A) $1,740.

B) $1,340.

C) $200.

D) $1,540.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On December 31, 2019, prior to adjustments, Accounts Receivable has a debit balance of $256,000 and the Allowance for Doubtful Accounts has a debit balance of $1,600. The firm estimates its losses from uncollectible accounts to be 5% of accounts receivable at the end of the year. The amount of the adjusting entry needed to record the estimated losses from uncollectible accounts is:

A) $12,800

B) $12,100

C) $14,400

D) $11,200

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is not correct?

A) The adjusting entry to record the estimated loss from uncollectible accounts includes a credit to Accounts Receivable.

B) Losses from uncollectible accounts can be estimated by analyzing sales or accounts receivable.

C) The allowance method involves anticipating losses from uncollectible accounts by recognizing an expense for these losses before the actual accounts are written off.

D) The balance of Uncollectible Accounts Expense appears among the operating expenses on the income statement.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On December 31, prior to adjustments, the balance of Accounts Receivable is $28,000 and Allowance for Doubtful Accounts has a debit balance of $200. The firm estimates its losses from uncollectible accounts to be 5.5% of accounts receivable at the end of the year. The adjusting entry needed to record the estimated losses from uncollectible accounts is

A) $200.

B) $1,540.

C) $1,340.

D) $1,740.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Uncollectible Accounts Expense is classified as

A) a Contra Asset on the Balance Sheet.

B) a Liability on the Balance Sheet.

C) a Contra Expense on the Income Statement.

D) an Expense on the Income Statement.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Millie's Draperies uses the allowance method of recording bad debts. On June 13, the company concluded that the $200 account balance of Jane Murphy should be written off as uncollectible. The entry to write off Murphy's account will be:

A) ![]()

B) ![]()

C) ![]()

D) ![]()

F) None of the above

Correct Answer

verified

Correct Answer

verified

Short Answer

The practice of estimating losses from uncollectible accounts before specific accounts become uncollectible is referred to as the ________ method.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm reported net credit sales of $355,000 for the year and an Accounts Receivable balance of $20,000 at year-end. Prior to adjustments, Allowance for Doubtful Accounts has a debit balance of $250. The firm estimates its losses from uncollectible accounts to be one-half of 1 percent of net credit sales. The entry to record the estimated losses from uncollectible accounts will include a credit to Allowance for Doubtful Accounts for

A) $1,775.

B) $2,025.

C) $1,525.

D) $3,550.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Allowance for Doubtful Accounts is a liability account.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

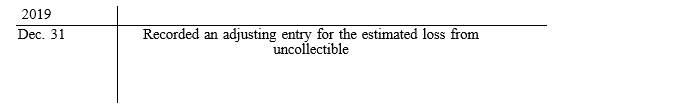

The Travel-Right Company uses the allowance method to provide for losses from uncollectible accounts. Record the following selected transactions on page 5 of a general journal, assuming the company also uses a cash receipts journal. Omit descriptions.

Dec. 31 Recorded an adjusting entry for the estimated loss from uncollectible accounts for 2019. The estimate is based on 0.5 percent of total credit sales. The total of the credit sales for 2019 was $260,000. Allowance for Doubtful Accounts has a credit balance of $175.

2020

Apr. 15 Wrote off the account of Brandon Reed, amounting to $650, as uncollectible. Nov. 20 Received a check for $650 from Brandon Reed in payment of his account,

which was written off on April 15.

Dec. 31 Recorded an adjusting entry for the estimated loss from uncollectible accounts for 2020. The estimate is based on 0.5 percent of total credit sales. The total of the credit sales for 2020 was $224,000. Allowance for Doubtful Accounts has a debit balance of $200.

Dec. 31 Recorded an adjusting entry for the estimated loss from uncollectible accounts for 2019. The estimate is based on 0.5 percent of total credit sales. The total of the credit sales for 2019 was $260,000. Allowance for Doubtful Accounts has a credit balance of $175.

2020

Apr. 15 Wrote off the account of Brandon Reed, amounting to $650, as uncollectible. Nov. 20 Received a check for $650 from Brandon Reed in payment of his account,

which was written off on April 15.

Dec. 31 Recorded an adjusting entry for the estimated loss from uncollectible accounts for 2020. The estimate is based on 0.5 percent of total credit sales. The total of the credit sales for 2020 was $224,000. Allowance for Doubtful Accounts has a debit balance of $200.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the direct charge-off method of accounting for uncollectible receivables is used, what general ledger account is debited to write off a customer's account as uncollectible?

A) Accounts Receivable

B) Allowance for Doubtful Accounts

C) Uncollectible Accounts Expense

D) Uncollectible Accounts Payable

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Essay

On April 22, 2019, Raymond Repair Services Company received a check for $220 from Caroline Smith, whose $380 account was written off on January 15. In the accompanying letter, Smith apologized and said she probably would not be unable to pay any of the remaining balance. Prepare the general journal entry necessary. (Assume the firm uses the direct charge-off method. Also assume that the entry in the cash receipts journal has already been made.)

Correct Answer

verified

Correct Answer

verified

Short Answer

The estimated loss from uncollectible accounts can be based on the net credit sales for the year or the-------- balance at the end of the year.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Nigel Lighting uses the direct charge-off method of recording bad debts. On Sept. 4, the $300 account balance of Louis Blue was charged off. However, on November 15, Blue paid $70 of the amount previously written off. The entry to record the payment from Blue would include:

A) debit Accounts Receivable $300; credit Uncollectible Account Expense $300

B) debit Cash $70; credit Accounts Receivable $70

C) debit Allowance for Doubtful Accounts $70; credit Accounts Receivable $70

D) debit Uncollectible Account Expense $70; credit Cash $70

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Allowance for Doubtful Accounts may, at times, have a debit balance.

B) False

Correct Answer

verified

Correct Answer

verified

Matching

Match the accounting description with description by entering the proper letter in the space provided.

Correct Answer

True/False

The allowance method may be used to record bad debt losses for income tax purposes.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

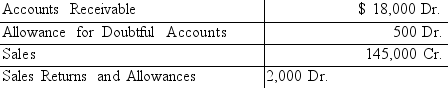

At the end of the current year, the trial balance of Tracey's Consulting Services included the accounts and balances shown below. Credit sales were $90,000. Returns and allowances on these sales were

$1,000. Assume that the firm bases its estimate of the loss from uncollectible accounts on 0.4 percent of net credit sales.

1. What is the estimated loss from uncollectible accounts for the current year?

2. What is the amount of the adjusting entry for the estimated loss from uncollectible accounts?

1. What is the estimated loss from uncollectible accounts for the current year?

2. What is the amount of the adjusting entry for the estimated loss from uncollectible accounts?

Correct Answer

verified

Correct Answer

verified

True/False

The balance of Allowance for Doubtful Accounts is added to the balance of Accounts Receivable on the balance sheet.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When the estimate of the losses from uncollectible accounts is based on the aging method, the primary concern is proper valuation of the accounts receivable on the balance sheet.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 93

Related Exams