Correct Answer

verified

Correct Answer

verified

Essay

Prepare journal entries to record the following production activities for Sherman Manufacturing. a.Incurred overhead costs of $79,000 (paid in cash). b.Applied overhead at 110% of direct labor costs which are $93,900. c.Transferred completed products with a cost of $258,200 to finished goods inventory. d.Sold $602,000 of product on credit.Cost is $271,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a process costing system,when manufacturing overhead costs are applied to the cost of production,they are debited to:

A) the Finished Goods Inventory account.

B) the Cost of Goods Sold account.

C) the Goods in Process Inventory account.

D) the Manufacturing Overhead account.

E) the Raw Materials Inventory account.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

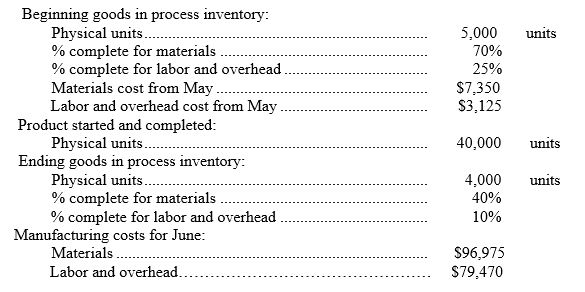

Refer to the following information about the Painting Department in the Richardson Factory for the month of June.Richardson Factory uses the weighted-average method of inventory costing.

Beginning goods in process inventory:

Compute the total cost of all units that were completed and transferred to finished goods during June.Compute the total cost of the ending goods in process inventory.

Compute the total cost of all units that were completed and transferred to finished goods during June.Compute the total cost of the ending goods in process inventory.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During March,the production department of a process manufacturing system completed a number of units of a product and transferred them to finished goods.Of the units transferred,25,000 were in process at the beginning of March and 110,000 were started and completed in March.March's beginning inventory units were 100% complete with respect to materials and 55% complete with respect to labor.At the end of March,30,000 additional units were in process in the production department and were 100% complete with respect to materials and 30% complete with respect to labor.Compute the number of equivalent units with respect to both materials and direct labor respectively for March using the weighted-average method.

A) 165,000; 165,000.

B) 135,000; 119,000.

C) 140,000; 130,250.

D) 165,000; 144,000.

E) 144,000; 144,000.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

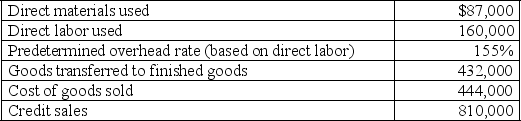

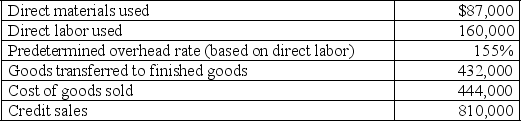

Embark produces mulch for landscaping use.The following information summarizes production operations for June.The journal entry to record June production activities for direct material usage is:

A) Debit Raw Materials Inventory $87,000; credit Accounts Payable $87,000.

B) Debit Raw Materials Inventory $87,000; credit Finished Goods Inventory $87,000.

C) Debit Cost of Goods Sold $87,000; credit Finished Goods Inventory $87,000.

D) Debit Goods in Process Inventory $87,000; credit Raw Materials Inventory $87,000.

E) Debit Goods in Process Inventory $87,000; credit Cost of Goods Sold $87,000.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The use of process costing is of little benefit to a service type of operation.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Equivalent units of production need to be determined only if a processing department adds materials and labor to its products at different rates.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is the best explanation for why it is necessary to calculate equivalent units of production in a process costing environment?

A) In most manufacturing environments, it is not possible to conduct a physical count of units.

B) Companies often use a combination of a process costing and job order costing systems.

C) In most process costing systems, direct materials are added at the beginning of the process while conversion costs are added evenly throughout the manufacturing process.

D) All of the work to make a unit 100% complete and ready to move to the next stage of production or to finished goods inventory may not have been completed in a single time period.

E) In most cases, there is no difference between physical units and equivalent units of production.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Short Answer

When the completed goods are sold,the cost of the completed goods are transferred to ____________________ .

Correct Answer

verified

Correct Answer

verified

True/False

A process cost accounting system records all factory overhead costs directly in the Goods in Process Inventory accounts.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The FIFO method separates prior period costs from costs incurred during the current period.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Embark produces mulch for landscaping use.The following information summarizes production operations and sales activities for June.The journal entry to record June sales is:

A) Debit Accounts Receivable $810,000; credit Cost of Goods Sold $810,000.

B) Debit Accounts Receivable $810,000; credit Sales $366,000; credit Finished Goods Inventory $444,000.

C) Debit Cost of Goods Sold $444,000; credit Sales $444,000.

D) Debit Finished Goods Inventory $444,000; debit Sales $810,000; credit Accounts Receivable $810,000; credit Cost of Goods Sold $444,000.

E) Debit Accounts Receivable $810,000; credit Sales $810,000; debit Cost of Goods Sold $444,000; credit Finished Goods Inventory $444,000.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company uses a process cost accounting system.Its Assembly Department's beginning inventory consisted of 50,000 units,3/4 complete with respect to direct labor and overhead.The department completed and transferred out 127,500 units this period.The ending inventory consists of 40,000 units that are 1/4 complete with respect to direct labor and overhead.All direct materials are added at the beginning of the process.The department incurred direct labor costs of $24,000 and overhead costs of $32,000 for the period.Assuming the weighted average method,the direct labor cost per equivalent unit (rounded to the nearest cent) is:

A) $0.14.

B) $0.16.

C) $0.17.

D) $0.30.

E) $0.37.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following characteristics does not usually apply to process manufacturing systems?

A) Each unit of product is separately identifiable.

B) Partially completed products are transferred between processes.

C) Different managers are responsible for different processes.

D) The output of all processes except the final process is an input to the next process.

E) All of the choices include characteristics of process manufacturing systems.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Process cost accounting systems consider direct costs to include those costs that can be readily identified with a particular process.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In a process cost accounting system,a department's production should be measured in terms of equivalent units when its beginning or ending inventory includes goods in process.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Process manufacturing usually reflects a manufacturer that produces large quantities of identical products.

B) False

Correct Answer

verified

Correct Answer

verified

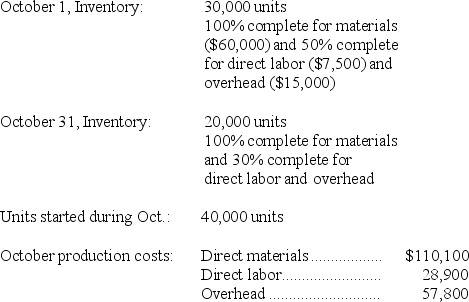

Essay

Heesacker,Inc.uses a process cost accounting system.The following operating and cost data occurred during October:

Materials are added at the beginning of the process.Direct labor and overhead are incurred evenly throughout the process.Prepare the October process cost summary assuming the weighted average method of inventory costing.

Materials are added at the beginning of the process.Direct labor and overhead are incurred evenly throughout the process.Prepare the October process cost summary assuming the weighted average method of inventory costing.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Medina Corp.uses the weighted average method for inventory costs and had the following information available for the year.Equivalent units of production for the year are: Beginning inventory of goods in process (40% complete,$1,100) ………..200 units Ending inventory of goods in process (80% complete) ……….. 400 units Total units started during the year……………… 3,200 units

A) 3,200 units.

B) 3,320 units.

C) 3,240 units.

D) 3,520 units.

E) 3,800 units.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 156

Related Exams