A) $800,000

B) $600,000

C) $480,000

D) $500,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

In choosing a depreciation method for financial reporting,a company should use the method that most closely approximates the amount of depreciation on the tax return.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Laramie Co.paid $800,000 for a purchase that included land,building,and office furniture.An appraiser provided the following estimates of the market values of the assets if they had been purchased separately: Land,$100,000,Building,$740,000,and Office Furniture,$160,000.What is the cost that should be allocated to the land?

A) $80,000

B) $70,000

C) $100,000

D) $107,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would not be classified as a tangible long-term asset?

A) Delivery truck

B) Timber reserve

C) Land

D) Copyright

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Matching

Indicate whether each of the following statements regarding accounting for long-term assets is true or false.

Correct Answer

Multiple Choice

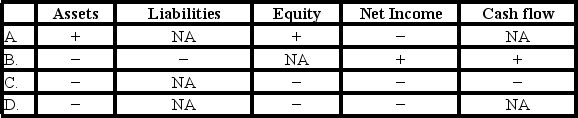

Chubb Company paid cash to purchase equipment on January 1,Year 1.Select the answer that shows how the recognition of depreciation expense in Year 2 would affect assets,liabilities,equity,net income,and cash flows.

A) option A

B) option B

C) option C

D) option D

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

With an accelerated depreciation method,an asset can be depreciated below its salvage value.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What term is used to describe the situation where the value of an intangible asset may be significantly diminished?

A) Amortization

B) Impairment

C) Depletion

D) Depreciation

F) A) and C)

Correct Answer

verified

B

Correct Answer

verified

Matching

Indicate whether each of the following statements is true or false.

Correct Answer

True/False

An impairment of an intangible asset decreases assets,stockholders' equity,and net income.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,Year 1,Milton Manufacturing Company purchased equipment with a list price of $88,000.A total of $4,000 was paid for installation and testing.During the first year,Milton paid $6,000 for insurance on the equipment and another $2,200 for routine maintenance and repairs.Milton uses the units-of-production method of depreciation.Useful life is estimated at 100,000 units,and estimated salvage value is $8,000.During Year 1,the equipment produced 13,000 units.What is the amount of depreciation for Year 1?

A) $10,920

B) $11,960

C) $11,700

D) $12,740

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,Year 1,Zach Company purchased equipment that cost $50,000.The equipment had a useful life of 5 years and a $10,000 salvage value.Zach Company used the double-declining-balance method to depreciate its assets.What is the accumulated depreciation at the end of Year 2?

A) $10,000

B) $12,000

C) $20,000

D) $32,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following measurements would not be affected by the choice of depreciation methods?

A) Debt-to-assets ratio

B) Total assets

C) Total cash flow from investing activities

D) Return-on-equity ratio

F) A) and B)

Correct Answer

verified

Correct Answer

verified

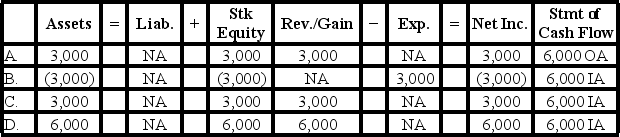

Multiple Choice

Farmer Company sold a piece of equipment for $6,000.The equipment had an original cost of $34,000 and accumulated depreciation of $31,000 at the time of the sale.Which of the following correctly shows the effect of the sale on the elements of the financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How is depreciation expense reported in the financial statements?

A) Long-term liabilities section of the statement of stockholders' equity

B) Financing activities section of the statement of cash flows

C) Current assets section of the balance sheet

D) Operating expenses section of the income statement

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

When depreciation is recorded on equipment,Depreciation Expense is increased and the Equipment account is decreased.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tyler Company purchased equipment that cost $260,000 cash on January 1,Year 1.The equipment had an expected useful life of five years and an estimated salvage value of $10,000.Tyler depreciates its assets under the straight-line method.What is the amount of depreciation expense appearing on the Year 1 income statement?

A) $26,000

B) $50,000

C) $52,000

D) $100,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would most likely not be expensed using the straight-line method?

A) A copyright

B) A building

C) A timber reserve

D) A patent

F) None of the above

Correct Answer

verified

Correct Answer

verified

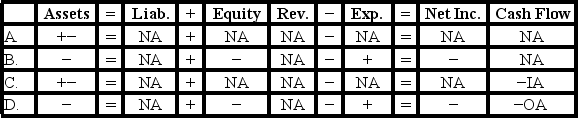

Multiple Choice

Good Company paid cash to purchase mineral rights on a large parcel of land.Which of the following choices accurately reflects how this event would affect the horizontal financial statements model?

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Title search and transfer document costs incurred to purchase a building are expensed in the period the building is acquired.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 122

Related Exams