A) Option A

B) Option B

C) Option C

D) Option D

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fred and Barney started a partnership.During Year 1,Fred invested $20,000 in the business and Barney invested $32,000.The partnership agreement called for each partner to receive an annual distribution equal to 15% of his capital contribution.Any further earnings were to be retained in the business and divided equally between the partners.The partnership reported net income of $38,000 during Year 1.How will the $38,000 of net income be split between Fred and Barney respectively? (Hint: Consider both the cash withdrawals and allocation of remaining income.) Fred Barney

A)

B)

C)

D)

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Personal liability is a significant disadvantage of the partnership form of business organization.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Treasury Stock is reported on the balance sheet between the liabilities and stockholders' equity sections.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A purchase of treasury stock is an asset use transaction.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The earnings of sole proprietorships are taxable to the owners rather than the company itself.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements best describes the term "par value?"

A) The number of shares currently in the hands of stockholders

B) The amount that must be paid to purchase a share of stock

C) Determined by dividing total stockholder's equity by the number of shares of stock

D) An amount used in determining a corporation's legal capital

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The number of shares of stock outstanding generally is greater than the number of shares of stock issued.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.]

Gilligan Corporation was established on February 15, Year 1. Gilligan is authorized to issue 500,000 shares of $6.00 par value common stock. As of December 31, Year 3, Gilligan's stockholders' equity accounts report the following balances:

![[The following information applies to the questions displayed below.] Gilligan Corporation was established on February 15, Year 1. Gilligan is authorized to issue 500,000 shares of $6.00 par value common stock. As of December 31, Year 3, Gilligan's stockholders' equity accounts report the following balances: At the end of Year 3, Gilligan decides to issue a 5% stock dividend. At the time of issue, the market price of the stock was $22 per share. -What is the number of shares outstanding after the stock dividend is issued? A) 57,750 B) 55,000 C) 52,250 D) 525,000](https://d2lvgg3v3hfg70.cloudfront.net/TB1323/11ea7eef_7f20_f0a1_ace2_5568a00c35de_TB1323_00_TB1323_00_TB1323_00_TB1323_00.jpg) At the end of Year 3, Gilligan decides to issue a 5% stock dividend. At the time of issue, the market price of the stock was $22 per share.

-What is the number of shares outstanding after the stock dividend is issued?

At the end of Year 3, Gilligan decides to issue a 5% stock dividend. At the time of issue, the market price of the stock was $22 per share.

-What is the number of shares outstanding after the stock dividend is issued?

A) 57,750

B) 55,000

C) 52,250

D) 525,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

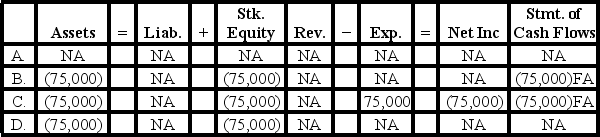

Chadwick Associates retained $850,000 of net income in the business in Year 1.If $75,000 was appropriated to satisfy the restrictive covenant of a loan agreement,what are the effects of the appropriation on the elements of the financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a contra equity account?

A) Retained Earnings

B) Paid-in Capital in Excess of Par Value

C) Treasury Stock

D) Appropriated Retained Earnings

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is a reason why a company would buy treasury stock?

A) Because management believes the market price of the stock is undervalued.

B) To have stock available to issue to employees in stock option plans.

C) To avoid a hostile takeover.

D) All of these are reasons a company would buy treasury stock.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following entities would have a "Paid-in Capital in Excess" account in the equity section of the balance sheet?

A) A corporation

B) A municipality

C) A sole proprietorship

D) A partnership

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On September 1,Year 1,Orville Corporation has unrestricted retained earnings of $600,000,appropriated retained earnings of $400,000,cash of $850,000,and accounts payable of $50,000.What is the maximum amount that can be used for cash dividends?

A) $850,000

B) $600,000

C) $800,000

D) $450,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which form of business organization is established as a separate legal entity?

A) Sole proprietorship

B) Partnership

C) Corporation

D) None of these

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Chisolm Corporation issued 10,000 shares of $5 par common stock for $22 per share.As a result of this transaction,Chisolm's legal capital increased by $50,000.

B) False

Correct Answer

verified

Correct Answer

verified

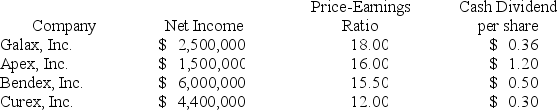

Multiple Choice

Ben Weaver is planning to invest in one of the following companies based on their average performance over the past five years,summarized below.

If Ben is looking for a company that is likely to achieve rapid growth in revenues and profitability,which one should he choose?

If Ben is looking for a company that is likely to achieve rapid growth in revenues and profitability,which one should he choose?

A) Galax, Inc.

B) Apex, Inc.

C) Bendex, Inc.

D) Curex, Inc.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

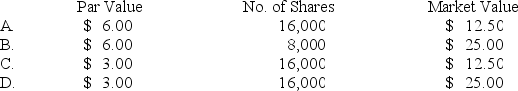

Multiple Choice

Helena Corporation declared a 2-for-1 stock split on 8,000 shares of $6 par value common stock.If the market price of the stock had been $25 a share before the split,the par value,number of shares,and approximate market value after the split would be:

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A partner is responsible for his/her own actions,but not for actions taken by another partner on behalf of the partnership.

B) False

Correct Answer

verified

Correct Answer

verified

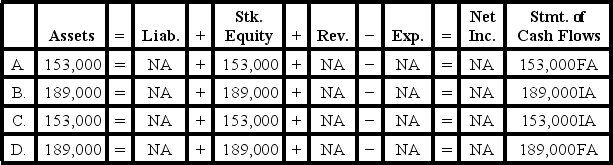

Multiple Choice

On February 2,Year 1,Farmer Corporation issued 9,000 shares of no-par stock for $17 per share.Within two hours of the issue,the stock's price jumped on the New York Stock Exchange to $21 per share.Which of the following answers describes the effect of the February 2 transaction on the elements of the financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 88

Related Exams