B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a company uses the FIFO cost flow method for its income tax return it must also use FIFO for financial reporting.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which inventory costing method will produce an amount for cost of goods sold that is closest to current market value?

A) Weighted average

B) Specific identification

C) LIFO

D) FIFO

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

[The following information applies to the questions displayed below.]

Singleton Company's perpetual inventory records included the following information:

![[The following information applies to the questions displayed below.] Singleton Company's perpetual inventory records included the following information: -If Singleton uses the weighted-average cost flow method,its average cost per unit would be $8.00.](https://d2lvgg3v3hfg70.cloudfront.net/TB1323/11ea7eef_7f62_b4df_ace2_9974b45d071f_TB1323_00_TB1323_00_TB1323_00_TB1323_00_TB1323_00_TB1323_00.jpg) -If Singleton uses the weighted-average cost flow method,its average cost per unit would be $8.00.

-If Singleton uses the weighted-average cost flow method,its average cost per unit would be $8.00.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.] The inventory records for Radford Co. reflected the following: -What is the amount of cost of goods sold assuming the LIFO cost flow method?

A) $4,100

B) $4,320

C) $2,360

D) $3,600

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The gross margin method of estimating inventory is not useful in detecting inventory fraud.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

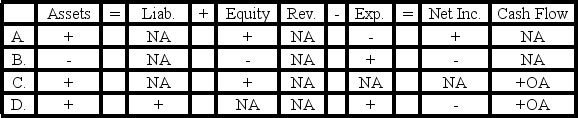

How does an error that results in an overstatement of ending inventory affect the elements of the company's financial statements in the current year?

A) Option A

B) Option B

C) Option C

D) Option D

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Landis Company is preparing its financial statements.Gross margin is normally 40% of sales.Information taken from the company's records revealed sales of $25,000; beginning inventory of $2,500 and purchases of $17,500.What is the estimated amount of ending inventory at the end of the period?

A) $15,000

B) $5,000

C) $8,000

D) $10,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not required to apply the gross margin method?

A) Total sales for the current period

B) The amount of inventory on hand at the end of the current period

C) Amount of purchases during the current period

D) The beginning inventory for the current period

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How is inventory turnover calculated?

A) Cost of goods sold divided by inventory

B) Sales divided by inventory

C) Beginning inventory divided by the ending inventory

D) Inventory divided by cost of goods sold

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Koontz Company uses the perpetual inventory method and the weighted-average method.On January 1,Year 1,the company's first day of operations,Koontz purchased 400 units of inventory that cost $7.50 each.On January 10,Year 1,the company purchased an additional 600 units of inventory that cost $9.00 each.If the company sells 550 units of inventory,what is the amount of inventory that would appear on the balance sheet immediately following the sale?

A) $3,780

B) $4,738

C) $3,080

D) $3,713

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.]

![[The following information applies to the questions displayed below.] -What is the average number of days to sell inventory for Company Y? A) 15.3 B) 24.8 C) 23.9 D) 25.6](https://d2lvgg3v3hfg70.cloudfront.net/TB1323/11ea7eef_7f61_f18e_ace2_bdfe0a2c6c10_TB1323_00_TB1323_00.jpg) -What is the average number of days to sell inventory for Company Y?

-What is the average number of days to sell inventory for Company Y?

A) 15.3

B) 24.8

C) 23.9

D) 25.6

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The cost flow method chosen by a company will impact its inventory turnover ratio.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At the end of the Year 2 accounting period,DeYoung Company determined that the market value of its inventory was $79,800.The historical cost of this inventory was $81,400.DeFazio uses the perpetual inventory method.Assuming the amount is material,how will the necessary write-down to reduce the inventory to the lower-of-cost-or-market affect the elements of the company's financial statements?

A) Decrease total assets and gross margin

B) Decrease total assets and net income

C) Increase total assets and net income

D) Decrease total assets, gross margin, and net income

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What happens when prices are falling?

A) LIFO will result in lower net income and a lower inventory valuation than will FIFO.

B) LIFO will result in lower net income and a higher inventory valuation than will FIFO.

C) LIFO will result in higher net income and a higher inventory valuation than will FIFO.

D) LIFO will result in higher net income and a lower inventory valuation than will FIFO.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A company uses a cost flow method (such as LIFO or FIFO)to allocate product costs between cost of goods sold and beginning inventory.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.] The inventory records for Radford Co. reflected the following: -What is the amount of gross margin assuming the weighted-average inventory cost flow method?

A) $3,015

B) $2,412

C) $1,314

D) $2,970

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

In most businesses,the physical flow of goods occurs on a FIFO basis,but a different cost flow method is allowed under generally accepted accounting principles.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A company's gross margin reported on the income statement is not affected by the inventory cost flow method it uses.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Why are the inventory and cost of goods sold accounts attractive targets for managerial fraud?

A) There are few if any procedures that can check for fraud in these accounts.

B) There are no adequate methods of record keeping for inventory.

C) These accounts are more significant than most other accounts.

D) Cost of goods sold and Inventory accounts are not attractive targets of fraud.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 84

Related Exams