A) time it will take to recover the initial cash outflow of an investment.

B) additional cash inflows from operating activities.

C) rate of return per dollar invested in a capital project.

D) ratio of the net present value of an investment to the initial investment.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which method for evaluating capital investment proposals deducts the present value of cash outflows from the present value of cash inflows?

A) Payback method

B) Internal rate of return

C) Net present value

D) Unadjusted rate of return

F) All of the above

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

Harvey wants to determine the net present value for a proposed capital investment. He has determined the desired rate of return, the expected investment time period, a series of cash inflows of equal amount, the salvage value of the investment, and the required cash outflows. Which of the following tables would most likely be used to calculate the net present value of the investment?

A) Present value of annuity.

B) Future value of a lump sum.

C) Present value of annuity and present value of a lump sum.

D) Future value of annuity and future value of a lump sum.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Butch's Barbecue thinks that offering delivery will increase their sales. Butch's is considering whether to purchase a used delivery truck costing $12,000. Additional net income from the delivery service will be $1,400 per year. The truck will last approximately 5 years. What is the unadjusted rate of return based on the average investment?

A) About 58.3%

B) About 11.7%

C) About 23.3%

D) About 857.1%

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which method of evaluating capital investment decisions uses the concept of present value to compute a rate of return?

A) Internal rate of return

B) Unadjusted rate of return

C) Net present value

D) Payback

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

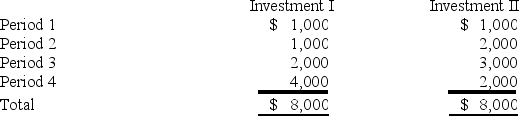

Morrisey Company has two investment opportunities. Both investments cost $5,500 and will provide the same total future cash inflows. The cash receipt schedule for each investment is given below:  What is the net present value of Investment II assuming an 8% minimum rate of return? Use Appendix Table 2. (Do not round your intermediate calculations. Round your answer to nearest whole dollar.)

What is the net present value of Investment II assuming an 8% minimum rate of return? Use Appendix Table 2. (Do not round your intermediate calculations. Round your answer to nearest whole dollar.)

A) $6,492

B) $992

C) $5,880

D) $380

F) A) and C)

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

Which of the following statements concerning payback analysis is true?

A) An investment with a shorter payback is preferable to an investment with a longer payback.

B) The payback method ignores the time value of money concept.

C) The payback method and the unadjusted rate of return are different approaches that will not consistently lead to the same conclusion.

D) All of the other answers are correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Newton Company is considering the purchase of an asset that will provide a depreciation tax shield of $10,000 per year for 10 years. Assuming the company is subject to a 40% tax rate during the period, and a zero salvage value, what is the depreciable cost of the new asset?

A) $100,000

B) $250,000

C) $400,000

D) Can't be determined from the information provided

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ashley projects that she can get $100,000 cash per year for 5 years on a real estate investment project. If Ashley wants to earn a rate of return of 12%, what is the maximum that she should pay for the investment? . (Round your answer to the nearest dollar.)

A) $56,743

B) $446,429

C) $360,478

D) $560,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A dollar to be received in the future is subject to the effects of risk and inflation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Nguyen Company has an opportunity to purchase an asset that will cost the company $36,000. The asset is expected to add $12,000 per year to the company's net income. Assuming the asset has a five-year useful life and zero salvage value, the unadjusted rate of return (based on average investment) will be:

A) 60%.

B) 66%.

C) 15%.

D) none of these answers is correct.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following are capital investment decisions except:

A) acquiring $100,000 of common stock.

B) buying a $5,000,000 manufacturing plant.

C) purchasing equipment for $80,000.

D) paying $600,000 to renovate a restaurant.

F) All of the above

Correct Answer

verified

A

Correct Answer

verified

True/False

When the effect of income taxes is considered in a capital budgeting analysis, the amount of depreciation expense must be added back to after-tax income to calculate the annual cash inflow.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Select the incorrect statement concerning the internal rate of return (IRR) method of evaluating capital projects.

A) The higher the IRR the better.

B) The internal rate of return is that rate that makes the present value of the initial outlay equal to zero.

C) If a project has a positive net present value then its IRR will exceed the hurdle rate.

D) A project whose IRR is less than the cost of capital should be rejected.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Grayson Company is considering purchase of equipment that costs $49,000 and is expected to offer annual cash inflows of $13,000. Grayson's minimum required rate of return is 10%. How many years must the cash flows last for the investment to be acceptable? (Do not round your intermediate calculations. Round to nearest whole year.)

A) 4

B) 5

C) 3

D) 6

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

When a capital investment is expected to provide unequal annual cash inflows, the payback period can be calculated by accumulating the incremental cash inflows until the sum equals the amount of the original investment.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following are not present value methods of analyzing capital investment proposals?

A) Internal rate of return and payback

B) Unadjusted rate of return and net present value

C) Net present value and payback

D) Payback and unadjusted rate of return

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Generro Company is considering the purchase of equipment that would cost $36,000 and offer annual cash inflows of $10,500 over its useful life of 5 years. Assuming a desired rate of return of 12%, is the project acceptable?

A) No, since the negative net present value indicates the investment will yield a rate of return below the desired rate of return.

B) Yes, since the investment will generate $52,500 in future cash flows, which is greater than the purchase cost of $36,000.

C) Yes, since the positive net present value indicates the investment will earn a rate of return greater than 12%.

D) The answer cannot be determined.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An investment that costs $20,000 will produce annual cash flows of $5,000 for a period of 6 years. Further, the investment has an expected salvage value of $3,000. Given a desired rate of return of 12%, what will the investment generate? Use Appendix Table 2. (Do not round your intermediate calculations. Round your answer to the nearest whole dollar.)

A) A positive net present value of $2,077.

B) A negative net present value of $2,077.

C) A positive net present value of $22,077.

D) A positive net present value of $557.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

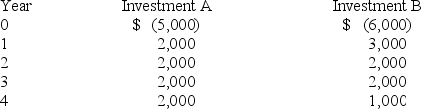

Garrison Company has two investment opportunities. A cash flow schedule for the investments is provided below:  Considering the unequal investments, which of the following techniques would be most appropriate for choosing between Investment A and Investment B?

Considering the unequal investments, which of the following techniques would be most appropriate for choosing between Investment A and Investment B?

A) Payback technique

B) Present value index

C) Net present value technique

D) None of these answers is correct.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 116

Related Exams