A) unemployment benefits.

B) transportation.

C) education.

D) housing.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A stock reflecting,at a given time,the financial and real assets an individual has accumulated is:

A) income.

B) wealth.

C) preferences.

D) noncash transfers.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When taxes and transfer payments are taken into account,the distribution of income in the United States:

A) is unchanged.

B) is less equally distributed.

C) is more equally distributed.

D) becomes more beneficial for the wealthy.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

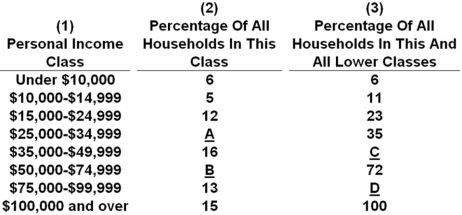

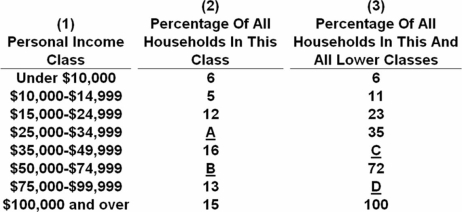

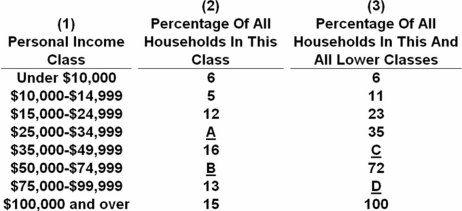

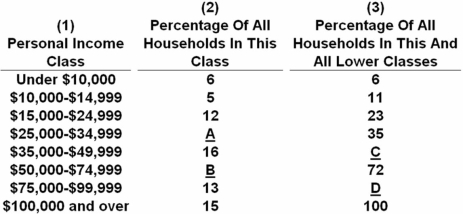

Using the data in the above table,what percentage should be reported in blank C of column 3?

Using the data in the above table,what percentage should be reported in blank C of column 3?

A) 6

B) 11

C) 35

D) 51

The blank in column 3 is found by adding the value in column 2 to the previous value in column 3.Thus,C is 35 + 16 = 51.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Income is more equally distributed over a longer time period than a shorter time period.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Using the data in the above table,what percentage of households made less than $15,000?

Using the data in the above table,what percentage of households made less than $15,000?

A) 5 percent

B) 6 percent

C) 11 percent

D) 23 percent

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Using the data in the above table,what percentage of households made $75,000-$99,999?

Using the data in the above table,what percentage of households made $75,000-$99,999?

A) 11 percent

B) 13 percent

C) 16 percent

D) 85 percent

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The earned income tax credit (EITC) is,in essence:

A) a tax credit for corporate contributions to charity.

B) a tax break for businesses that invest in community programs.

C) an income payment to those individuals who are not able to work.

D) a wage subsidy for low-income workers to offset Social Security taxes.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which is an example of a noncash transfer?

A) An inheritance of $1 million

B) Payments for labor services rendered

C) Postage stamps

D) Medicare

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which is a payment or wage subsidy made by the federal government to offset Social Security taxes for low-income workers?

A) Food stamp program

B) Supplement Security Income

C) Earned-income tax credit

D) Temporary Assistance to Needy Families

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose Tracy obtains 7 units of utility from the last dollar of income she receives and Brent obtains 7 units of utility from his last dollar of income.Assume both Brent and Tracy have the same capacity to derive utility from income with identical marginal-utility-of-income-curves.Those who favor an equal distribution of income would:

A) advocate redistributing income from Brent to Tracy.

B) advocate redistributing income from Tracy to Brent.

C) be content with this distribution of income between Tracy and Brent.

D) argue that any redistribution of income between them would increase total utility.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

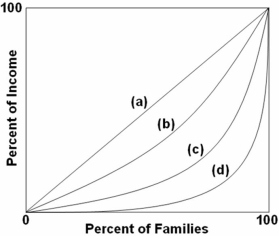

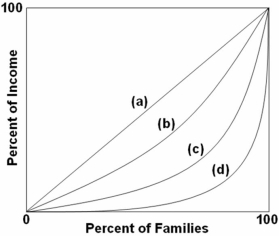

Refer to the above graph.The Gini ratio would be 0 for which curve?

Refer to the above graph.The Gini ratio would be 0 for which curve?

A) a

B) b

C) c

D) d

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An example of a public assistance program,as distinct from a social insurance program,would be:

A) Medicare.

B) Social Security.

C) unemployment compensation.

D) Supplemental Security Income.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The wages and salaries that people earn differ partly because of differences in:

A) wealth.

B) ability.

C) Social Security payments.

D) in-kind transfer payments.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Using the data in the above table,what percentage should be reported in blank A of column 2?

Using the data in the above table,what percentage should be reported in blank A of column 2?

A) 5

B) 6

C) 12

D) 17

The blank in column 2 is found by subtracting the percentage in column 3 for the entry $25,000 - $34,999 from the previous percentage.Thus,A is 35 - 23 = 12.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The diagonal line in a Lorenz curve represents perfect:

A) inequality in the distribution of personal income.

B) equality in the distribution of personal income.

C) inequality in factor shares of personal income.

D) equality in factor shares of personal income.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which would be considered part of wealth?

A) Wages and salaries

B) Rental payments

C) Profits from a corporation

D) Corporate stock holdings

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All but which one of the following are cash transfer programs?

A) TANF

B) Supplemental Security Income (SSI)

C) Subsidized public housing

D) Social Security

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to the above graph.If the United States is represented by Lorenz curve (C.above,which curve would represent most other industrially advanced nations?

Refer to the above graph.If the United States is represented by Lorenz curve (C.above,which curve would represent most other industrially advanced nations?

A) a

B) b

C) c

D) d

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which statement applies to the Social Security system?

A) Benefits are paid on the basis of need.

B) It provides cash assistance and services to families with dependent children.

C) It is financed by payroll taxes on employees and employers.

D) Benefit levels vary throughout the nation because the system is administered by the individual states.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 158

Related Exams