A) -$156,727

B) -$131,301

C) -$74,208

D) $11,507

E) $26,433

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your firm spends $48,000 a week to pay bills and maintains a lower cash balance limit of $50,000.The standard deviation of the disbursements is $8,100.The applicable weekly interest rate is 0.054 percent and the fixed cost of transferring funds is $65.What is your cash balance target based on the Miller-Orr model?

A) $48,156

B) $49,990

C) $54,884

D) $68,093

E) $75,726

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following statements is correct concerning zero-balance accounts?

A) Each zero-balance account is offset by a compensating balance account.

B) Zero-balance accounts are used for depositing incoming funds.

C) A master account must be used in conjunction with a zero-balance account.

D) Zero-balance accounts are used solely in conjunction with a lockbox system.

E) Zero-balance accounts are still required to maintain a minimal balance.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements related to the BAT model is correct? I.The BAT model is used to determine the target cash balance for a firm. II.The BAT model is rarely used in business due to its complex nature. III.The BAT model is a model that helps eliminate a firm's collection float. IV.One disadvantage of the BAT model is the fact that it assumes all cash outflows are known with certainty.

A) I and II only

B) III and IV only

C) II and III only

D) I and III only

E) I and IV only

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

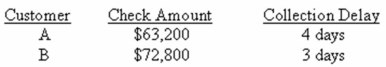

National Exporters deals strictly with two customers.The average amount each customer pays per month along with the collection delay associated with each payment is shown below.Given this information,what is the amount of the average daily receipts? Assume that every month has 30 days.

A) $2,653.33

B) $3,006.33

C) $4,533.33

D) $7,811.67

E) $8,600.00

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The main purpose of a cash concentration account is to:

A) decrease collection float.

B) decrease disbursement float.

C) consolidate funds.

D) replace a lockbox system.

E) cover compensating balance requirements.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

GT Motors regularly issues short-term debt to finance its daily operations.Suddenly,the credit markets froze and no funds were available for borrowing.Fortunately,the firm had some cash reserves saved that it was able to use to fund its operations until additional credit was available.The need to retain cash for situations such as this is referred to as which one of the following motives for holding cash?

A) speculative

B) float

C) compensating

D) precautionary

E) transaction

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On an average day,Town Center Hardware receives $2,420 in checks from customers.These checks clear the bank in an average of 2.1 days.The applicable daily interest rate is 0.025 percent.What is the maximum amount this store should pay to completely eliminate its collection float? Assume each month has 30 days.

A) $1,152.38

B) $1,288.15

C) $2,109.16

D) $4,637.33

E) $5,082.00

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following variables are included in the BAT model? I.upper cash limit II.interest rate on marketable securities III.opportunity cost of holding cash IV.fixed cost of each securities trade

A) II only

B) I and III only

C) II and IV only

D) II, III, and IV only

E) I, III, and IV only

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On average,your firm receives 65 checks a day from customers.These checks,on average,are worth $39.90 each and clear the bank in 1.5 days.In addition,your firm disburses 38 checks a day with an average amount of $89.50.These checks clear your bank in 2 days.What is the average amount of the collection float?

A) $2,473.80

B) $3,401.00

C) $3,890.25

D) $5,101.50

E) $6,802.00

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Miller-Orr model assumes that:

A) the cash balance is depleted at regular intervals.

B) all cash flows are known with certainty.

C) the average change in the daily cash flows is positive.

D) management will set both the lower and the upper desired levels of cash.

E) the cash balance fluctuates in a random manner.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following statements is correct concerning a cash management system that employs both lockboxes and a concentration bank account?

A) All customer payments must be submitted to a lockbox.

B) The party which collects the checks from the lockbox is responsible for recording the payment on the customer's account.

C) Payments received in a lockbox are transferred immediately to the concentration account.

D) The firm's cash manager determines how the funds in the concentration account are disbursed.

E) The concentration account must be zeroed out on a daily basis.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Brown Trucking is buying a U.S.Treasury bill today with the understanding that the seller will buy it back tomorrow at a slightly higher price.This investment is known as a:

A) commercial paper transaction.

B) repurchase agreement.

C) private certificate of deposit.

D) revenue anticipation note.

E) bill anticipation note.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The BAT model is used to:

A) maximize the benefits of leverage.

B) determine the optimal cash position of a firm.

C) eliminate all daily cash surpluses.

D) analyze the cash balance given fluctuating cash inflows and outflows.

E) maximize the opportunity costs of holding cash.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following collection times is correctly described?

A) The processing delay starts when a firm mails out a billing statement and ends when the payment is received from a customer.

B) Mailing time begins when a firm mails out a billing statement and ends when the payment is received.

C) Collection time begins when a firm mails out a billing statement and ends when the cash payment for that billing is available to the firm.

D) Availability delay begins when a firm deposits a customer's check into its bank account and ends when the cash from that payment is available to the firm.

E) Processing delay begins when a firm mails out billing statements and ends when the firm deposits the payment for that statement into its bank account.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

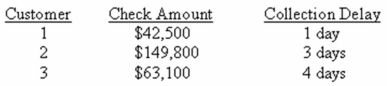

Hot Tub Builders sells to three retail outlets.Each retailer pays once a month in the amounts shown below.The collection delay associated with each payment is also given below.What is the amount of the average daily receipts if you assume each month has 30 days?

A) $2,389.70

B) $8,513.33

C) $14,608.13

D) $23,896.97

E) $81,900.00

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following should help reduce the total collection time for a firm? I.opening a post office box so mail can be received earlier in the morning II.assigning additional staff in the morning to process incoming payments III.providing a discount for customers who pay electronically IV.establishing preauthorized payments from customers

A) I and II only

B) III and IV only

C) II, III, and IV only

D) I, II, and IV only

E) I, II, III, and IV

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The cash found in a cash drawer that a check-out clerk uses to make change is an example of which of the following motives for holding cash?

A) speculative

B) daily float

C) compensating balance

D) precautionary

E) transaction

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following costs related to holding cash are minimized when the level of cash a firm holds is optimized?

A) opportunity costs

B) trading costs

C) total costs

D) both trading and opportunity costs

E) trading costs, opportunity costs, and total costs

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Parkway Express needs $318,000 a week to pay bills.The standard deviation of the weekly disbursements is $31,000.The firm has established a lower cash balance limit of $60,000.The applicable interest rate is 4.5 percent and the fixed cost of transferring funds is $65.Based on the BAT model,what is the opportunity cost of holding cash?

A) $3,873

B) $4,918

C) $5,207

D) $109,283

E) $110,440

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 101

Related Exams