B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

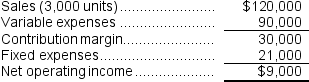

The variable expense ratio is closest to:

A) 33%

B) 67%

C) 25%

D) 75%

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

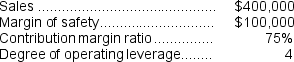

Hopi Corporation expects the following operating results for next year:  What is Hopi expecting total fixed expenses to be next year?

What is Hopi expecting total fixed expenses to be next year?

A) $75,000

B) $100,000

C) $200,000

D) $225,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

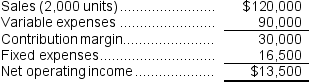

The break-even point in dollar sales is closest to:

A) $162,000

B) $117,000

C) $0

D) $173,700

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Break-even analysis assumes that:

A) Total revenue is constant.

B) Unit variable expense is constant.

C) Unit fixed expense is constant.

D) Selling prices must fall in order to generate more revenue.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the selling price increases by $3 per unit and the sales volume decreases by 400 units, the net operating income would be closest to:

A) $19,000

B) $16,800

C) $13,800

D) $17,733

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sales at East Corporation declined from $100,000 to $80,000, while net operating income declined by 300%.Given these data, the company must have had an operating leverage of:

A) 15

B) 2.7

C) 30

D) 12

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

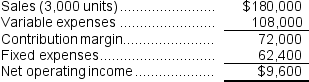

Kelchner Corporation has provided the following contribution format income statement.All questions concern situations that are within the relevant range.  The contribution margin ratio is closest to:

The contribution margin ratio is closest to:

A) 67%

B) 40%

C) 33%

D) 60%

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Creswell Corporation's fixed monthly expenses are $29,000 and its contribution margin ratio is 56%.Assuming that the fixed monthly expenses do not change, what is the best estimate of the company's net operating income in a month when sales are $95,000?

A) $12,800

B) $24,200

C) $53,200

D) $66,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Essay

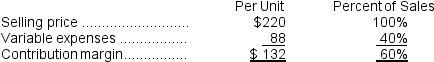

Data concerning Neuner Corporation's single product appear below:  Fixed expenses are $425,000 per month.The company is currently selling 4,000 units per month.

Required:

The marketing manager would like to cut the selling price by $11 and increase the advertising budget by $23,700 per month.The marketing manager predicts that these two changes would increase monthly sales by 400 units.What should be the overall effect on the company's monthly net operating income of this change? Show your work!

Fixed expenses are $425,000 per month.The company is currently selling 4,000 units per month.

Required:

The marketing manager would like to cut the selling price by $11 and increase the advertising budget by $23,700 per month.The marketing manager predicts that these two changes would increase monthly sales by 400 units.What should be the overall effect on the company's monthly net operating income of this change? Show your work!

Correct Answer

verified

Correct Answer

verified

Multiple Choice

This question is to be considered independently of all other questions relating to Lemelin Corporation.Refer to the original data when answering this question. The marketing manager would like to cut the selling price by $18 and increase the advertising budget by $37,000 per month.The marketing manager predicts that these two changes would increase monthly sales by 1,600 units.What should be the overall effect on the company's monthly net operating income of this change?

A) increase of $118,200

B) increase of $302,200

C) decrease of $118,200

D) decrease of $7,800

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mio Canoe Livery rents canoes and transports canoes and customers to and from their canoe trip on a local river.The trip is priced at $20 per person and has a CM ratio of 30%.Mio's fixed expenses are $84,000.Last year, sales were $400,000 and profit was $36,000.How many units need to be sold to break-even, and how many need to be sold to earn a profit of $42,000?

A) 1,800 and 2,100

B) 6,000 and 8,143

C) 14,000 and 21,000

D) 4,200 and 6,300

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A decrease in the number of units sold will decrease the break-even point.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

For a capital intensive, automated company the break-even point will tend to be higher and the margin of safety will be lower than for a less capital intensive company with the same sales.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Black Corporation's sales are $600,000, its fixed expenses are $150,000, and its variable expenses are 60% of sales.The margin of safety is:

A) $90,000

B) $190,000

C) $225,000

D) $240,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lofft Corporation has provided the following contribution format income statement.All questions concern situations that are within the relevant range.  Using the degree of operating leverage, the estimated percent increase in net operating income as the result of a 10% increase in sales is closest to:

Using the degree of operating leverage, the estimated percent increase in net operating income as the result of a 10% increase in sales is closest to:

A) 1.13%

B) 88.89%

C) 22.22%

D) 4.50%

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Nocum Corporation has provided the following contribution format income statement.All questions concern situations that are within the relevant range.  If sales decline to 2,900 units, the net operating income would be closest to:

If sales decline to 2,900 units, the net operating income would be closest to:

A) $29,000

B) $1,000

C) $8,700

D) $8,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is true regarding the contribution margin ratio of a company that produces only a single product?

A) As fixed expenses decrease, the contribution margin ratio increases.

B) The contribution margin ratio multiplied by the selling price per unit equals the contribution margin per unit.

C) The contribution margin ratio will decline as unit sales decline.

D) The contribution margin ratio equals the selling price per unit less the variable expense ratio.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The break-even in monthly unit sales is closest to:

A) 2,328 units

B) 1,342 units

C) 3,441 units

D) 2,200 units

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Derst Inc.sells a particular textbook for $140.Variable expenses are $25 per book.At the current volume of 6,000 books sold per year the company is just breaking even.Given these data, the annual fixed expenses associated with the textbook total:

A) $400,000

B) $690,000

C) $840,000

D) $150,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 241 - 260 of 260

Related Exams