A) increase the par value by 25 percent.

B) increase the number of shares outstanding by 400 percent.

C) increase the market value but not affect the par value per share.

D) increase a $1 par value to $4.

E) increase a $1 par value to $5.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If you ignore taxes and costs, a stock repurchase will: I. reduce the total assets of a firm. II. decrease the earnings per share. III. reduce the PE ratio more so than an equivalent stock dividend. IV. reduce the total equity of a firm.

A) I and III only

B) I and IV only

C) II and IV only

D) I, III, and IV only

E) II, III, and IV only

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The common stock of Gillen Entertainment is selling for $78 a share. The par value per share is $1. Currently, the firm has a total market value of $936,000. How many shares of stock will be outstanding if the firm does a 5-for-2 stock split?

A) 4,800 shares

B) 9,600 shares

C) 15,000 shares

D) 30,000 shares

E) 32,200 shares

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following tend to keep dividends low? I. shareholders desiring current income II. terms contained in bond indenture agreements III. the desire to maintain constant dividends over time IV. flotation costs

A) II and III only

B) I and IV only

C) II, III, and IV only

D) I, II, and III only

E) I, II, III, and IV

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kate purchased 500 shares of Fast Deliveries stock on Wednesday, July 7th. Ted purchased 100 shares of Fast Deliveries stock on Thursday, July 8th. Fast Deliveries declared a dividend on June 20th to shareholders of record on July 12th and payable on August 1st. Which one of the following statements concerning the dividend paid on August 1st is correct given this information?

A) Neither Kate nor Ted is entitled to the dividend.

B) Kate is entitled to the dividend but Ted is not.

C) Ted is entitled to the dividend but Kate is not.

D) Both Ted and Kate are entitled to the dividend.

E) Both Ted and Kate are entitled to one-half of the dividend amount.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following statements related to stock repurchases is correct?

A) An open market stock repurchase increases the total wealth of a shareholder if you ignore taxes, costs, and market imperfections.

B) Targeted repurchases must be offered to all shareholders but can be done in steps such that only a portion of the shareholders have the option to sell at any one point in time.

C) When a firm wishes to repurchase shares in the open market, it will do so in a special trading session that is set up by the SEC.

D) A firm may spend more cash over the course of a year on stock repurchases than it does on cash dividends.

E) Tender offer prices must be set equal to the opening market price on the day the tender offer is announced.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

City Center Pharmacy has 11,500 shares of stock outstanding with a par value of $1 per share and a market value of $10 a share. The company just announced a 3-for-7 reverse stock split. What will the market value per share be after the reverse stock split?

A) $4.29

B) $7.00

C) $10.00

D) $23.33

E) $25.21

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A reverse stock split is defined as:

A) an increase in the number of shares outstanding that does not affect owners' equity.

B) a firm buying back existing shares of its stock on the open market.

C) a firm selling new shares of stock on the open market.

D) a decrease in the number of shares outstanding that does not affect owner's equity.

E) a decrease in both the number of shares outstanding and the price per share.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Josh's, Inc. has 7,000 shares of stock outstanding with a par value of $1.00 per share and a market value of $32 a share. The balance sheet shows $76,000 in the capital in excess of par account, $7,000 in the common stock account, and $64,800 in the retained earnings account. The firm just announced a 10 percent stock dividend. What is the value of the capital in excess of par account after the dividend?

A) $50,600

B) $54,300

C) $76,000

D) $97,700

E) $101,400

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Green Roof Motels has more cash on hand than its operations require. Thus, the firm has decided to pay out some of its earnings in the form of cash to its shareholders. What are these payments to shareholders called?

A) dividends

B) stock payments

C) repurchases

D) payments-in-kind

E) stock splits

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Turtle Cave currently has 160,000 shares of stock outstanding that sell for $60 per share. Assume no market imperfections or tax effects exist. What will the new share price be if the firm declares a 15 percent stock dividend?

A) $48.72

B) $52.17

C) $60.00

D) $64.50

E) $69.00

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Blasco's has a market value equal to its book value. Currently, the firm has excess cash of $1,332, other assets of $11,674, and equity of $7,200. The firm has 600 shares of stock outstanding and net income of $838. Blasco's has decided to spend one-third of its excess cash on a share repurchase program. How many shares of stock will be outstanding after the stock repurchase is completed?

A) 537 shares

B) 550 shares

C) 563 shares

D) 578 shares

E) 584 shares

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A stock repurchase program:

A) requires all shareholders to sell a fraction of their shares.

B) is preferred over a high-dividend program only by tax-exempt shareholders.

C) decreases both the number of shares outstanding and the market price per share.

D) has no effect on a firm's financial statements.

E) is essentially the same as a cash dividend program provided there are no taxes or other costs.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Southern Fried Chicken has 8,000 shares of stock outstanding with a par value of $1 per share and a market value of $34 per share. The balance sheet shows $39,000 in the capital in excess of par account, $8,000 in the common stock account, and $152,000 in the retained earnings account. The firm just announced a 5 percent stock dividend. What will total owners' equity be after the dividend?

A) $185,800

B) $196,000

C) $199,000

D) $206,800

E) $212,200

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following involves a payment in shares by a stock issuer that increases the number of shares a shareholder owns but also decreases the value per share?

A) cash dividend

B) stock dividend

C) stock repurchase

D) stock split

E) reverse stock split

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Tanning Bed has 10,000 shares of stock outstanding with a par value of $1 per share and a market value of $8 per share. The balance sheet shows $10,000 in the common stock account, $60,000 in the capital in excess of par account, and $94,300 in the retained earnings account. The firm just announced a 100 percent stock dividend. What will be the value of the common stock account after the dividend?

A) $5,000

B) $10,000

C) $11,000

D) $15,000

E) $20,000

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Al owns 800 shares of The Good Life Co. The company recently issued a statement that it will pay a dividend per share of $0.55 this year and a $0.60 per share dividend next year. Al does not want any dividend income this year but does want as much dividend income as possible next year. Al earns 8.5 percent on his investments. Ignoring taxes, what will Al's total homemade dividend be next year?

A) $910.20

B) $920.00

C) $930.50

D) $941.80

E) $957.40

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the information content effect?

A) any type of new information that causes a firm to cease paying dividends

B) any news announcement that was anticipated and thus produces no reaction from investors

C) the primary contributing data that helps directors determine the amount of a particular dividend payment

D) any type of reaction from a shareholder in response to a news announcement related to the stock issuer

E) the financial market's reaction to a change in the amount of a firm's dividend

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stock splits can be used to:

A) adjust the market price of a stock such that it falls within a preferred trading range.

B) decrease the excess cash held by a firm thereby lowering agency costs.

C) increase both the number of shares outstanding and the market price per share.

D) increase the total equity of a firm.

E) adjust the debt-equity ratio.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

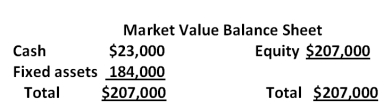

The balance sheet for Apple Pie Corp. is shown here in market value terms. There are 4,000 shares of stock outstanding.  The company has declared a dividend of $1.80 per share. The stock goes ex-dividend tomorrow. Ignore any tax effects. What will the price of the stock be tomorrow?

The company has declared a dividend of $1.80 per share. The stock goes ex-dividend tomorrow. Ignore any tax effects. What will the price of the stock be tomorrow?

A) $18.90

B) $36.20

C) $49.95

D) $52.15

E) $71.80

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 104

Related Exams