B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,Year 1,Burton Corporation issued bonds with a face value of $200,000 for $196,000 cash.: Which of the following correctly describes the related transaction?

A) Burton issued bonds at 102.

B) Burton issued bonds at 98.

C) Burton issued bonds at a $4,000 premium.

D) Burton signed a note payable for $196,000.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,Year 1,Strang Incorporated issued bonds with a face value of $500,000,a stated rate of interest of 8%,and a 5-year term to maturity.The effective rate of interest was 10%.Interest is payable in cash on June 30 and December 31 of each year.Which of the following statements is true?

A) This bond was issued at a premium, and each semiannual cash payment is $25,000.

B) This bond was issued at a discount, and each semiannual cash payment is $20,000.

C) This bond was issued at a discount, and the annual interest expense is $40,000.

D) This bond was issued at a premium, and the annual interest expense is $40,000.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Matching

Indicate whether each of the following statements is true or false.

Correct Answer

Matching

Indicate whether each of the following statements about bonds payable is true or false.

Correct Answer

True/False

Davis Corporation borrowed $50,000 on January 1,Year 1.The loan is for a 5-year period and has an annual interest rate of 9%.At the end of each year,Davis will make a payment of $7,791,which includes both principal and interest.The amount of the payment for Year 1 that is interest expense is $4,500.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

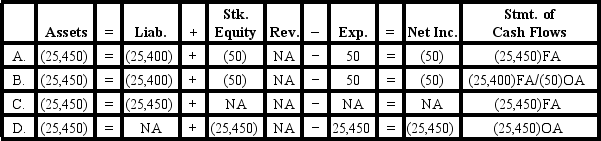

On January 1,Year 2,Pierce Corporation called the bonds payable at a price of $25,450.Which of the following shows the effect of this transaction on the elements of the financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

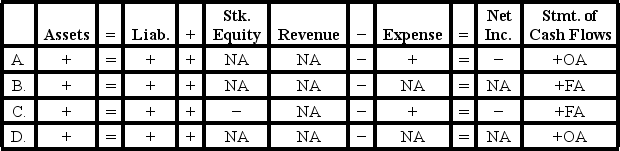

[The following information applies to the questions displayed below.]

On January 1, Year 1, Niagara Corporation arranges a $6,000 line of credit with Centennial Bank. It accepted the bank's offer of 1% above the prime rate with interest payments on December 31 of each year. All borrowings and repayments are to take place on January 1 of each year.

-Niagara begins its loan transactions with Centennial Bank by borrowing $2,000 on January 1,Year 1.Which of the following shows the effect of this event on the elements of the financial statements?

![[The following information applies to the questions displayed below.] On January 1, Year 1, Niagara Corporation arranges a $6,000 line of credit with Centennial Bank. It accepted the bank's offer of 1% above the prime rate with interest payments on December 31 of each year. All borrowings and repayments are to take place on January 1 of each year. -Niagara begins its loan transactions with Centennial Bank by borrowing $2,000 on January 1,Year 1.Which of the following shows the effect of this event on the elements of the financial statements? A) Option A B) Option B C) Option C D) Option D](https://d2lvgg3v3hfg70.cloudfront.net/TB1323/11ea7eef_7f26_47da_ace2_33abc9e399b5_TB1323_00_TB1323_00.jpg)

A) Option A

B) Option B

C) Option C

D) Option D

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Davis Corporation borrowed $50,000 on January 1,Year 1.The loan is for a 10-year period and has an annual interest rate of 9%.At the end of each year,Davis will make a payment of $7,791,which includes both principal and interest.With this loan,the amount of interest expense that Davis reports on its income statement will be the same for each year of the loan.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Park Enterprises issued bonds with a face value of $500,000,a stated rate of interest of 7%,and a 5-year term to maturity.The proceeds from the issuance were $508,000.Interest is payable in cash on December 31 of each year.Assuming straight-line amortization,the amount of interest expense for the first year would be $31,600.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Johansen Company issued a bond at a discount.Which of the following shows how the issuance of the bonds affects the elements of the financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If the stated interest rate for bonds is the same as the effective interest rate,the bonds will be issued at their face value.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If bonds are issued at a premium,the bond issuer will pay the bondholders an amount lower than the issue price at maturity.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The effective interest rate method of amortizing bond discounts and premiums results in a constant amount of interest expense every period.

B) False

Correct Answer

verified

Correct Answer

verified

Matching

On January 1,Year 1,O'Keefe Co.issued bonds with a face value of $400,000 and a stated interest rate of 10%.The bonds have a life of ten years and were sold at 108.O'Keefe uses the straight-line method to amortize bond discounts and premiums.On December 31,Year 4,O'Keefe called the bonds at 106.Indicate whether each of the following statements is true or false.

Correct Answer

Multiple Choice

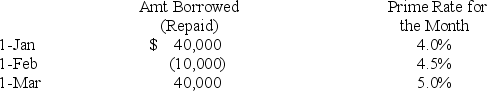

Franklin Company obtained a $160,000 line of credit from State Bank on January 1,Year 1.The company agreed to accept a variable interest rate that was set at 2% above the bank's prime lending rate.The bank's prime rate of interest and the amounts borrowed or repaid during the first three months of Year 1 are shown in the following table.Assume that Franklin borrows or repays on the first day of each month.

What is the amount of interest expense recognized in March?

What is the amount of interest expense recognized in March?

A) $232

B) $262

C) $292

D) $408

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.]

On January 1, Year 1, Platte Corporation issues a 5-year note payable for $5,000. The interest rate is 5% and the annual payment of $1,156, due each December 31, includes both interest and principal.

-Which of the following correctly shows the effects of the December 31,Year 2 payment (rounded to the nearest whole dollar) ?

![[The following information applies to the questions displayed below.] On January 1, Year 1, Platte Corporation issues a 5-year note payable for $5,000. The interest rate is 5% and the annual payment of $1,156, due each December 31, includes both interest and principal. -Which of the following correctly shows the effects of the December 31,Year 2 payment (rounded to the nearest whole dollar) ? A) Option A B) Option B C) Option C D) Option D](https://d2lvgg3v3hfg70.cloudfront.net/TB1323/11ea7eef_7f25_8488_ace2_855821a82dcf_TB1323_00_TB1323_00.jpg)

A) Option A

B) Option B

C) Option C

D) Option D

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Chico Company borrowed $40,000 on a four-year,8% installment note.How will this transaction affect Chicos financial statements?

A) Cash and installment notes payable increase by $43,200

B) Cash and interest payable increase by $40,000

C) Cash and interest payable increase by $43,200

D) Cash and installment notes payable increase by $40,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Peak Enterprises issued bonds with a face value of $500,000,receiving cash of $508,000.In this transaction,the liability account,Bonds Payable,will increase by $500,000.

B) False

Correct Answer

verified

Correct Answer

verified

Matching

On January 1,Year 1,Carlyle Corporation issued a 5-year term note.The note requires an annual cash payment on December 31 of each year.The payment includes a principal repayment and interest.Indicate whether each of the following statements is true or false.

Correct Answer

Showing 41 - 60 of 112

Related Exams