A) $7 per unit

B) $16 per unit

C) $11 per unit

D) $10 per unit

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Variable costing is more compatible with cost-volume-profit analysis than is absorption costing.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

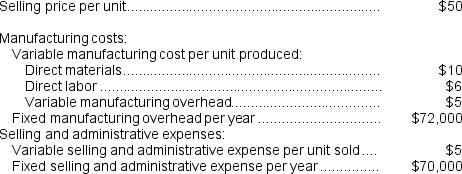

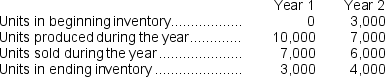

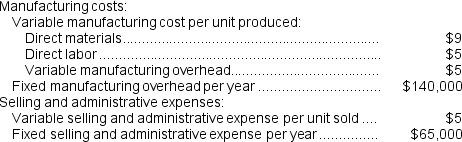

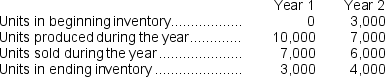

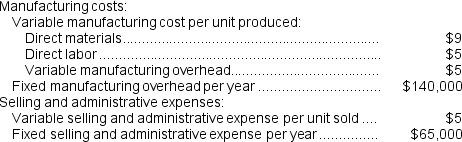

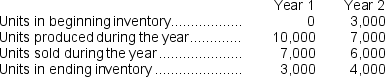

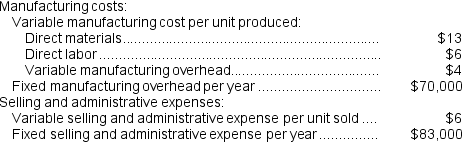

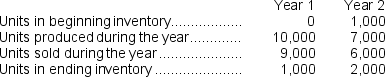

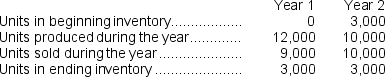

Mandato Corporation has provided the following data for its two most recent years of operation:

-The net operating income (loss) under variable costing in Year 1 is closest to:

-The net operating income (loss) under variable costing in Year 1 is closest to:

A) $144,000

B) $2,000

C) $26,000

D) $174,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

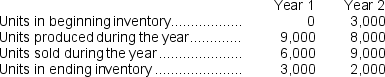

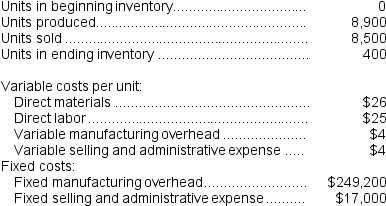

A manufacturing company that produces a single product has provided the following data concerning its most recent month of operations:

The total gross margin for the month under absorption costing is:

The total gross margin for the month under absorption costing is:

A) $72,500

B) $95,100

C) $20,000

D) $57,500

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

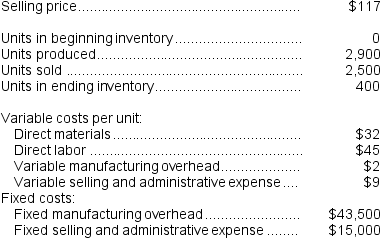

Smidt Corporation has provided the following data for its two most recent years of operation:

-The net operating income (loss) under variable costing in Year 1 is closest to:

-The net operating income (loss) under variable costing in Year 1 is closest to:

A) $420,000

B) $480,000

C) $139,000

D) $159,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Smidt Corporation has provided the following data for its two most recent years of operation:

-The net operating income (loss) under absorption costing in Year 2 is closest to:

-The net operating income (loss) under absorption costing in Year 2 is closest to:

A) $81,000

B) $13,000

C) $184,000

D) $142,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

All other things the same,if a division's traceable fixed expenses decrease then the division's segment margin will decrease.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Smidt Corporation has provided the following data for its two most recent years of operation:

-The unit product cost under absorption costing in Year 1 is closest to:

-The unit product cost under absorption costing in Year 1 is closest to:

A) $19.00

B) $14.00

C) $33.00

D) $38.00

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Caruso Inc., which produces a single product, has provided the following data for its most recent month of operations:

There were no beginning or ending inventories.

-What is the total period cost for the month under the absorption costing?

There were no beginning or ending inventories.

-What is the total period cost for the month under the absorption costing?

A) $93,100

B) $133,100

C) $40,000

D) $73,500

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

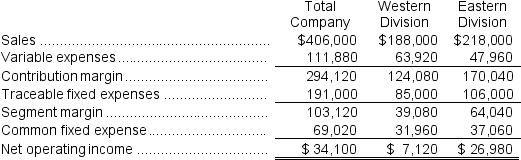

Jemmott Corporation has two divisions: Western Division and Eastern Division. The following report is for the most recent operating period:

The common fixed expenses have been allocated to the divisions on the basis of sales.

-The Eastern Division's break-even sales is closest to:

The common fixed expenses have been allocated to the divisions on the basis of sales.

-The Eastern Division's break-even sales is closest to:

A) $135,897

B) $224,385

C) $358,929

D) $183,410

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

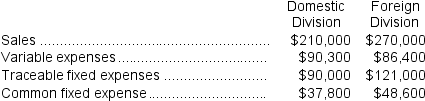

Gardella Corporation has two divisions: Domestic Division and Foreign Division. The following data are for the most recent operating period:

The common fixed expenses have been allocated to the divisions on the basis of sales.

-The Domestic Division's break-even sales is closest to:

The common fixed expenses have been allocated to the divisions on the basis of sales.

-The Domestic Division's break-even sales is closest to:

A) $309,474

B) $157,895

C) $224,211

D) $470,663

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lenart Corporation has provided the following data for its two most recent years of operation:

-The unit product cost under variable costing in Year 1 is closest to:

-The unit product cost under variable costing in Year 1 is closest to:

A) $29.00

B) $30.00

C) $23.00

D) $36.00

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Last year,Tinklenberg Corporation's variable costing net operating income was $52,400 and its inventory decreased by 1,400 units.Fixed manufacturing overhead cost was $8 per unit for both units in beginning and in ending inventory.What was the absorption costing net operating income last year?

A) $41,200

B) $11,200

C) $63,600

D) $52,400

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

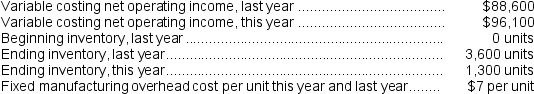

Norenberg Corporation manufactures a single product. The following data pertain to the company's operations over the last two years:

-What was the absorption costing net operating income this year?

-What was the absorption costing net operating income this year?

A) $80,000

B) $100,500

C) $108,000

D) $112,200

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Moskowitz Corporation has provided the following data for its two most recent years of operation:

-Which of the following statements is true for Year 2?

-Which of the following statements is true for Year 2?

A) The amount of fixed manufacturing overhead released from inventories is $686,000

B) The amount of fixed manufacturing overhead released from inventories is $24,000

C) The amount of fixed manufacturing overhead deferred in inventories is $686,000

D) The amount of fixed manufacturing overhead deferred in inventories is $24,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

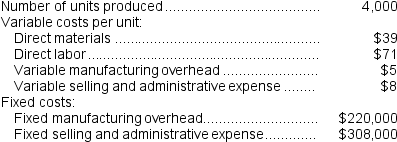

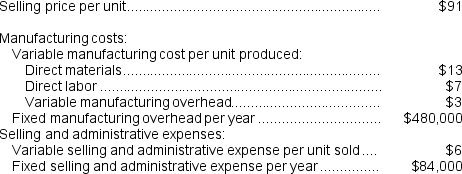

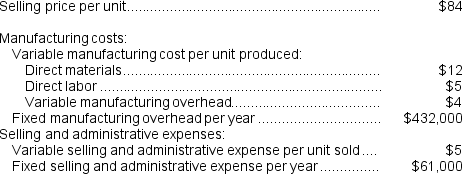

A manufacturing company that produces a single product has provided the following data concerning its most recent month of operations:

What is the variable costing unit product cost for the month?

What is the variable costing unit product cost for the month?

A) $59 per unit

B) $83 per unit

C) $87 per unit

D) $55 per unit

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

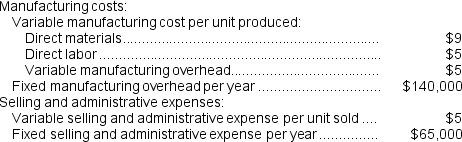

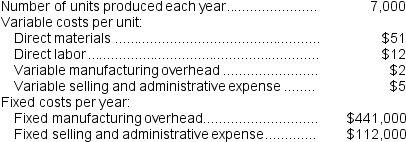

Mullee Corporation produces a single product and has the following cost structure:

The absorption costing unit product cost is:

The absorption costing unit product cost is:

A) $149 per unit

B) $65 per unit

C) $63 per unit

D) $128 per unit

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Allocating common fixed costs to segments on segmented income statements increases the usefulness of such statements.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

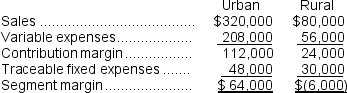

Azuki Corporation operates in two sales territories, Urban and Rural. Data concerning last year's operations appear below:

Azuki's common fixed expenses were $25,000 last year.

-If Urban sales were 10% higher last year,by approximately how much would Azuki's net operating income have increased? (Assume no change in selling prices,unit variable expenses,or total fixed expenses.)

Azuki's common fixed expenses were $25,000 last year.

-If Urban sales were 10% higher last year,by approximately how much would Azuki's net operating income have increased? (Assume no change in selling prices,unit variable expenses,or total fixed expenses.)

A) $4,400

B) $6,400

C) $11,200

D) $32,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Neef Corporation has provided the following data for its two most recent years of operation:

-The unit product cost under variable costing in Year 1 is closest to:

-The unit product cost under variable costing in Year 1 is closest to:

A) $21.00

B) $57.00

C) $62.00

D) $26.00

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 291

Related Exams