 percent annually.Today,his account is valued at $364,209.11.How much did your grandfather save every three months?

A) $425.15

B) $428.67

C) $431.09

D) $443.13

E) $462.25

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Egg House just borrowed $260,000 to build a new restaurant.The loan terms call for equal annual payments at the end of each year.The loan is for 15 years at an APR of 8 percent.How much of the first annual payment will be used to reduce the principal balance?

A) $8,311.62

B) $9,575.68

C) $10,211.08

D) $10,554.60

E) $11,420.90

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Belk Department Store charges a daily rate of 0.01 percent on its store credit cards.What interest rate is the company required by law to report to potential customers?

A) 35.98 percent

B) 36.50 percent

C) 39.00 percent

D) 40.04 percent

E) 40.48 percent

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Webster Mining is considering the purchase of a new sorting machine.The quote consists of a quarterly payment of $29,600 for seven years at 8 percent interest.What is the purchase price of the equipment?

A) $621,380.92

B) $629,925.66

C) $687,418.22

D) $774,311.28

E) $836,267.35

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A local magazine is offering a $2,500 grand prize to one lucky winner.The prize will be paid in four annual payments of $625 each,starting one year after the drawing.How much would this prize be worth to you if you can earn 9 percent on your money?

A) $1,848.18

B) $1,934.24

C) $2,024.82

D) $2,450.14

E) $2,545.54

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kris will receive $800 a month for the next five years from an insurance settlement.The interest rate is 4 percent,compounded monthly,for the first two years and 5 percent,compounded monthly,for the final three years.What is this settlement worth to him today?

A) $36,003.18

B) $38,219.97

C) $41,388.71

D) $43,066.22

E) $45,115.16

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following will decrease the present value of an annuity?

A) Increase in the annuity's future value

B) Increase in the payment amount

C) Increase in the time period

D) Decrease in the discount rate

E) Decrease in the annuity payment

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Rent-to-Own Store has a six-year,interest-only loan at 12 percent interest.The firm originally borrowed $125,000.How much will the firm pay in total interest over the life of the loan?

A) $15,000.00

B) $53,666.67

C) $67,500.00

D) $69,000.00

E) $90,000.00

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following cannot be computed?

A) Future value of an ordinary annuity

B) Future value of a perpetuity

C) Present value of a perpetuity

D) Present value of an annuity due

E) Present value of an ordinary annuity

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

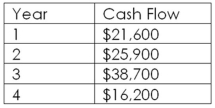

If the appropriate discount rate for the following cash flows is 11.7 percent per year,what is the present value of the cash flows?

A) $71,407.19

B) $74,221.80

C) $78,270.77

D) $80,407.16

E) $81,121.03

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Julie is borrowing $12,800 to purchase a car.The loan terms are 36 months at 7.5 percent interest.How much interest will she pay on this loan if she pays the loan as agreed? Round your answer to the nearest whole dollar.

A) $1,338

B) $1,414

C) $1,459

D) $1,506

E) $1,534

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Jones Brothers recently established a trust fund that will provide annual scholarships of $12,000 indefinitely.These annual scholarships can best be described by which one of the following terms?

A) Ordinary annuity

B) Annuity due

C) Amortized payment

D) Perpetuity

E) Continuation

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Overnight Trucking recently purchased a new truck costing $150,800.The firm financed this purchase at 8.6 percent interest with monthly payments of $2,100.How many years will it take the firm to pay off this debt?

A) 7.04 years

B) 7.22 years

C) 8.10 years

D) 8.23 years

E) 8.44 years

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A credit card has an annual percentage rate of 12.9 percent and charges interest monthly.The effective annual rate on this account:

A) will be less than 12.9 percent.

B) can either be less than or equal to 12.9 percent.

C) is 12.9 percent.

D) can either be greater than or equal to 12.9 percent.

E) will be greater than 12.9 percent.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You just won a contest! You will receive $100,000 a year for 20 years,starting today.If you can earn 12 percent on your investments,what are your winnings worth today?

A) $750,000.00

B) $833,333.33

C) $836,577.69

D) $850,000.00

E) $887,450.72

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

PayDay Loans wants to earn an effective annual return on its consumer loans of 18 percent per year.The bank uses daily compounding on its loans.What interest rate is the bank required by law to report to potential borrowers?

A) 16.23 percent

B) 16.56 percent

C) 17.62 percent

D) 18.39 percent

E) 18.88 percent

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Alfa Life Insurance Co.is trying to sell you an investment policy that will pay you and your heirs $10,000 per year forever.If the required return on this investment is 4.75 percent,how much will you pay for the policy?

A) $206,576.83

B) $210,526.32

C) $214,211.50

D) $217,119.02

E) $221,160.91

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Travis borrowed $10,000 four years ago at an annual interest rate of 7 percent.The loan term is six years.Since he borrowed the money,Travis has been making annual payments of $700 to the bank.Which type of loan does he have?

A) Interest-only

B) Pure discount

C) Compound

D) Amortized

E) Complex

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Doris's Fashions has just signed a $2.2 million contract.The contract calls for a payment of $0.6 million today,$0.8 million one year from today,and $0.8 million two years from today.What is this contract worth today if the firm can earn 8.2 percent on its money?

A) $2,038,616.67

B) $2,022,709.37

C) $2,108,001.32

D) $2,124,339.07

E) $2,202,840.91

G) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 123

Related Exams