A) special-interest effect.

B) bureaucratic inefficiency.

C) pressure by special-interest groups.

D) extensive positive externalities from public and quasi-public goods.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The "pork" in pork-barrel politics refers to government projects that politicians try to secure in favor of the common good for the whole nation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The concept of limited and bundled choice, as used in public choice theory, refers to the fact that

A) politicians may not be objective in evaluating economic policy programs due to their individual biases.

B) because of the importance of television and other modern communication media, the best and brightest candidates may not be the ones elected by voters.

C) in an election, each voter must select a candidate who has various preferences (in a wide array of issues) that do not exactly match the preferences of the voter.

D) the most economically efficient public policy programs may not be selected because political leaders do not know enough about economics.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Nobody gains from pork-barrel politics other than the politicians.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is a likely explanation for why the budget of a government agency might increase beyond its optimal size?

A) the paradox of voting

B) the influence of the median voter

C) the power of special-interest groups

D) the allocative efficiency of government

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The situation where "the few who yell the loudest get heard" is referred to as the

A) special-interest effect.

B) principal-agent problem.

C) moral hazard problem.

D) adverse selection effect.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In what way, if any, does the invisible hand affect government resource allocation?

A) It enhances government efficiency by promoting competition for resources within government.

B) It does not help resource allocation, as there are no competitive forces within government that automatically direct resources to their best uses.

C) It rewards government bureaucrats who are most efficient at implementing public policies.

D) It reduces government efficiency by sending market signals that interfere with government decision making.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Proponents of deregulation point to all of the following industries as examples of successful deregulation except for

A) airlines.

B) pharmaceuticals.

C) railroads.

D) interstate trucking.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

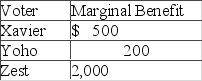

Answer the question on the basis of this table showing the marginal benefit that a particular public project will provide to each of the three members of a community. No vote trading is allowed.  If the tax cost of this proposed project is $300 per person, a majority vote will

If the tax cost of this proposed project is $300 per person, a majority vote will

A) defeat this project and resources will be underallocated to it.

B) pass this project and resources will be allocated efficiently.

C) pass this project and resources will be underallocated to it.

D) defeat this project and resources will be overallocated to it.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If a public good provides social benefits that are greater than its costs, then the majority of voters would always vote in favor of producing the good.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Public choice economists

A) analyze the incidence of taxes.

B) are also known as Keynesian economists.

C) use the tools of economics to analyze decision making, politics, and elections in the public sector.

D) are, by definition, economists employed by federal, state, and local governments.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When politicians support policies such as imposing punitive tariffs on imports, which are popular among voters but which also reduce economic efficiency, we refer to this as

A) regulatory capture.

B) voter failure.

C) limited and bundled choice.

D) paradox of voting.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Interest groups result when people

A) in a certain zip code vote together.

B) who share strong preferences on a choice band together.

C) do not all vote in elections.

D) do not have strong preferences on the issues to be voted on.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Special-interest groups result from people with strong preferences on a particular issue banding together to let policymakers know their preferences and could thereby lead to efficient outcomes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a key difference between the economic activities of government and those of private firms?

A) Private firms face the constraint of scarcity; government does not.

B) Government focuses primarily on equity; private firms focus only on efficiency.

C) Private economic activities create externalities; government activities do not.

D) Government has the legal right to force people to do things; private firms do not.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Economists widely support deregulation of industries that tend toward monopoly or generate substantial negative externalities.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Deregulation of an industry will always lead to an improvement in economic efficiency.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In presidential elections, voters often find that they do not agree with any single candidate on all the issues that matter to them (the voters) . This is known as the

A) principal-agent problem.

B) limited and bundled choice problem.

C) rent-seeking behavior problem.

D) lack of accountability problem.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Majority voting produces efficient outcomes because it takes into account the strength of the preferences of individual voters.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Government in a market system can increase economic efficiency by collecting taxes in order to subsidize the production of

A) goods with negative externalities.

B) goods with positive externalities.

C) private sector goods.

D) complementary goods.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 275

Related Exams