B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

(Consider This) Economist Arthur Laffer equated Robin Hood to:

A) government and equated the people passing through Sherwood Forest to taxpayers.

B) charitable organizations and equated the people passing through Sherwood Forest to poor people.

C) businesses and equated the people passing through Sherwood Forest to consumers.

D) government and equated the people passing through Sherwood Forest to importers of goods and services.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

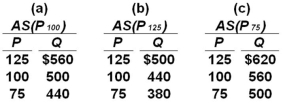

Suppose the full employment level of real output (Q) for a hypothetical economy is $500,the price level (P) initially is 100,and prices and wages are flexible both upward and downward.Use the following short-run aggregate supply schedules to answer the question.  Refer to the information given.In the long run,a fall in the price level from 100 to 75 will:

Refer to the information given.In the long run,a fall in the price level from 100 to 75 will:

A) decrease real output from $500 to $440.

B) increase real output from $500 to $620.

C) change the aggregate supply schedule from (a) to (c) and produce an equilibrium level of real output of $500.

D) change the aggregate supply schedule from (a) to (b) and produce an equilibrium level of real output of $500.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If government uses its stabilization policies to maintain full employment under conditions of cost-push inflation:

A) a deflationary spiral is likely to occur.

B) an inflationary spiral is likely to occur.

C) stagflation is likely to occur.

D) the Phillips Curve is likely to shift inward.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Inflation in the U.S.economy tends to be:

A) a finite,one-time event resulting from a shock.

B) ongoing,as increases in aggregate demand generally exceed the increases in aggregate supply.

C) a finite,one-time event as the Fed actively works to eliminate all inflation.

D) ongoing,as aggregate supply is continually shifting to the left.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the last half of the 1990s,the usual short-run trade-off between inflation and unemployment did not arise because:

A) the Fed held interest rates constant.

B) the federal government balanced its budget.

C) the U.S.personal savings rate rose.

D) productivity (and thus aggregate supply) grew faster than previously.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The short-run aggregate supply curve is upsloping because higher price levels:

A) lower interest rates and encourage firms to invest and produce more.

B) create incentives to expand output when resource prices are unresponsive to price-level changes.

C) encourage importation of foreign goods.

D) create an expectation among producers of still higher price levels.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the research of Christina Romer and David Romer:

A) a tax reduction of 1 percent of GDP lowers real GDP by roughly 2 to 3 percent.

B) a tax increase of 1 percent of GDP lowers real GDP by roughly 2 to 3 percent.

C) a tax reduction of 2 to 3 percent raises real GDP by roughly 1 percent.

D) a tax increase of 2 to 3 percent lowers real GDP by roughly 1 percent.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The last few years of the 1990s in the United States were characterized by:

A) low inflation and high unemployment.

B) stagflation.

C) low inflation and low unemployment.

D) a high misery index.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the long run:

A) attempts to "fine-tune" the economy cause the rate of unemployment to accelerate.

B) there is no inflation-unemployment trade-off.

C) there is an inflation-unemployment trade-off and the terms of that trade-off have worsened in recent years.

D) there is an inflation-unemployment trade-off,but the terms of that trade-off have improved in recent years.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Laffer Curve is a central concept in:

A) monetarism.

B) Keynesianism.

C) welfare economics.

D) supply-side economics.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 71 of 71

Related Exams