A) Initial cost of an investment

B) Arbitrary cutoff point

C) Cash flow direction

D) Time value of money

E) Timing of each cash inflow

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Discounted cash flow valuation is the process of discounting an investment's:

A) assets.

B) future profits.

C) liabilities.

D) costs.

E) future cash flows.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

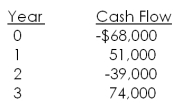

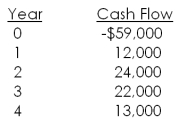

What is the net present value of the following cash flows if the relevant discount rate is 8.8 percent?

A) $1,482.15

B) $3,385.96

C) $23,507.19

D) $54,211.40

E) $68,278.59

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

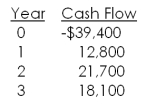

What is the net present value of a project with the following cash flows if the discount rate is 14 percent?

A) $742.50

B) $801.68

C) $823.92

D) $899.46

E) $901.15

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In which one of the following situations would the payback method be the preferred method of analysis?

A) A project that can easily be expanded

B) Two mutually exclusive projects

C) A proposed expansion of a firm's current operations

D) Different-sized projects

E) Investment funds available only for a limited period of time

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

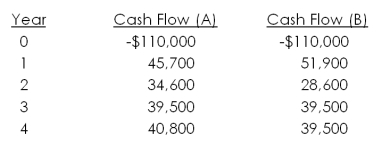

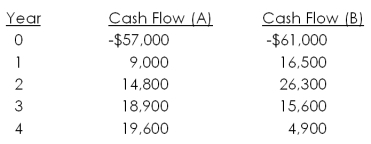

Textiles Unlimited has gathered projected cash flows for two projects. At what interest rate would the company be indifferent between the two projects? Which project is better if the required return is above this interest rate?

A) 11.76 percent; A

B) 12.49 percent; A

C) 12.49 percent; B

D) 13.15 percent; A

E) 13.15 percent: B

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The possibility that more than one discount rate can cause the net present value of an investment to equal zero is referred to as:

A) duplication.

B) the net present value profile.

C) multiple rates of return.

D) the AAR problem.

E) the dual dilemma.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is specifically designed to compute the rate of return on a project that has unconventional cash flows?

A) Average accounting return

B) Profitability index

C) Internal rate of return

D) Indexed rate of return

E) Modified internal rate of return

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm is reviewing a project that has an initial cost of $71,000. The project will produce annual cash inflows, starting with year 1, of $8,000, $13,400, $18,600, $33,100 and finally in year five, $37,900. What is the profitability index if the discount rate is 11 percent?

A) 0.92

B) 0.98

C) 1.02

D) 1.07

E) 1.12

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The net present value profile illustrates how the net present value of an investment is affected by which one of the following?

A) Project's initial cost

B) Discount rate

C) Timing of the project's cash inflows

D) Inflation rate

E) Real rate of return

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The net present value:

A) decreases as the required rate of return increases.

B) is equal to the initial investment when the internal rate of return is equal to the required return.

C) method of analysis cannot be applied to mutually exclusive projects.

D) is directly related to the discount rate.

E) is unaffected by the timing of an investment's cash flows.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following methods of analysis is most similar to computing the return on assets (ROA) ?

A) Internal rate of return

B) Profitability index

C) Average accounting return

D) Net present value

E) Payback

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Services United is considering a new project that requires an initial cash investment of $75,000. The project will generate cash inflows of $26,500, $32,700, $18,500, and $10,000 over each of the next four years, respectively. How long will it take to recover the initial investment?

A) 2.74 years

B) 2.85 years

C) 2.99 years

D) 3.27 years

E) 3.68 years

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

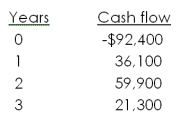

A project has the following cash flows. What is the internal rate of return?

A) 12.21 percent

B) 12.47 percent

C) 13.46 percent

D) 13.82 percent

E) 14.19 percent

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The net present value of a project's cash inflows is $8,216 at a 14 percent discount rate. The profitability index is 1.03 and the firm's tax rate is 34 percent. What is the initial cost of the project?

A) $6,900.00

B) $7,018.50

C) $7,428.32

D) $7,976.70

E) $8,066.67

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is most closely related to the net present value profile?

A) Internal rate of return

B) Average accounting return

C) Profitability index

D) Payback

E) Discounted payback

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is an indicator that an investment is acceptable?

A) Modified internal rate of return equal to zero

B) Profitability index of zero

C) Internal rate of return that exceeds the required return

D) Payback period that exceeds the required period

E) Negative average accounting return

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Flour Baker is considering a project with the following cash flows. Should this project be accepted based on its internal rate of return if the required return is 11 percent?

A) Yes; the project's rate of return is 7.78 percent

B) Yes; the project's rate of return is 9.36 percent

C) No; the project's rate of return is 7.78 percent

D) No; the project's rate of return is 9.36 percent

E) No; the project's rate of return is 13.08 percent

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Alpha Zeta is considering purchasing some new equipment costing $390,000. The equipment will be depreciated on a straight line basis to a zero book value over the four-year life of the project. Projected net income for the four years is $18,900, $21,300, $26,700, and $25,000. What is the average accounting rate of return?

A) 11.78 percent

B) 11.93 percent

C) 12.01 percent

D) 12.49 percent

E) 13.20 percent

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Baker's Supply imposes a payback cutoff of 3.5 years for its international investment projects. If the company has the following two projects available, should it accept either of them?

A) Accept both Projects A and B

B) Accept Project A but not Project B

C) Accept Project B but not Project A

D) Both Project A and B are acceptable but you can only select one project

E) Reject both Projects A and B

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 114

Related Exams