A) 1.58%

B) 5.68%

C) 12.20%

D) 13.33%

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following results in an increase in cash to the firm?

A) Dividends paid

B) A delay in collecting on accounts receivable

C) Net new investments

D) Increase in accounts payable

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Another term for EVA is ________.

A) net income

B) operating income

C) residual income

D) market based income

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a ratio used in the DuPont analysis?

A) Interest burden

B) Profit margin

C) Asset turnover

D) Earnings yield ratio

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm has a ROE equal to the industry average but its price-to-book ratio is below the industry average. You know that the firm's ________.

A) earnings yield is above the industry average

B) P/E ratio is above the industry average

C) dividend payout ratio is too high

D) interest burden must be below the industry average

F) A) and C)

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

If a firm has a positive tax rate, a positive operating ROA, and the interest rate on debt is the same as the operating ROA, then operating ROA will be ________.

A) greater than zero but it is impossible to determine how operating ROA will compare to ROE

B) equal to ROE

C) greater than ROE

D) less than ROE

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following ratios are related to efficiency except for ________.

A) total asset turnover

B) fixed asset turnover

C) average collection period

D) cash ratio

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following transactions will result in a decrease in cash flow from investments?

A) Acquisition of another business

B) Capital gain from sale of a subsidiary

C) Decrease in net investments

D) Sale of equipment

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

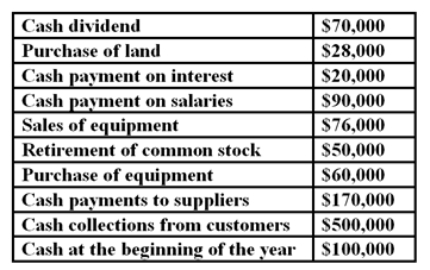

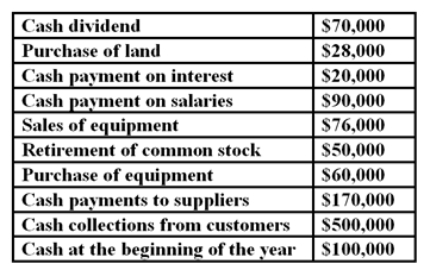

Use the following cash flow data of Haven Hardware for the year ended 31 December 2013.  What is the net increase or decrease in cash for Haven Hardware for 2013?

What is the net increase or decrease in cash for Haven Hardware for 2013?

A) ($94 000)

B) ($88 000)

C) $88 000

D) $188 000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Common-size balance sheets are prepared by dividing all quantities by ________.

A) total assets

B) total liabilities

C) shareholder's equity

D) fixed assets

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following cash flow data of Haven Hardware for the year ended 31 December 2013.  What is the cash at the end of 2013 for Haven Hardware?

What is the cash at the end of 2013 for Haven Hardware?

A) $6 000

B) $94 000

C) $736 000

D) $188 000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The ABS company has a capital base of $100 million, an opportunity cost of capital (k) of 15%, a return on assets (ROA) of 9% and a return on equity (ROE) of 18%. What is the economic value added (EVA) for ABS?

A) $8 million

B) -$6 million

C) $3 million

D) -$4 million

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm purchases goods on credit worth $90. The same firm pays off $100 in old credit purchases. An investment is made via the purchase of a new facility and equity is issued in the amount of $180 to pay for the purchase. What is the change in net cash provided by investments?

A) $10 decrease

B) $90 decrease

C) $180 decrease

D) $190 decrease

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm has a compound leverage factor greater than 1 indicates that ________.

A) this firm has no interest payments

B) this firm uses less debt as a percentage of financing

C) its interest payments are equal to the firm's pretax profits

D) its debt has a positive contribution to the firm's ROA

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Operating ROA is calculated as ________ while ROE is calculated as ________.

A) EBIT/Total assets; Net profit/Total assets

B) Net profit/Total assets; EBIT/Total assets

C) EBIT/Total assets; Net profit/Equity

D) Net profit/EBIT; Sales/Total assets

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a firm's ratio of (shareholders' equity/total assets) is lower than the industry average and its ratio of (long-term debt/shareholders' equity) is also lower than the industry average, this would suggest that the firm ________.

A) has more current liabilities than the industry average

B) has more leased assets than the industry average

C) will be less profitable than the industry average

D) has more current assets than the industry average

F) None of the above

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

A firm has an ROA of 19%, a debt/equity ratio of 1.8, a tax rate of 30%, and the interest rate on its debt is 7%. Its ROE is ________.

A) 15.12%

B) 28.42%

C) 37.24%

D) 40.60%

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What ratio will definitely increase when a firm increases its annual sales with no corresponding increase in assets?

A) Asset turnover

B) Current ratio

C) Liquidity ratio

D) Quick ratio

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the interest rate on debt is higher than the ROA, then a firm's ROE will ________.

A) decrease

B) increase

C) not change

D) change but in an indeterminable manner

F) C) and D)

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

The level of real income of a firm can be distorted by the reporting of depreciation and interest expense. During periods of low inflation, the level of reported depreciation tends to ________ income, and the level of interest expense reported tends to ________ income.

A) understate; overstate

B) understate; understate

C) overstate; understate

D) overstate; overstate

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 55

Related Exams