A) Traditional budgeting.

B) Management budgeting.

C) Master budgeting.

D) Activity-based budgeting.

E) Cash budgeting.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In preparing a budgeted balance sheet,the amount for Accounts Receivable is primarily determined from:

A) The purchases budget.

B) The sales budget.

C) The capital expenditures budget.

D) The budgeted income statement.

E) The selling expenses budget.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The set of periodic budgets that are prepared and periodically revised in the practice of continuous budgeting are called:

A) Production budgets.

B) Sales budgets.

C) Cash budgets.

D) Rolling budgets.

E) Capital expenditures budgets.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would not be used in preparing a cash budget for October?

A) Beginning cash balance on October 1.

B) Budgeted sales and collections for October.

C) Estimated depreciation expense for October.

D) Budgeted salaries expense for October.

E) Budgeted capital equipment purchases for October.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a result of following a well-designed budgeting process?

A) Improved decision-making processes.

B) Improved performance evaluations.

C) Improved coordination of business activities.

D) Assurance of future profits.

E) All of these are benefits of effective budgeting.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Activity-based budgeting is a budget system based on expected activities and their activity levels,which helps management plan for the resources required.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

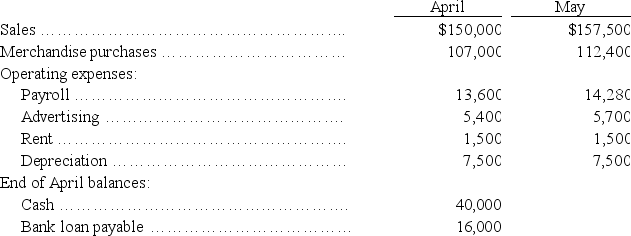

Sweeny Co.is preparing a cash budget for the second quarter of the coming year.The following data have been forecasted:

Additional data:

(1)Sales are 40% cash and 60% credit.The collection pattern for credit sales is 50% in the month following the sale and 50% in the month thereafter.Total sales in March were $125,000.

(2)Purchases are all on credit,with 40% paid in the month of purchase and the balance paid in the following month.

(3)Operating expenses are paid in the month they are incurred.

(4)A minimum cash balance of $40,000 is required at the end of each month.

(5)Loans are used to maintain the minimum cash balance.At the end of each month,interest of 1% per month is paid on the outstanding loan balance as of the beginning of the month.Repayments are made whenever excess cash is available.

Prepare the company's cash budget for May.Show the ending loan balance at May 31.

Additional data:

(1)Sales are 40% cash and 60% credit.The collection pattern for credit sales is 50% in the month following the sale and 50% in the month thereafter.Total sales in March were $125,000.

(2)Purchases are all on credit,with 40% paid in the month of purchase and the balance paid in the following month.

(3)Operating expenses are paid in the month they are incurred.

(4)A minimum cash balance of $40,000 is required at the end of each month.

(5)Loans are used to maintain the minimum cash balance.At the end of each month,interest of 1% per month is paid on the outstanding loan balance as of the beginning of the month.Repayments are made whenever excess cash is available.

Prepare the company's cash budget for May.Show the ending loan balance at May 31.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The usual budget period is:

A) An annual period of 250 working days.

B) A monthly period separated into daily budgets.

C) A quarterly period separated into weekly budgets.

D) An annual period separated into weekly budgets.

E) An annual period separated into quarterly and monthly budgets.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Keegan Company manufactures a single product and has a JIT policy that ending inventory must equal 10% of the next month's sales.It estimates that May's ending inventory will consist of 20,000 units.June and July sales are estimated to be 280,000 and 290,000 units,respectively.Compute the number of units to be produced that would appear on the company's production budget for the month of June.

A) 288,000.

B) 260,000.

C) 289,000.

D) 280,000.

E) 309,000.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A plan that lists the types and amounts of selling expenses expected during the budget period is called a(n) :

A) Sales budget.

B) Operating budget.

C) Capital expenditures budget.

D) Selling expense budget.

E) Purchases budget.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Short Answer

A ________________________ is a continuously revised budget that adds future months or quarters to replace months or quarters that have lapsed.

Correct Answer

verified

Correct Answer

verified

True/False

A budget can be an effective means of communicating management's plans to the employees of a business.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The merchandise purchases budget depends on information provided by the sales budget.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A cash budget is a plan that includes the expected cash receipts and cash expenditures during each of the periods that it covers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Barrett's Fashions forecasts sales of $125,000 for the quarter ended December 31.Its gross profit rate is 20% of sales,and its September 30 inventory is $32,500.If the December 31 inventory is targeted at $41,500,budgeted purchases for the fourth quarter should be:

A) $134,000.

B) $109,000.

C) $ 91,500.

D) $ 25,000.

E) $ 91,000.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Budgets are normally more effective when all levels of management are involved in the budgeting process.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In preparing financial budgets:

A) The budgeted balance sheet is usually prepared last.

B) The cash budget is usually not prepared.

C) The budgeted income statement is usually not prepared.

D) The capital expenditures budget is usually prepared last.

E) The merchandise purchases budget is the key budget.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When preparing the cash budget,all the following should be considered except:

A) Cash receipts from customers.

B) Cash payments for merchandise.

C) Depreciation expense.

D) Cash payments for income taxes.

E) Cash payments for capital expenditures.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

A capital expenditures budget is prepared before the operating budgets.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A plan showing the planned sales units and the revenue to be derived from these sales,and is the usual starting point in the budgeting process,is called the:

A) Operating budget.

B) Business plan.

C) Income statement budget.

D) Merchandise purchases budget.

E) Sales budget.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 153

Related Exams