A) Suppose a firm is operating its fixed assets at below 100% of capacity, but it has no excess current assets. Based on the AFN equation, its AFN will be larger than if it had been operating with excess capacity in both fixed and current assets.

B) If a firm retains all of its earnings, then it cannot require any additional funds to support sales growth.

C) Additional funds needed (AFN) are typically raised using a combination of notes payable, long-term debt, and common stock. Such funds are non-spontaneous in the sense that they require explicit financing decisions to obtain them.

D) If a firm has a positive free cash flow, then it must have either a zero or a negative AFN.

E) Since accounts payable and accrued liabilities must eventually be paid off, as these accounts increase, AFN as calculated by the AFN equation must also increase.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is NOT one of the steps taken in the financial planning process?

A) Monitor operations after implementing the plan to spot any deviations and then take corrective actions.

B) Determine the amount of capital that will be needed to support the plan.

C) Develop a set of forecasted financial statements under alternative versions of the operating plan in order to analyze the effects of different operating procedures on projected profits and financial ratios.

D) Consult with key competitors about the optimal set of prices to charge, i.e., the prices that will maximize profits for our firm and its competitors.

E) Forecast the funds that will be generated internally. If internal funds are insufficient to cover the required new investment, then identify sources from which the required external capital can be raised.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The first, and perhaps the most critical, step in forecasting financial requirements is to forecast future sales.

B) Forecasted financial statements, as discussed in the text, are used primarily as a part of the managerial compensation program, where management's historical performance is evaluated.

C) The capital intensity ratio gives us an idea of the physical condition of the firm's fixed assets.

D) The AFN equation produces more accurate forecasts than the forecasted financial statement method, especially if fixed assets are lumpy, economies of scale exist, or if excess capacity exists.

E) Perhaps the most important step when developing forecasted financial statements is to determine the breakdown of common equity between common stock and retained earnings.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Firms pay a low interest rate on spontaneous liabilities so these funds are its cheapest source of capital.Consequently,the firm should make arrangements with its suppliers to use as much of this credit as possible.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The minimum growth rate that a firm can achieve with no access to external capital is called the firm's sustainable growth rate.It can be calculated by using the AFN equation with AFN equal to zero and solving for g.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Two firms with identical capital intensity ratios are generating the same amount of sales.However,Firm A is operating at full capacity,while Firm B is operating below capacity.If the two firms expect the same growth in sales during the next period,then Firm A is likely to need more additional funds than Firm B,other things held constant.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Daniel Sawyer,the CEO of the Sawyer Group,is initiating planning for the company's operations next year,and he wants you to forecast the firm's additional funds needed (AFN) .The firm is operating at full capacity.Data for use in your forecast are shown below.Based on the AFN equation,what is the AFN for the coming year? Dollars are in millions.

A) $102.8

B) $108.2

C) $113.9

D) $119.9

E) $125.9

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The AFN equation assumes that the ratios of assets and liabilities to sales remain constant over time.However,this assumption can be relaxed when we use the forecasted financial statement method.Three conditions where constant ratios cannot be assumed are economies of scale,lumpy assets,and excess capacity.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A firm will use spontaneous funds to the extent possible; however,due to credit terms,contracts with workers,and tax laws there is little flexibility in their usage.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

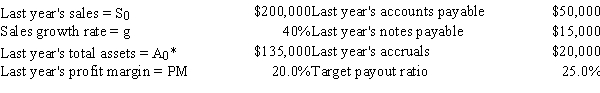

In your internship with Lewis,Lee,& Taylor Inc.you have been asked to forecast the firm's additional funds needed (AFN) for next year.The firm is operating at full capacity.Data for use in your forecast are shown below.Based on the AFN equation,what is the AFN for the coming year?

A) −$14,440

B) −$15,200

C) −$16,000

D) −$16,800

E) −$17,640

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Companies with relatively high assets-to-sales ratios require a relatively large amount of new assets for any given increase in sales; hence,they have a greater need for external financing.There are currently no alternatives for these types of firms to lower their asset requirements.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A firm's profit margin is 5%,its debt/assets ratio is 56%,and its dividend payout ratio is 40%.If the firm is operating at less than full capacity,then sales could increase to some extent without the need for external funds,but if it is operating at full capacity with respect to all assets,including fixed assets,then any positive growth in sales will require some external financing.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The capital intensity ratio is generally defined as follows:

A) The percentage of liabilities that increase spontaneously as a percentage of sales.

B) The ratio of sales to current assets.

C) The ratio of current assets to sales.

D) The amount of assets required per dollar of sales, or A0*/S0.

E) Sales divided by total assets, i.e., the total assets turnover ratio.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

North Construction had $850 million of sales last year,and it had $425 million of fixed assets that were used at only 60% of capacity.What is the maximum sales growth rate North could achieve before it had to increase its fixed assets?

A) 54.30%

B) 57.16%

C) 60.17%

D) 63.33%

E) 66.67%

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Last year Baron Enterprises had $350 million of sales,and it had $270 million of fixed assets that were used at 65% of capacity last year.In millions,by how much could Baron's sales increase before it is required to increase its fixed assets?

A) $170.09

B) $179.04

C) $188.46

D) $197.88

E) $207.78

G) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Firms with high capital intensity ratios have found ways to lower this ratio permitting them to achieve a given level of growth with fewer assets and consequently less external capital.For example,just-in-time inventory systems,multiple shifts for labor,and outsourcing production are all feasible ways for firms to reduce their capital intensity ratios.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

As long as a firm does not pay out 100% of its earnings,the firm's annual profit that is retained in the business (i.e.,the addition to retained earnings)is another source of funds for a firm's expansion.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Operating plans sketch out broad approaches for realization of the firm's strategic vision.These plans usually are developed for a period no longer than a 1-year time horizon because detail is "lost" by extending out the time horizon by more than 1 year.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a firm's capital intensity ratio (A0*/S0)decreases as sales increase,use of the AFN formula is likely to understate the amount of additional funds required,other things held constant.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If a firm's assets are growing at a positive rate, but its retained earnings are not increasing, then it would be impossible for the firm's AFN to be negative.

B) If a firm increases its dividend payout ratio in anticipation of higher earnings, but sales and earnings actually decrease, then the firm's actual AFN must, mathematically, exceed the previously calculated AFN.

C) Higher sales usually require higher asset levels, and this leads to what we call AFN. However, the AFN will be zero if the firm chooses to retain all of its profits, i.e., to have a zero dividend payout ratio.

D) Dividend policy does not affect the requirement for external funds based on the AFN equation.

E) The sustainable growth rate is the maximum achievable growth rate without the firm having to raise external funds. In other words, it is the growth rate at which the firm's AFN equals zero.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 46

Related Exams