B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Aharon exercises 10 stock options awarded several years ago. The following information pertains to the options: (1) each option gives the employee the right to buy 10 shares, (2) the market price on the grant date was $7, (3) the strike price is $10, and (4) the market price on the exercise date was $15. How much will it cost Aharon to purchase the options on the exercise date?

A) $90.

B) $500.

C) $700.

D) $1,000.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding employer provided educational benefits is true?

A) All undergraduate tuition expenses can be excluded.

B) Only educational benefits from public universities can be excluded.

C) Up to $5,250 in tuition benefits can be excluded.

D) All graduate tuition expenses are included.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Rachel receives employer provided health insurance. The employer's cost of the health insurance is $6,000 annually. What is her employer's after-tax cost of providing the health insurance, assuming that the employer's marginal tax rate is 35 percent?

A) $0

B) $3,900

C) $4,198

D) $6,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following forms is filled out by an employee, who is a citizen, at the beginning of an employment relationship?

A) Form I-9.

B) Form W-2.

C) Form W-4.

D) Form 1099.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bonnie's employer provides her with an annual dinner club membership costing $5,000. Her marginal tax rate is 25 percent. Her employer has a marginal tax rate of 35 percent. What is Bonnie's after-tax benefit?

A) $0.

B) $1,250.

C) $3,750.

D) $5,000.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tasha receives reimbursement from her employer for dependent care expenses for up to $8,000. Tasha applies for and receives reimbursement of $6,000 for her 10 year old son. How much, if any, is includible in her income?

A) $0.

B) $1,000.

C) $3,000.

D) $6,000.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding restricted stock is false?

A) Like stock options, restricted stock has to vest before it can be sold.

B) Like nonqualified stock options, the employee's income inclusion for restricted stock is the bargain element.

C) Even if the value of restricted stock decreases from the price on the grant date, it retains some value to the employee.

D) There is no effective tax planning elections for restricted stock.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the items is not correct regarding withholding?

A) Employees that also have self employment income can have additional amounts withheld to avoid estimated tax payments.

B) Employees cannot claim an allowance for a child unless they are entitled to claim the child as a dependent.

C) Employees can claim exempt and avoid withholding.

D) Married employees can choose to be withheld at the higher single rates.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Short Answer

Suzanne received 20 ISOs (each option gives her the right to purchase 20 shares of stock for $12 per share) at the time she started working when the stock price was $13 per share. Three years later, when the share price was $23 per share, she exercised all of her options. If Suzanne holds the shares for one additional year and sells them when the market price is $30, how much gain will Suzanne recognize on the sale and how much tax will she pay assuming her marginal tax rate is 35 percent?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding income tax withholding is incorrect?

A) The withholding tables are designed so that employee withholding approximates the tax liability.

B) Large itemized deductions require the need for additional withholding.

C) The withholding tables vary based on filing status.

D) Extra allowances can be claimed and reduce withholding.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is false regarding a section 83(b) election?

A) The election freezes the value of the employee's compensation at the grant date.

B) The election is an important tax planning tool if the stock is expected to increase in value.

C) The election must be made within 30 days of the grant date.

D) If an employee leaves before the vesting date, any loss is limited to $3,000.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Short Answer

Lina, a single taxpayer with a 35 percent marginal tax rate, desires health insurance. The health insurance would cost Lina $8,000 to purchase if she pays for it herself (Lina's AGI is too high to receive any tax deduction for the insurance as a medical expense). Lina's employer has a 30 percent marginal tax rate. What is the maximum amount of before-tax salary Lina would give up to receive health insurance?

Correct Answer

verified

Correct Answer

verified

True/False

Up to $5,250 of educational benefits can be excluded from an employee's compensation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a purpose of equity-based compensation?

A) Provide risk and incentives to employees.

B) Motivate employees by aligning employee and employer incentives.

C) Avoid compensation limits for executives.

D) Provides a low or no cost form of compensation.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

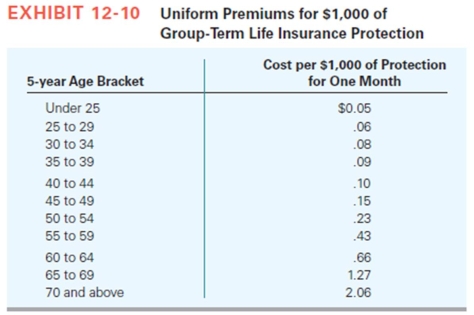

Grace's employer is now offering group-term life insurance. The company will provide each employee with $200,000 of group-term life insurance. It costs Grace's employer $700 to provide this amount of insurance to Grace each year. Assuming that Grace is 43 years old, use the table to determine the monthly premium that Grace must include in income as a result of receiving the group-term life benefit.

A) $0.

B) $15.00.

C) $22.00.

D) $58.33.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

On Form W-4, an employee can only claim one allowance for each personal or dependency exemption that will be claimed on the employee's income tax return.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

Rick recently received 500 shares of restricted stock from his employer, Crazy Corporation, when the share price was $5 per share. Rick's restricted shares vested three years later when the market price was $12. Rick held the shares for a little more than a year and sold them when the market price was $15. What is the amount of Rick's income on the vesting date? Assuming a marginal tax rate of 30 percent, what is Rick's tax on the restricted stock?

Correct Answer

verified

Correct Answer

verified

Short Answer

Hazel received 20 NQOs (each option gives her the right to purchase 10 shares of stock for $7 per share) at the time she started working when the stock price was $14 per share. Now that the share price is $20 per share, she intends to exercise all of her options. How much income will Hazel recognize on the exercise date and how much tax will she pay assuming her marginal tax rate is 25 percent?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tanya's employer offers a cafeteria plan that allows employees to choose among a number of benefits. Each employee is allowed $6,000 in benefits. For 2014, Tanya selected $3,200 of parking, $2,200 in 401(k) contributions, and $800 of cash. How much must Tanya include in taxable income?

A) $0.

B) $1,000.

C) $1,120.

D) $4,000.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 102

Related Exams