A) -$110

B) $320

C) $350

D) $430

E) $490

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Not Answered

Using two separate graphs, illustrate a flexible and a restrictive short-term financing policy. Place costs on the vertical axis and current assets on the horizontal axis. On each graph, indicate the shortage costs, carrying costs, total costs, and indicate the optimal investment in current assets.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You've worked out a line of credit arrangement that allows you to borrow up to $50 million at any time. The interest rate is 0.5 percent per month. In addition, 5 percent of the amount that you borrow must be deposited in a non-interest bearing account. Assume your bank uses compound interest on its line of credit loans. What is the effective annual interest rate on this lending arrangement?

A) 6.50 percent

B) 6.62 percent

C) 6.81 percent

D) 6.87 percent

E) 6.94 percent

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following increases cash?

A) granting credit to a customer

B) purchasing new machinery

C) making a payment on a bank loan

D) purchasing inventory

E) accepting credit from a supplier

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following statements is correct concerning the cash balance of a firm?

A) Most firms attempt to maintain a zero cash balance at all times.

B) The cumulative cash surplus shown on a cash budget is equal to the ending cash balance plus the minimum desired cash balance.

C) On a cash balance report, the cumulative cash surplus at the end of May is used as June's beginning cash balance.

D) A cumulative cash deficit indicates a borrowing need.

E) The ending cash balance must equal the minimum desired cash balance.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Dog House expects sales of $560, $650, $670, and $610 for the months of May through August, respectively. The firm collects 20 percent of sales in the month of sale, 70 percent in the month following the month of sale, and 8 percent in the second month following the month of sale. The remaining 2 percent of sales is never collected. How much money does the firm expect to collect in the month of August?

A) $621

B) $628

C) $633

D) $639

E) $643

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

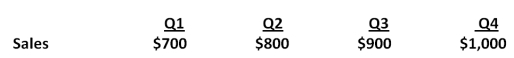

Workout Together has projected the following sales for the coming year:  Sales in the year following this one are projected to be 18 percent greater in each quarter. Assume the firm places orders during each quarter equal to 29 percent of projected sales for the next quarter. How much will the firm pay to its suppliers in Quarter 2 if its accounts payable period is 60 days?

Sales in the year following this one are projected to be 18 percent greater in each quarter. Assume the firm places orders during each quarter equal to 29 percent of projected sales for the next quarter. How much will the firm pay to its suppliers in Quarter 2 if its accounts payable period is 60 days?

A) $212.67

B) $224.33

C) $241.67

D) $251.33

E) $256.67

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Shortage costs include which of the following? I. disruption of production schedules II. inventory ordering costs III. lost customer goodwill IV. brokerage costs

A) I and II only

B) II and III only

C) II, III, and IV only

D) I, II, and III only

E) I, II, III, and IV

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Forest Gardens, Inc., has a beginning receivables balance on February 1 of $730. Sales for February through May are $720, $760, $820, and $850, respectively. The accounts receivable period is 30 days. What is the amount of the April collections? Assume a year has 360 days.

A) $720

B) $760

C) $790

D) $820

E) $850

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If you pay your suppliers five days sooner, then:

A) your payables turnover rate will decrease.

B) you may require additional funds from other sources to fund the cash cycle.

C) the cash cycle will decrease.

D) your operating cycle will increase.

E) the accounts receivable period will decrease.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An increase in which one of the following will decrease the cash cycle, all else equal?

A) payables turnover

B) days sales in inventory

C) operating cycle

D) inventory turnover rate

E) accounts receivable period

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

North Side Wholesalers has sales of $948,000. The cost of goods sold is equal to 72 percent of sales. The firm has an average inventory of $23,000. How many days on average does it take the firm to sell its inventory?

A) 11.24 days

B) 12.30 days

C) 16.48 days

D) 26.35 days

E) 29.68 days

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Costs that decrease as a firm acquires additional current assets are called _____ costs.

A) carrying

B) shortage

C) debt

D) equity

E) payables

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following statements is correct?

A) Seasonal needs are financed externally when firms adhere to a flexible financing policy.

B) A flexible financing policy tends to increase the risk of encountering financial distress.

C) Long-term interest rates tend to be less volatile than short-term rates.

D) Most firms tend to finance inventory with long-term debt.

E) Short-term interest rates are generally higher than long-term rates.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Cement Works has a beginning cash balance for the quarter of $784. Susie, the firm's president, requires that a minimum cash balance of $800 be maintained and requires that borrowing be used to maintain that balance. If funds have been borrowed, then she requires that those loans be repaid as soon as excess funds are available. Currently, the firm has a loan outstanding of $1,260. How much will the firm borrow or repay this quarter if the quarterly receipts are $3,918 and the quarterly disbursements are $3,774?

A) borrow $16

B) borrow $128

C) borrow $144

D) repay $128

E) repay $144

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A flexible short-term financial policy:

A) increases a firm's need for long-term financing.

B) minimizes net working capital.

C) avoids bad debts by only selling items for cash.

D) maximizes fixed assets and minimizes current assets.

E) is most appropriate for a firm with relatively high carrying costs and relatively low shortage costs.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Rose's Gift Shop borrows money on a short-term basis by pledging its inventory as collateral. This is an example of a(n) :

A) debenture.

B) line of credit.

C) banker's acceptance.

D) working loan.

E) inventory loan.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Nadine's Boutique has a 30 day accounts payable period. The firm has expected quarterly sales of $1,100, $1,400, $1,700, and $2,100, respectively, for next year. The quarterly cost of goods sold is equal to 68 percent of the next quarter's sales. The firm has a beginning accounts payable balance of $550 as of Quarter 1. What is the amount of the projected cash disbursements for accounts payable for Quarter 3 of the next year? Assume a year has 360 days.

A) $1,195

B) $1,208

C) $1,247

D) $1,337

E) $1,380

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following will increase net working capital? Assume the current ratio is greater than 1.0.

A) paying a supplier for a previous purchase

B) paying off a long-term debt

C) selling inventory at cost

D) purchasing inventory on credit

E) selling inventory at a profit on credit

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Bear Rug has sales of $811,000. The cost of goods sold is equal to 63 percent of sales. The beginning accounts receivable balance is $41,000 and the ending accounts receivable balance is $38,000. How long on average does it take the firm to collect its receivables?

A) 17.26 days

B) 17.78 days

C) 18.58 days

D) 20.44 days

E) 29.77 days

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 110

Related Exams