Correct Answer

verified

Correct Answer

verified

Essay

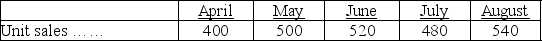

Addams, Inc., is preparing its master budget for the second quarter. The following sales and production data have been forecasted:

Finished goods inventory on March 31: 120 units

Raw materials inventory on March 31: 450 pounds

Desired ending inventory each month:

Finished goods: 30% of next month's sales

Raw materials: 25% of next month's production needs

Number of pounds of raw material required per finished unit: 4 lbs.

How many pounds of raw materials should be purchased in April?

Finished goods inventory on March 31: 120 units

Raw materials inventory on March 31: 450 pounds

Desired ending inventory each month:

Finished goods: 30% of next month's sales

Raw materials: 25% of next month's production needs

Number of pounds of raw material required per finished unit: 4 lbs.

How many pounds of raw materials should be purchased in April?

Correct Answer

verified

Correct Answer

verified

Essay

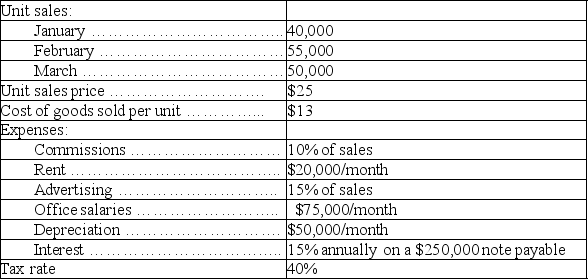

Argenta, Inc. is preparing its master budget for the first quarter of its calendar year. The following forecasted data relate to the first quarter:

Prepare a budgeted income statement for this first quarter.

Prepare a budgeted income statement for this first quarter.

Correct Answer

verified

Correct Answer

verified

True/False

The production budget cannot be prepared until the direct materials and direct labor budgets are prepared.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Walter Enterprises expects its September sales to be 20% higher than its August sales of $150,000. Purchases were $100,000 in August and are expected to be $120,000 in September. All sales are on credit and are collected as follows: 30% in the month of the sale and 70% in the following month. Merchandise purchases are paid as follows: 25% in the month of purchase and 75% in the following month. The beginning cash balance on September 1 is $7,500. The ending cash balance on September 30 would be:

A) $31,500.

B) $67,500.

C) $54,000.

D) $61,500.

E) $136,500.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Larger, more complex organizations usually require a longer time to prepare their budgets than smaller organizations because of the considerable effort to coordinate the different units within the business.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A July sales forecast projects that 6,000 units are going to be sold at a price of $10.50 per unit. The management forecasts 2% growth in sales each month. Total August sales are anticipated to be:

A) $63,000.

B) $67,500.

C) $61,250.

D) $64,260.

E) $60,000.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A managerial accounting report that presents predicted amounts of the company's assets, liabilities, and equity as of the end of the budget period is called a(n) :

A) Rolling balance sheet.

B) Continuous balance sheet.

C) Budgeted balance sheet.

D) Cash balance sheet.

E) Operating balance sheet.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ratchet Manufacturing anticipates total sales for August, September, and October of $200,000, $210,000, and $220,500 respectively. Cash sales are normally 25% of total sales and the remaining sales are on credit. All credit sales are collected in the first month after the sale. Compute the amount of cash received for September.

A) $150,000.

B) $202,500.

C) $157,500.

D) $102,500.

E) $307,500.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company's history indicates that 20% of its sales are for cash and the rest are on credit. Collections on credit sales are 30% in the month of the sale, 50% in the next month, and 15% the following month. Projected sales for January, February, and March are $60,000, $85,000 and $95,000, respectively. The March expected cash receipts from all current and prior credit sales is:

A) $57,000

B) $63,080

C) $64,000

D) $80,750

E) $90,250

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following budgets is not an operating budget?

A) Sales budget.

B) Cash budget.

C) General and administrative expense budget.

D) Selling expenses budget.

E) Production budget.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Flack Corporation, a merchandiser, provides the following information for its December budgeting process: The November 30 inventory was 1,800 units. Budgeted sales for December are 4,000 units. Desired December 31 inventory is 2,840 units. Budgeted purchases are:

A) 5,040 units.

B) 1,240 units.

C) 6,840 units.

D) 4,000 units.

E) 5,800 units.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cameroon Corp. manufactures and sells electric staplers for $16 each. If 10,000 units were sold in December, and management forecasts 4% growth in sales each month, the number of electric stapler sales budgeted for February should be:

A) 10,000

B) 11,249

C) 10,400

D) 10,816

E) 11,000

G) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The financial statement effects of the budgeting process are summarized on the cash budget and the capital expenditures budget.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following accounts would appear on a budgeted balance sheet?

A) Income tax expense.

B) Accounts receivable.

C) Sales commissions.

D) Depreciation expense.

E) All of the choices are correct.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Production budgets always show both budgeted units of product and total costs for the budgeted units.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A quantity of inventory that provides protection against lost sales caused by unfulfilled demands from customers is called:

A) Just-in-time inventory.

B) Budgeted stock.

C) Continuous inventory.

D) Capital stock.

E) Safety stock.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cameroon Corp. manufactures and sells electric staplers for $16 each. If 10,000 units were sold in December, and management forecasts 4% growth in sales each month, the dollar amount of electric stapler sales budgeted for February should be:

A) $187,177

B) $166,400

C) $179,978

D) $173,056

E) $160,000

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The central guidance of the budget process is the responsibility of the:

A) Chief Accounting Officer.

B) Chief Executive Officer (CEO) .

C) Chief Financial Officer (CFO) .

D) Budget Committee.

E) Board of Directors.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Calgary Industries is preparing a budgeted income statement for 2018 and has accumulated the following information. Predicted sales for the year are $730,000 and cost of goods sold is 40% of sales. The expected selling expenses are $81,000 and the expected general and administrative expenses are $90,000, which includes $23,000 of depreciation. The company's income tax rate is 30%. The budgeted net income for 2018 is:

A) $438,000.

B) $186,900.

C) $267,000.

D) $84,700.

E) $80,100.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 213

Related Exams