A) $6,727

B) $6,893

C) $7,965

D) $9,440

E) $9,481

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are trying to attract new customers that you feel could become repeat customers.The average selling price of your products is $69 each with a $41 per unit variable cost.The monthly interest rate is 1.5 percent.Your experience tells you that 8 percent of these customers will never pay their bill.What is the value of a new customer who does not default on his or her bill?

A) $1,733

B) $1,867

C) $2,617

D) $4,817

E) $8,867

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are considering switching from an all cash credit policy to a net 30 credit policy.You do not expect the switch to affect either your sales quantity or your sales price.Ignoring interest and assuming that every month has 30 days,your net present value of the switch will be equal to:

A) zero.

B) your selling price per unit.

C) your selling price per unit multiplied by -1.

D) your selling price per unit multiplied by -30.

E) your total monthly sales multiplied by -1.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Town Hardware sells goods on credit with payment due 30 days after purchase.If payment is not received by the 30th day,the store mails a friendly reminder to the customer.If payment is not received by the 45th day,the store calls the customer and requests payment and also stops offering credit to that customer.These procedures are referred to as the store's:

A) customer service policy.

B) credit policy.

C) collection policy.

D) payables policy.

E) disbursements policy.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scott purchased a shovel,a rake,and a wheelbarrow from The Local Hardware Store yesterday.Today,the store issued a bill for these items and mailed it to Scott.What is the name given to this bill?

A) ledger statement

B) warranty

C) indenture

D) receipt

E) invoice

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The terms of sale generally include which of the following? I.type of credit instrument II.cash discount III.credit period IV.discount period

A) I and III only

B) II and IV only

C) III and IV only

D) II, III, and IV only

E) I, II, III, and IV

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Any written proof that a customer owes you money for goods or services provided is referred to as a(n) :

A) account document.

B) sales draft.

C) credit instrument.

D) commercial paper.

E) letter of debt.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jillian was recently hired by a major retail store.Her job is to determine the probability that individual customers will fail to pay for their charge sales.Jillian's job best relates to which one of the following?

A) terms of sale

B) credit analysis

C) collection policy

D) payables policy

E) customer service

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Geoff Industries offers its credit customers a 2 percent discount if they pay within 10 days.This discount is referred to as a:

A) cash discount.

B) purchase discount.

C) collection discount.

D) market discount.

E) receivables discount.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

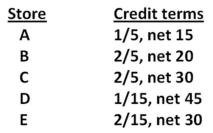

You are doing some comparison shopping.Five stores offer the product you want at basically the same price.Which one of the following stores offers the best credit terms if you plan to forego the discount?

A) store A

B) store B

C) store C

D) store D

E) store E

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

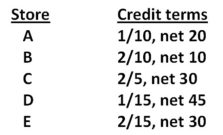

You are doing some comparison shopping.Five stores offer the product you want at basically the same price.Which one of the following stores offers the best credit terms if you plan on taking the discount?

A) store A

B) store B

C) store C

D) store D

E) store E

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Saucier & Co.currently sells 2,100 units a month for total monthly sales of $86,500.The company is considering replacing its current cash only credit policy with a net 30 policy.The variable cost per unit is $18 and the monthly interest rate is 1.2 percent.What is the switch break-even level of sales? Assume the selling price per unit and the variable costs per unit remain constant.

A) 1,943 units

B) 2,117 units

C) 2,145 units

D) 2,406 units

E) 2,548 units

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following statements is correct?

A) An aging schedule helps identify those customers who are the most delinquent.

B) The percentage of total receivables that falls within a certain time period on an aging schedule will remain constant over time even if the firm has seasonal sales.

C) Normally firms call their delinquent customers prior to sending them a past due letter.

D) A constant average collection period over a period of time is cause for concern.

E) It is common practice when a customer files for bankruptcy to sell that customer's receivable at face value.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following are frequently used as sources of information when trying to ascertain the creditworthiness of a customer? I.payment history with similar firms II.credit reports III.financial statements IV.information provided by a bank

A) I and III only

B) II and IV only

C) I and II only

D) I, II, and III only

E) I, II, III, and IV

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Today,October 12,Nadine's Fashions purchased $511 worth of merchandise from a supplier.The credit terms are 1/5,net 20.By what day does Nadine's have to make the payment to receive the discount? Note: October has 31 days.

A) October 13

B) October 15

C) October 17

D) October 27

E) November 1

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

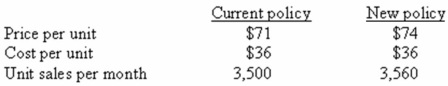

The Dilana Corporation is considering a change in its cash-only policy.The new terms would be net one period.The required return is 2 percent per period.What is the NPV of the new policy given the following information?

A) -$230,880

B) -$118,420

C) $311,508

D) $328,997

E) $388,340

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Cycle Shoppe has decided to offer credit to its customers during the spring selling season.Sales are expected to be 330 bicycles.The average cost to the shop of a bicycle is $300.The owner knows that only 93 percent of the customers will be able to make their payments.To identify the remaining 7 percent,she is considering subscribing to a credit agency.The initial charge for this service is $540,with an additional charge of $6 per individual report.What is the amount of the net savings from subscribing to the credit agency?

A) $3,790

B) $3,920

C) $4,080

D) $4,410

E) $4,950

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under credit terms of 1/5,net 15,customers should:

A) always pay on the 15th day.

B) take the 5 percent discount and pay immediately.

C) take the discount and pay on the day following the day of sale.

D) either take the discount or pay on the 15th day.

E) both take the discount and pay on the 15th day.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Blackwell Brothers sells men's suits.The store offers a 1 percent discount if payment is received within 10 days.Otherwise,payment is due within 30 days.This credit offering is referred to as the:

A) terms of sale.

B) credit analysis.

C) collection policy.

D) payables policy.

E) collection float.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The incremental investment in receivables under the accounts receivable approach is equal to:

A) P - vQ′.

B) PQ′.

C) PQ + v(Q′ - Q) .

D) P(Q′ - Q) .

E) PQ(Q′ - Q) .

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 97

Related Exams