A) The average squared difference between the arithmetic and the geometric average annual returns.

B) The squared summation of the differences between the actual returns and the average geometric return.

C) The average difference between the annual returns and the average return for the period.

D) The difference between the arithmetic average and the geometric average return for the period.

E) The average squared difference between the actual returns and the arithmetic average return.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

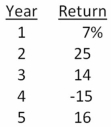

Calculate the standard deviation of the following rates of return:

A) 10.79 percent

B) 12.60 percent

C) 13.48 percent

D) 14.42 percent

E) 15.08 percent

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Inside information has the least value when financial markets are:

A) weak form efficient.

B) semiweak form efficient.

C) semistrong form efficient.

D) strong form efficient.

E) inefficient.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following statements related to capital gains is correct?

A) The capital gains yield includes only realized capital gains.

B) An increase in an unrealized capital gain will increase the capital gains yield.

C) The capital gains yield must be either positive or equal to zero.

D) The capital gains yield is expressed as a percentage of the sales price.

E) The capital gains yield represents the total return earned by an investor.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A stock has annual returns of 5 percent,21 percent,-12 percent,7 percent,and -6 percent for the past five years.The arithmetic average of these returns is _____ percent while the geometric average return for the period is _____ percent.

A) 3.89; 3.62

B) 3.89; 4.60

C) 3.62; 3.89

D) 4.60; 3.62

E) 4.60; 3.89

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The return earned in an average year over a multi-year period is called the _____ average return.

A) arithmetic

B) standard

C) variant

D) geometric

E) real

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements related to market efficiency tend to be supported by current evidence? I.Markets tend to respond quickly to new information. II.It is difficult for investors to earn abnormal returns. III.Short-run prices are difficult to predict accurately based on public information. IV.Markets are most likely weak form efficient.

A) I and III only

B) II and IV only

C) I and IV only

D) I, III, and IV only

E) I, II, and III only

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A stock has annual returns of 6 percent,14 percent,-3 percent,and 2 percent for the past four years.The arithmetic average of these returns is _____ percent while the geometric average return for the period is _____ percent.

A) 4.57; 4.75

B) 4.75; 4.57

C) 6.33; 6.19

D) 6.19; 6.33

E) 6.33; 6.33

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following statements is correct concerning market efficiency?

A) Real asset markets are more efficient than financial markets.

B) If a market is efficient, arbitrage opportunities should be common.

C) In an efficient market, some market participants will have an advantage over others.

D) A firm will generally receive a fair price when it issues new shares of stock.

E) New information will gradually be reflected in a stock's price to avoid any sudden change in the price of the stock.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Standard deviation is a measure of which one of the following?

A) average rate of return

B) volatility

C) probability

D) risk premium

E) real returns

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following categories of securities had the lowest average risk premium for the period 1926-2010?

A) long-term government bonds

B) small company stocks

C) large company stocks

D) long-term corporate bonds

E) U.S. Treasury bills

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stacy purchased a stock last year and sold it today for $3 a share more than her purchase price.She received a total of $0.75 in dividends.Which one of the following statements is correct in relation to this investment?

A) The dividend yield is expressed as a percentage of the selling price.

B) The capital gain would have been less had Stacy not received the dividends.

C) The total dollar return per share is $3.

D) The capital gains yield is positive.

E) The dividend yield is greater than the capital gains yield.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One year ago,you purchased a stock at a price of $33.49.The stock pays quarterly dividends of $0.20 per share.Today,the stock is selling for $28.20 per share.What is your capital gain on this investment?

A) -$5.49

B) -$5.29

C) -$4.76

D) -$4.16

E) -$5.09

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The real rate of return on a stock is approximately equal to the nominal rate of return:

A) multiplied by (1 + inflation rate) .

B) plus the inflation rate.

C) minus the inflation rate.

D) divided by (1 + inflation rate) .

E) divided by (1 - inflation rate) .

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The primary purpose of Blume's formula is to:

A) compute an accurate historical rate of return.

B) determine a stock's true current value.

C) consider compounding when estimating a rate of return.

D) determine the actual real rate of return.

E) project future rates of return.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Today,you sold 200 shares of Indian River Produce stock.Your total return on these shares is 6.2 percent.You purchased the shares one year ago at a price of $31.10 a share.You have received a total of $100 in dividends over the course of the year.What is your capital gains yield on this investment?

A) 3.68 percent

B) 4.59 percent

C) 5.67 percent

D) 7.26 percent

E) 7.41 percent

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is a correct ranking of securities based on their volatility over the period of 1926-2010? Rank from highest to lowest.

A) large company stocks, U.S. Treasury bills, long-term government bonds

B) small company stocks, long-term corporate bonds, large company stocks

C) small company stocks, long-term corporate bonds, intermediate-term government bonds

D) large company stocks, small company stocks, long-term government bonds

E) intermediate-term government bonds, long-term corporate bonds, U.S. Treasury bills

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following correctly describes the dividend yield?

A) next year's annual dividend divided by today's stock price

B) this year's annual dividend divided by today's stock price

C) this year's annual dividend divided by next year's expected stock price

D) next year's annual dividend divided by this year's annual dividend

E) the increase in next year's dividend over this year's dividend divided by this year's dividend

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The excess return is computed as the:

A) return on a security minus the inflation rate.

B) return on a risky security minus the risk-free rate.

C) risk premium on a risky security minus the risk-free rate.

D) the risk-free rate plus the inflation rate.

E) risk-free rate minus the inflation rate.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that the market prices of the securities that trade in a particular market fairly reflect the available information related to those securities.Which one of the following terms best defines that market?

A) riskless market

B) evenly distributed market

C) zero volatility market

D) Blume's market

E) efficient capital market

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 98

Related Exams