A) is $1.

B) is $2.

C) is $3.

D) cannot be determined with the information given.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As a proportion of domestic output,taxes in the United States:

A) are lower than in most other industrially advanced countries.

B) are higher than in most other industrially advanced countries.

C) are approximately the same as in most other industrially advanced countries.

D) doubled in the 1990s.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that you pay $10,000 of tax on a taxable income of $50,000.If your taxable income were $150,000,your tax payment would be $25,000.This tax structure is:

A) progressive.

B) proportional.

C) regressive.

D) discriminatory.

The tax rate at $50,000 income is $10,000/$50,000 = 0.2 and the tax rate at $150,000 income is $25,000/$150,000 = 0.167,so the tax rate is regressive.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that government imposes a specific excise tax on product X of $2 per unit and that the price elasticity of demand for X is unitary (coefficient = 1) .If the incidence of the tax is such that consumers pay $1.80 of the tax and the producers pay $.20,we can conclude that the:

A) supply of X is highly inelastic.

B) supply of X is highly elastic.

C) demand for X is highly inelastic.

D) demand for X is highly elastic.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

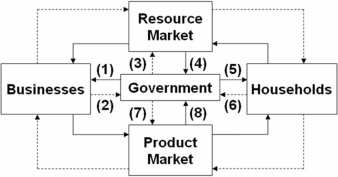

Refer to the above diagram,in which solid arrows reflect real flows and broken arrows are monetary flows.Flow (4) might represent:

Refer to the above diagram,in which solid arrows reflect real flows and broken arrows are monetary flows.Flow (4) might represent:

A) the services of NASA astrophysicists.

B) the purchase of Stealth bombers.

C) personal income taxes.

D) investment spending by private corporations.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The marginal tax rate is:

A) less than the average tax rate when a tax is progressive.

B) calculated by dividing total taxes paid by one's total taxable income.

C) the percentage of one's total income that is paid in taxes.

D) the percentage of an increment of income that is paid in taxes.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Government assumes some responsibility for providing a minimum standard of living for all citizens to compensate for the increase in income inequality caused by government tax revenues and expenditures.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The marginal tax rate is the tax rate that applies to additional income.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax that takes a larger proportion of income from low-income groups than from high-income groups is a:

A) stabilizing tax.

B) regressive tax.

C) progressive tax.

D) proportional tax.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Approximately what percentage of local government expenditures goes to finance education?

A) 36 percent

B) 44 percent

C) 53 percent

D) 69 percent

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Approximately what percentage of the federal government's tax revenues were generated from personal income taxes in 2010?

A) 85 percent

B) 18 percent

C) 37 percent

D) 42 percent

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The burden of taxes in the United States is:

A) lower than in all other countries of the world.

B) higher than in all other countries of the world.

C) on the low end when compared to other industrialized countries of the world.

D) on the high end when compared to other industrialized countries of the world.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Indy currently earns $50,000 in taxable income and pays $8000 in taxes.Suppose that Indy faces a marginal tax rate of 25 percent and his boss offers him a raise of $2000 per year.Indy should:

A) accept the raise because his after-tax income will rise by $1500.

B) accept the raise because his after-tax income will rise by $2000.

C) reject the raise because his after-tax income will fall by $4500.

D) reject the raise because his after-tax income will fall by $6000.

If the raise is $2000 per year and the marginal tax rate is 25 percent,taxes will rise by $500 and after-tax income will rise by $2000 - $500 = $1500.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

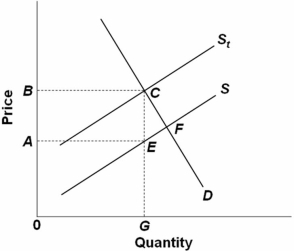

Refer to the above figure in which S is the before-tax supply curve and St is the supply curve after an excise tax is imposed.The efficiency loss of this tax will be area:

Refer to the above figure in which S is the before-tax supply curve and St is the supply curve after an excise tax is imposed.The efficiency loss of this tax will be area:

A) ABCE.

B) ABCE + ECF.

C) 0AEG.

D) ECF.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the demand for a product is perfectly elastic and supply is upsloping,a $1 excise tax per unit on suppliers will:

A) not raise price at all.

B) lower price by $1.

C) raise price by $1.

D) raise price by more than $1.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The benefits-received principle of taxation is most evident in:

A) inheritance taxes.

B) excise taxes on gasoline.

C) personal income taxes.

D) corporate income taxes.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following taxes is least likely to be shifted?

A) A state excise tax on the sellers of football tickets

B) A personal income tax

C) A general sales tax on retailers who sell foodstuffs and clothing

D) A federal excise tax on the producers of whiskey

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One difference between sales and excise taxes is that:

A) sales taxes are only applied at the state level,while excise taxes are only applied at the federal level.

B) excise taxes apply to a wide range of products,while sales taxes apply only to a select list of products.

C) sales taxes are calculated as a percentage of the price paid,while excise taxes are levied on a per-unit basis.

D) excise taxes are calculated as a percentage of the price paid,while sales taxes are levied on a per-unit basis.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The greater the elasticity of supply of and demand for a good,the:

A) smaller will be the efficiency loss of an excise tax on the good.

B) more likely the good will be a public good rather than a private good.

C) larger will be the efficiency loss of an excise tax on the good.

D) larger will be the proportion of an excise tax on the good that will be shifted forward to consumers.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If you must pay $5000 in taxes on a $25,000 taxable income and $7000 on a $30,000 taxable income,then the marginal tax rate on the additional $5000 of income is:

A) 40 percent and the average tax rate is about 23 percent at the $30,000 income level.

B) 50 percent and the average tax rate is about 40 percent at the $30,000 income level.

C) 40 percent and the average tax rate is about 25 percent at the $25,000 income level.

D) 30 percent,but average tax rates cannot be determined from the information given.

The marginal tax rate is the change in taxes divided by the change in income.In this case,the change in taxes was $2000 ,so the marginal tax rate was $2000/$5000 = 0.40.Average tax is $7000/$30,000 = 0.233.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 140

Related Exams