A) $46,600

B) $19,200

C) $13,700

D) $38,700

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The cash budget is the starting point in preparing the master budget.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

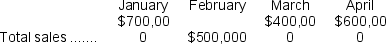

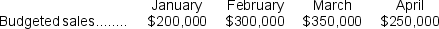

All of Pocast Corporation's sales are on account.Sixty percent of the credit sales are collected in the month of sale,30% in the month following sale,and 10% in the second month following sale.The following are budgeted sales data for the company:

Cash receipts in April are expected to be:

Cash receipts in April are expected to be:

A) $530,000

B) $360,000

C) $460,000

D) $410,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

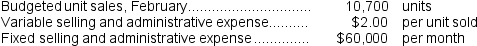

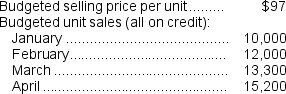

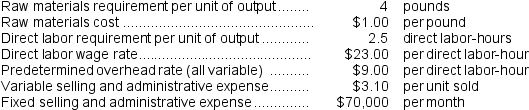

Yerkey Corporation makes one product and has provided the following information to help prepare the master budget:

The estimated selling and administrative expense for February is closest to:

The estimated selling and administrative expense for February is closest to:

A) $81,400

B) $21,400

C) $54,270

D) $60,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

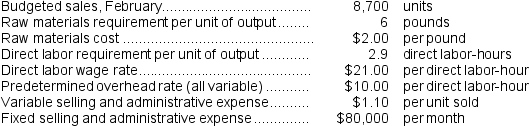

Fredericksen Corporation makes one product and has provided the following information:

The estimated cost of goods sold for February is closest to:

The estimated cost of goods sold for February is closest to:

A) $886,530

B) $634,230

C) $252,300

D) $721,230

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Essay

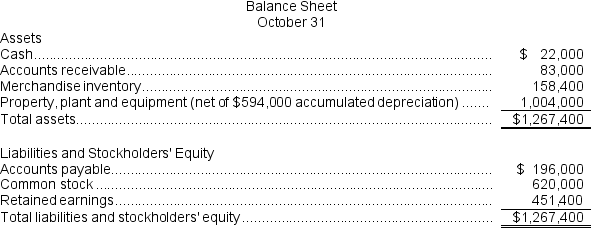

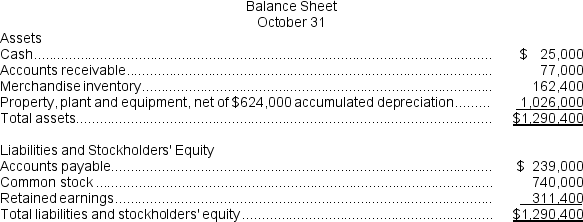

Weller Industrial Gas Corporation supplies acetylene and other compressed gases to industry.Data regarding the store's operations follow:

o Sales are budgeted at $330,000 for November,$300,000 for December,and $320,000 for January.

o Collections are expected to be 85% in the month of sale and 15% in the month following the sale.

o The cost of goods sold is 60% of sales.

o The company desires an ending merchandise inventory equal to 80% of the cost of goods sold in the following month.

o Payment for merchandise is made in the month following the purchase.

o Other monthly expenses to be paid in cash are $21,200.

o Monthly depreciation is $21,000.

o Ignore taxes.

Required:

a.Prepare a Schedule of Expected Cash Collections for November and December.

b.Prepare a Merchandise Purchases Budget for November and December.

c.Prepare Cash Budgets for November and December.

d.Prepare Budgeted Income Statements for November and December.

e.Prepare a Budgeted Balance Sheet for the end of December.

Required:

a.Prepare a Schedule of Expected Cash Collections for November and December.

b.Prepare a Merchandise Purchases Budget for November and December.

c.Prepare Cash Budgets for November and December.

d.Prepare Budgeted Income Statements for November and December.

e.Prepare a Budgeted Balance Sheet for the end of December.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Catano Corporation pays for 40% of its raw materials purchases in the month of purchase and 60% in the following month.If the budgeted cost of raw materials purchases in July is $256,550 and in August is $278,050,then in August the total budgeted cash disbursements for raw materials purchases is closest to:

A) $265,150

B) $153,930

C) $166,830

D) $111,220

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

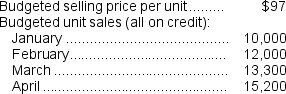

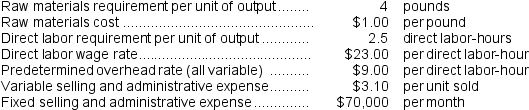

Bonkowski Corporation makes one product and has provided the following information to help prepare the master budget for the next four months of operations:

Credit sales are collected:

30% in the month of the sale

70% in the following month

Raw materials purchases are paid:

30% in the month of purchase

70% in the following month

The ending finished goods inventory should equal 30% of the following month's sales. The ending raw materials inventory should equal 10% of the following month's raw materials production needs.

-The expected cash collections for February is closest to:

Credit sales are collected:

30% in the month of the sale

70% in the following month

Raw materials purchases are paid:

30% in the month of purchase

70% in the following month

The ending finished goods inventory should equal 30% of the following month's sales. The ending raw materials inventory should equal 10% of the following month's raw materials production needs.

-The expected cash collections for February is closest to:

A) $970,000

B) $1,028,200

C) $349,200

D) $679,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Darke Corporation makes one product and has provided the following information: A.Budgeted unit sales for October,November,and December are 7,600,9,000,and 10,100 units respectively. B.The ending finished goods inventory equals 40% of the following month's sales. C.Each unit of finished goods requires 5 pounds of raw materials.The raw materials cost $1.00 per pound. D.The direct labor wage rate is $19.00 per hour.Each unit of finished goods requires 3.0 direct labor-hours. E.Manufacturing overhead is entirely variable and is $11.00 per direct labor-hour. The estimated finished goods inventory balance at the end of November is closest to:

A) $294,920

B) $383,800

C) $133,320

D) $250,480

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bonkowski Corporation makes one product and has provided the following information to help prepare the master budget for the next four months of operations:

Credit sales are collected:

30% in the month of the sale

70% in the following month

Raw materials purchases are paid:

30% in the month of purchase

70% in the following month

The ending finished goods inventory should equal 30% of the following month's sales. The ending raw materials inventory should equal 10% of the following month's raw materials production needs.

-The estimated finished goods inventory balance at the end of February is closest to:

Credit sales are collected:

30% in the month of the sale

70% in the following month

Raw materials purchases are paid:

30% in the month of purchase

70% in the following month

The ending finished goods inventory should equal 30% of the following month's sales. The ending raw materials inventory should equal 10% of the following month's raw materials production needs.

-The estimated finished goods inventory balance at the end of February is closest to:

A) $335,160

B) $245,385

C) $281,295

D) $89,775

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Seventy percent of Pitkin Corporation's sales are collected in the month of sale,20% in the month following sale,and 10% in the second month following sale.The following are budgeted sales data for the company:

Total budgeted cash collections in April would be:

Total budgeted cash collections in April would be:

A) $175,000

B) $275,000

C) $70,000

D) $30,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Michard Corporation makes one product and it provided the following information to help prepare the master budget for the next four months of operations: a. The budgeted selling price per unit is $125. Budgeted unit sales for April, May, June, and July are 7,600, 10,500, 13,800, and 12,900 units, respectively. All sales are on credit. b. Regarding credit sales, 20% are collected in the month of the sale and 80% in the following month. c. The ending finished goods inventory equals 20% of the following month's sales. d. The ending raw materials inventory equals 30% of the following month's raw materials production needs. Each unit of finished goods requires 4 pounds of raw materials. The raw materials cost $2.00 per pound. e. Regarding raw materials purchases, 30% are paid for in the month of purchase and 70% in the following month. f. The direct labor wage rate is $25.00 per hour. Each unit of finished goods requires 3.0 direct labor-hours. g. The variable selling and administrative expense per unit sold is $3.40. The fixed selling and administrative expense per month is $80,000. -If 54,480 pounds of raw materials are required for production in June,then the budgeted cost of raw material purchases for May is closest to:

A) $148,752

B) $89,280

C) $121,968

D) $95,184

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is NOT correct concerning the Manufacturing Overhead Budget?

A) The Manufacturing Overhead Budget provides a schedule of all costs of production other than direct materials and labor costs.

B) The Manufacturing Overhead Budget shows only the variable portion of manufacturing overhead.

C) The Manufacturing Overhead Budget shows the expected cash disbursements for manufacturing overhead.

D) The Manufacturing Overhead Budget is prepared after the Sales Budget.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Dilly Farm Supply is located in a small town in the rural west. Data regarding the store's operations follow:

o Sales are budgeted at $290,000 for November, $310,000 for December, and $210,000 for January.

o Collections are expected to be 65% in the month of sale and 35% in the month following the sale.

o The cost of goods sold is 80% of sales.

o The company desires to have an ending merchandise inventory at the end of each month equal to 70% of the next month's cost of goods sold. Payment for merchandise is made in the month following the purchase.

o Other monthly expenses to be paid in cash are $21,100.

o Monthly depreciation is $21,000.

o Ignore taxes.

-The cost of December merchandise purchases would be:

-The cost of December merchandise purchases would be:

A) $248,000

B) $232,000

C) $117,600

D) $192,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

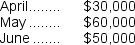

Marty's Merchandise has budgeted sales as follows for the second quarter of the year:

Cost of goods sold is equal to 70% of sales. The company wants to maintain a monthly ending inventory equal to 120% of the cost of goods sold for the following month. The inventory on March 31 was below this target and was only $22,000. The company is now preparing a Merchandise Purchases Budget for April, May, and June.

-The beginning inventory for September should be:

Cost of goods sold is equal to 70% of sales. The company wants to maintain a monthly ending inventory equal to 120% of the cost of goods sold for the following month. The inventory on March 31 was below this target and was only $22,000. The company is now preparing a Merchandise Purchases Budget for April, May, and June.

-The beginning inventory for September should be:

A) 1,020 units

B) 1,050 units

C) 1,065 units

D) 735 units

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Arciba Inc.bases its manufacturing overhead budget on budgeted direct labor-hours.The direct labor budget indicates that 7,400 direct labor-hours will be required in January.The variable overhead rate is $9.50 per direct labor-hour.The company's budgeted fixed manufacturing overhead is $130,980 per month,which includes depreciation of $10,360.All other fixed manufacturing overhead costs represent current cash flows.The company recomputes its predetermined overhead rate every month.The predetermined overhead rate for January should be:

A) $27.20

B) $25.80

C) $17.70

D) $9.50

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Control involves developing goals and preparing various budgets to achieve those goals.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

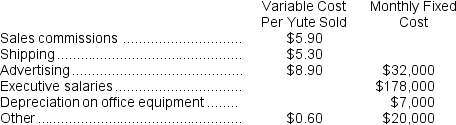

Porter Corporation makes and sells a single product called a Yute. The company is in the process of preparing its Selling and Administrative Expense Budget for the last quarter of the year. The following budget data are available:

All of these expenses (except depreciation) are paid in cash in the month they are incurred.

-If the company has budgeted to sell 12,000 Yutes in December,then the budgeted total cash disbursements for selling and administrative expenses for December would be:

All of these expenses (except depreciation) are paid in cash in the month they are incurred.

-If the company has budgeted to sell 12,000 Yutes in December,then the budgeted total cash disbursements for selling and administrative expenses for December would be:

A) $237,000

B) $485,400

C) $248,400

D) $478,400

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

LBC Corporation makes and sells a product called Product WZ. Each unit of Product WZ requires 3.5 hours of direct labor at the rate of $14.50 per direct labor-hour. Management would like you to prepare a Direct Labor Budget for June. -The company plans to sell 39,000 units of Product WZ in June.The finished goods inventories on June 1 and June 30 are budgeted to be 200 and 100 units,respectively.Budgeted direct labor costs for June would be:

A) $1,984,325

B) $1,974,175

C) $1,979,250

D) $564,050

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Michard Corporation makes one product and it provided the following information to help prepare the master budget for the next four months of operations: a. The budgeted selling price per unit is $125. Budgeted unit sales for April, May, June, and July are 7,600, 10,500, 13,800, and 12,900 units, respectively. All sales are on credit. b. Regarding credit sales, 20% are collected in the month of the sale and 80% in the following month. c. The ending finished goods inventory equals 20% of the following month's sales. d. The ending raw materials inventory equals 30% of the following month's raw materials production needs. Each unit of finished goods requires 4 pounds of raw materials. The raw materials cost $2.00 per pound. e. Regarding raw materials purchases, 30% are paid for in the month of purchase and 70% in the following month. f. The direct labor wage rate is $25.00 per hour. Each unit of finished goods requires 3.0 direct labor-hours. g. The variable selling and administrative expense per unit sold is $3.40. The fixed selling and administrative expense per month is $80,000. -If 54,480 pounds of raw materials are required for production in June,then the budgeted raw material purchases for May is closest to:

A) 74,376 pounds

B) 44,640 pounds

C) 47,592 pounds

D) 60,984 pounds

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 234

Related Exams