A) Form 940.

B) Form 1099.

C) Form 104.

D) Form W-2.

E) Form W-4.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

A company's income before interest expense and taxes is $250,000 and its interest expense is $100,000.Its times interest earned ratio is .4.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Define liabilities and explain the difference between current and long-term liabilities.

Correct Answer

verified

Liabilities are probable future payments of assets or services a company is presently obligated to make as a result of past transactions or events. Current liabilities are obligations due within one year or the company's operating cycle,whichever is longer. Long-term liabilities are obligations due beyond one year or the company's operating cycle,whichever is longer.

Correct Answer

verified

Multiple Choice

Accounts payable:

A) Are amounts owed to suppliers for products and/or services purchased on credit.

B) Are long-term liabilities.

C) Are estimated liabilities.

D) Do not include specific due dates.

E) Must be paid within 30 days.

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Required payroll deductions result from laws and include income taxes,Social Security taxes,pension and health contributions,union dues,and charitable giving.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Employers:

A) Pay FICA taxes equal to the amount of FICA taxes withheld from the employees.

B) Withhold employees' FICA taxes.

C) Pay unemployment taxes to the federal government.

D) Pay unemployment taxes to both the state and federal governments.

E) All of the choices are correct.

G) A) and E)

Correct Answer

verified

E

Correct Answer

verified

Essay

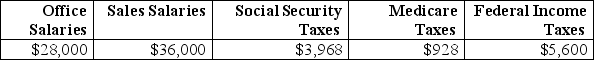

Frado Company provides you with following information related to payroll transactions for the month of May.Prepare journal entries to record the transactions for May.

a.Recorded the March payroll using the payroll register information given above.

b.Recorded the employer's payroll taxes resulting from the March payroll.The company had a merit rating that reduces its state unemployment tax rate to 3.5% of the first $7,000 paid each employee.Only $42,000 of the current months salaries are subject to unemployment taxes.The federal rate is .8%.

c.Issued a check to Swift Bank in payment of the May FICA and employee taxes.

d.Issued a check to the state for the payment of the SUTA taxes for the month of May.

e.Issued a check to Swift Bank in payment of the employer's quarterly FUTA taxes for the first quarter in the amount of $1,360.

a.Recorded the March payroll using the payroll register information given above.

b.Recorded the employer's payroll taxes resulting from the March payroll.The company had a merit rating that reduces its state unemployment tax rate to 3.5% of the first $7,000 paid each employee.Only $42,000 of the current months salaries are subject to unemployment taxes.The federal rate is .8%.

c.Issued a check to Swift Bank in payment of the May FICA and employee taxes.

d.Issued a check to the state for the payment of the SUTA taxes for the month of May.

e.Issued a check to Swift Bank in payment of the employer's quarterly FUTA taxes for the first quarter in the amount of $1,360.

Correct Answer

verified

Correct Answer

verified

Short Answer

__________ are obligations due within one year or the company's operating cycle,whichever is longer.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Federal Insurance Contributions Act (FICA) requires that each employer file a:

A) W-4.

B) Form 941.

C) Form 1040.

D) Form 1099.

E) All of the choices are correct.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Contingent liabilities must be recorded if:

A) The future event is probable and the amount owed can be reasonably estimated.

B) The future event is remote.

C) The future event is reasonably possible.

D) The amount owed cannot be reasonably estimated.

E) All of the choices are correct.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During August,Arena Company sells $356,000 in product that has a one year warranty.Experience shows that warranty expenses average about 5% of the selling price.The warranty liability account has a balance of $12,800 before adjustment.Customers returned product for warranty repairs during the month that used $9,400 in parts for repairs.The entry to record the customer warranty repairs is:

A) Debit Warranty Expense $17,800; credit Estimated Warranty Liability $17,800.

B) Debit Warranty Expense $9,400; credit Estimated Warranty Liability $9,400.

C) Debit Warranty Expense $14,400; credit Estimated Warranty Liability $14,400.

D) Debit Estimated Warranty Liability $9,400; credit Parts Inventory $9,400.

E) Debit Estimated Warranty Liability $17,800; credit Parts Inventory $17,800.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Obligations not due within one year or the company's operating cycle,whichever is longer,are reported as current liabilities.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

On November 1,Bob's Skateboards signed a $12,000,90-day,5% note payable to cover a past due account payable. a.What amount of interest expense on this note should Bob's Skateboards report on year-end December 31? b.Prepare Bob's journal entry to record the issuance of the note payable. c.Prepare Bob's journal entry to record the payment of the note on February 1 of the following year.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On November 1,Carter Company signed a 120-day,10% note payable,with a face value of $9,000.What is the adjusting entry for the accrued interest at December 31 on the note?

A) Debit interest expense, $0; credit interest payable, $0.

B) Debit interest expense, $100; credit interest payable, $100.

C) Debit interest expense, $150; credit interest payable, $150.

D) Debit interest expense, $200; credit interest payable, $200.

E) Debit interest expense, $300; credit interest payable, $300.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Liabilities:

A) Must be certain.

B) Must sometimes be estimated.

C) Must be for a specific amount.

D) Must always have a definite date for payment.

E) Must involve an outflow of cash.

G) A) and C)

Correct Answer

verified

B

Correct Answer

verified

True/False

A liability is a probable future payment of assets or services that a company is presently obligated to make as a result of past transactions or events.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A bank that is authorized to accept deposits of amounts payable to the federal government is a:

A) Credit union.

B) FDIC insured bank.

C) Federal depository bank.

D) National bank.

E) Federal Reserve Bank.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On December 1,Martin Company signed a 90-day,6% note payable,with a face value of $5,000.What amount of interest expense is accrued at December 31 on the note?

A) $0

B) $25

C) $50

D) $75

E) $300

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fixed expenses:

A) Create risk.

B) Can be an advantage when a company is growing.

C) Include interest expense.

D) Do not fluctuate with changes in sales.

E) All of the choices are correct.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

A high value for the times interest earned ratio means that a company is a higher risk borrower.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 194

Related Exams