A) 300,000 units

B) 270,000 units

C) 260,000 units

D) 280,000 units

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the total budgeted selling and administrative expense for October is $518,520, then how many Yutes does the company plan to sell in October?

A) 13,300 units

B) 14,100 units

C) 13,800 units

D) 13,600 units

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The manufacturing overhead budget at Franklyn Corporation is based on budgeted direct labor-hours.The direct labor budget indicates that 4,400 direct labor-hours will be required in January.The variable overhead rate is $1.30 per direct labor-hour.The company's budgeted fixed manufacturing overhead is $60,280 per month, which includes depreciation of $17,160.All other fixed manufacturing overhead costs represent current cash flows.The January cash disbursements for manufacturing overhead on the manufacturing overhead budget should be:

A) $5,720

B) $43,120

C) $48,840

D) $66,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The October cash disbursements for manufacturing overhead on the manufacturing overhead budget should be:

A) $68,800

B) $64,960

C) $14,720

D) $50,240

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The estimated selling and administrative expense for May is closest to:

A) $115,700

B) $80,000

C) $77,130

D) $35,700

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If 54,480 pounds of raw materials are required for production in June, then the budgeted raw material purchases for May is closest to:

A) 74,376 pounds

B) 44,640 pounds

C) 47,592 pounds

D) 60,984 pounds

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the budgeted cost of raw materials purchases in February is $222,180, then the budgeted accounts payable balance at the end of February is closest to:

A) $222,180

B) $88,872

C) $117,912

D) $133,308

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

There are various budgets within the master budget.One of these budgets is the production budget.Which of the following BEST describes the production budget?

A) It details the required direct labor hours.

B) It details the required raw materials purchases.

C) It is calculated based on the sales budget and the desired ending inventory.

D) It summarizes the costs of producing units for the budget period.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

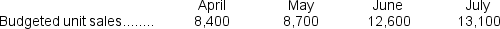

Reaser Corporation makes one product.  Each unit of finished goods requires 4 pounds of raw materials.The ending finished goods inventory equals 10% of the following month's sales.The ending raw materials inventory equals 40% of the following month's raw materials production needs.If 50,600 pounds of raw materials are required for production in June, then the budgeted raw material purchases for May is closest to:

Each unit of finished goods requires 4 pounds of raw materials.The ending finished goods inventory equals 10% of the following month's sales.The ending raw materials inventory equals 40% of the following month's raw materials production needs.If 50,600 pounds of raw materials are required for production in June, then the budgeted raw material purchases for May is closest to:

A) 56,600 pounds

B) 42,056 pounds

C) 71,144 pounds

D) 36,360 pounds

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The estimated direct labor cost for May is closest to:

A) $558,000

B) $33,480

C) $837,000

D) $279,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The budgeted variable selling and administrative expense is calculated by multiplying the budgeted unit sales by the variable selling and administrative expense per unit.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

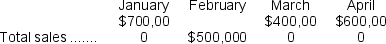

All of Pocast Corporation's sales are on account.Sixty percent of the credit sales are collected in the month of sale, 30% in the month following sale, and 10% in the second month following sale.The following are budgeted sales data for the company:  Cash receipts in April are expected to be:

Cash receipts in April are expected to be:

A) $530,000

B) $360,000

C) $460,000

D) $410,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The selling and administrative budget is typically prepared before the cash budget.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The budgeted sales for February is closest to:

A) $825,000

B) $1,166,000

C) $1,287,000

D) $1,320,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the company has budgeted to sell 14,000 Yutes in November, then the total budgeted selling and administrative expenses for November would be:

A) $526,800

B) $289,800

C) $237,000

D) $519,800

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The budgeted required production for February is closest to:

A) 11,020 units

B) 14,200 units

C) 10,600 units

D) 17,380 units

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 221 - 236 of 236

Related Exams