A) progressive.

B) proportional.

C) regressive.

D) discriminatory.

The tax rate at $24,000 income is $4000/$24,000 = 0.167 and the tax rate at $30,000 income is $5000/$30,000 = 0.167,so the tax rate is proportional.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Approximately what percentage of the U.S.labor force works for the government at either the federal,state,or local level?

A) 7 percent

B) 10 percent

C) 13 percent

D) 19 percent

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The benefits-received principle of taxation is used to support corporate and personal income taxes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At the state and local levels of government in the United States,the majority of government employees work in which area?

A) Postal Service

B) Education

C) Hospitals and other health care

D) Police and corrections

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

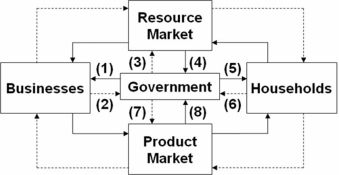

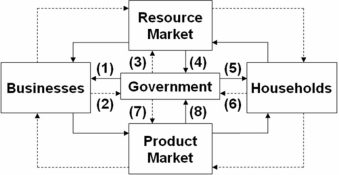

Refer to the above diagram,in which solid arrows reflect real flows and broken arrows are monetary flows.Flow (2) might represent:

Refer to the above diagram,in which solid arrows reflect real flows and broken arrows are monetary flows.Flow (2) might represent:

A) the provision of national defense by government.

B) a government subsidy to farmers.

C) corporate income tax payments.

D) welfare payments to low-income families.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to the above diagram,in which solid arrows reflect real flows and broken arrows are monetary flows.Flow (7) might represent:

Refer to the above diagram,in which solid arrows reflect real flows and broken arrows are monetary flows.Flow (7) might represent:

A) a transfer payment to disabled persons.

B) wage payments to public school teachers.

C) subsidies to corporations to stimulate exports.

D) the U.S.Bureau of Engraving and Printing's expenditures for paper.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

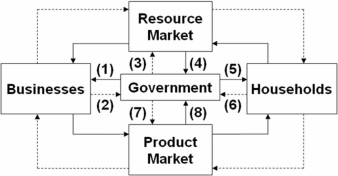

In which of the above market situations will the efficiency loss of an excise tax be the greatest?

In which of the above market situations will the efficiency loss of an excise tax be the greatest?

A) 4

B) 3

C) 2

D) 1

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

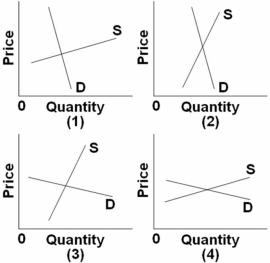

Refer to the above data.If government levies a per-unit excise tax of $1 on suppliers of this product,equilibrium price and quantity will be:

Refer to the above data.If government levies a per-unit excise tax of $1 on suppliers of this product,equilibrium price and quantity will be:

A) $9 and 3,000.

B) $7.50 and 2,250.

C) $8.50 and 2,250.

D) $7 and 3,000.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The marginal tax rate is:

A) the difference between the total tax rate and the average tax rate.

B) the percentage of total income paid as taxes.

C) Change in taxes/Change in taxable income.

D) Total taxes/Total taxable income.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Total governmental purchases-federal,state,and local combined-account for about what percentage of domestic output?

A) 5 percent

B) 10 percent

C) 20 percent

D) 40 percent

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

(Applying the Analysis) Proponents of a value-added tax (VAT) claim that a VAT:

A) is progressive,leading to a more equitable distribution of income.

B) equalizes the tax burden between buyers and sellers of goods.

C) is proportional,so all income groups pay a fair share.

D) penalizes consumption and encourages savings and investment.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to the above diagram,in which solid arrows reflect real flows and broken arrows are monetary flows.Flow (5) might represent:

Refer to the above diagram,in which solid arrows reflect real flows and broken arrows are monetary flows.Flow (5) might represent:

A) personal income tax revenues.

B) the provision of public schools by local governments.

C) the purchase of laptop computers by the State of Iowa.

D) transfer payments to unemployed workers.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

About two-thirds of all federal spending is for national defense.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sales and excise taxes are levied on retailers,but retailers add these taxes to the prices of their products.This illustrates the:

A) equal sacrifice theory of taxation.

B) shifting of taxes to consumers.

C) ability-to-pay principle of taxation.

D) benefits-received principle of taxation.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The equations for the demand and supply curves for a particular product are P = 10 - .4Q and P = 2 + .4Q,where P is price and Q is quantity expressed in units of 100.After an excise tax is imposed on the product,the supply equation is P = 3 + .4Q.The equilibrium quantity after the excise tax is imposed is:

A) 750 units.

B) 850 units.

C) 875 units.

D) 950 units.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The addition of government to the circular-flow model illustrates that government:

A) purchases resources in the resource market.

B) provides services to businesses and households.

C) purchases goods in the product market.

D) does all of these.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that government imposes a specific excise tax on product X of $2 per unit and that the price elasticity of supply of X is unitary (coefficient = 1) .If the incidence of the tax is such that the producers of X pay $1.90 of the tax and the consumers pay $.10,we can conclude that the:

A) supply of X is highly inelastic.

B) supply of X is highly elastic.

C) demand for X is highly inelastic.

D) demand for X is highly elastic.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Transfer payments are about ____ of U.S.domestic output (as of 2010) .

A) 8 percent

B) 15 percent

C) 25 percent

D) 35 percent

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume the Environmental Protection Agency imposes an excise tax on polluting firms.In which of the following situations would we expect the additional costs to be borne most heavily by consumers?

A) Demand is highly elastic and supply is highly inelastic.

B) Demand and supply are both highly elastic.

C) Demand and supply are both highly inelastic.

D) Demand is highly inelastic and supply is highly elastic.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The basic tax rate on taxable corporate income is:

A) 15 percent.

B) 22 percent.

C) 35 percent.

D) 52 percent.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 140

Related Exams