B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

(Advanced analysis) Answer the question on the basis of the following information for a private open economy.The letters Y,C,Ig,X,and M stand for GDP,consumption,gross investment,exports,and imports respectively.Figures are in billions of dollars. The equilibrium GDP (=Y) in the economy is:

A) $200.

B) $245.

C) $320.

D) $350.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If an unintended increase in business inventories occurs:

A) we can expect aggregate production to be unaffected.

B) we can expect businesses to increase the level of production.

C) we can expect businesses to lower the level of production.

D) aggregate expenditures must exceed the domestic output.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Actual investment is $62 billion at an equilibrium output level of $620 billion in a private closed economy.The average propensity to save at this level of output is:

A) 0.10.

B) 10.0.

C) 0.62.

D) 0.84.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume the MPC is .8.If government were to impose $50 billion of new taxes on household income,consumption spending would initially decrease by:

A) $100 billion.

B) $90 billion.

C) $40 billion.

D) $50 billion.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If at some level of GDP the economy is experiencing an unintended decrease in inventories:

A) the aggregate level of saving will decline.

B) the price level will fall.

C) the business sector will lay off workers.

D) domestic output will increase.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An increase in taxes of a specific amount will have a smaller impact on the equilibrium GDP than will a decline in government spending of the same amount because:

A) the MPC is smaller in the private sector than it is in the public sector.

B) declines in government spending always tend to stimulate private investment.

C) disposable income will fall by some amount smaller than the tax increase.

D) some of the tax increase will be paid out of income that would otherwise have been saved.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At equilibrium real GDP in a private closed economy:

A) the MPC must equal the APC.

B) the slope of the aggregate expenditures schedule equals the MPS.

C) aggregate expenditures and real GDP are equal.

D) planned saving and consumption are equal.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

(Advanced analysis) If S = -60 + .25Y and Ig = 60,where S is saving,Ig is gross investment,and Y is gross domestic product (GDP) ,then the equilibrium level of GDP is:

A) $200.

B) $320.

C) $360.

D) $480.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a correct statement of the impacts of a lump-sum tax?

A) Disposable income will increase by the amount of the tax and consumption at each level of GDP will decline by the amount of the tax multiplied by the MPC.

B) Disposable income will decline by the amount of the tax and consumption at each level of GDP will decline by the amount of the tax multiplied by the multiplier.

C) Disposable income will decline by the amount of the tax and consumption at each level of GDP will also decline by the amount of the tax.

D) Disposable income will decline by the amount of the tax and consumption at each level of GDP will decline by the amount of the tax multiplied by the MPC.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

(Advanced analysis) Assume the consumption schedule for a private closed economy is C = 40 + .75Y,where C is consumption and Y is gross domestic product.The multiplier for this economy is:

A) 3.

B) 4.

C) 5.

D) 10.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Answer the question on the basis of the following data for a private closed economy. Refer to the data.The MPS is:

A) 7/10.

B) 3/10.

C) 2/5.

D) 3/5.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An increase in taxes will have a greater effect on the equilibrium GDP:

A) if the tax revenues are redistributed through transfer payments.

B) the larger the MPS.

C) the smaller the MPC.

D) the larger the MPC.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If an increase in aggregate expenditures results in no increase in real GDP,we can surmise that the:

A) economy is in a deep recession.

B) MPC equals 1.

C) economy is already operating at full employment.

D) price level has fallen.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

(Advanced analysis) Answer the question on the basis of the following consumption and investment data for a private closed economy.Figures are in billions of dollars. C = 60 + .6Y I = I0 = 30 Refer to the data.In equilibrium,the level of consumption spending will be:

A) 170.

B) 270.

C) 160.

D) 195.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the economy is in equilibrium at $400 billion of GDP and the full-employment GDP is $500 billion:

A) real and nominal GDP will both increase.

B) GDP will remain at $400 billion unless aggregate expenditures change.

C) real GDP will increase,but nominal GDP will decrease.

D) the price level will increase.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Say's law and classical macroeconomics were disputed by:

A) Adam Smith.

B) Jeremy Bentham.

C) John Stuart Mill.

D) John Maynard Keynes.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

A lump-sum tax causes the after-tax consumption schedule to be flatter than the before-tax consumption schedule.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

(Advanced analysis) Answer the question on the basis of the following information for a private closed economy where C is consumption,Y is the gross domestic product,Ig is gross investment,and i is the interest rate: Refer to the information.The equilibrium level of GDP in this economy is:

A) $240.

B) $300.

C) $360.

D) $400.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

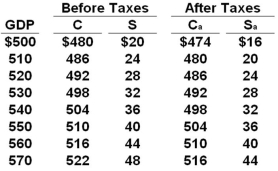

Answer the question on the basis of the following table:  Refer to the table.If an additional lump-sum tax of $20 were imposed,we would expect:

Refer to the table.If an additional lump-sum tax of $20 were imposed,we would expect:

A) equilibrium GDP to fall by $30.

B) equilibrium GDP to fall by $20.

C) equilibrium GDP to fall by $50.

D) equilibrium GDP to rise by $24.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 175

Related Exams