B) False

Correct Answer

verified

Correct Answer

verified

True/False

Cash inflows from a capital investment may include the terminal value of capital assets and increases in revenues.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

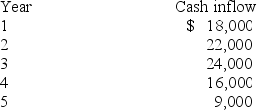

Young Corporation is considering purchasing equipment that costs $80,000 and is expected to provide the following cash inflows over its five-year useful life:  What is the payback period of this investment project (rounded to the nearest year) ?

What is the payback period of this investment project (rounded to the nearest year) ?

A) 2 years

B) 4 years

C) 3 years

D) 6 years

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Capital investment decisions involve all of the following, except:

A) the acquisition of short-term operational assets.

B) projects requiring relatively long periods of time and large cash flows.

C) the acquisition of long-term operational assets.

D) none of these answers is correct.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The payback method shows how long will be required to recover the cost of an investment in a capital asset.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Mary needs to have $20,000 one year from today. The formula to compute the amount of money that must be invested today is future value ÷ (1 - interest rate).

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A project's net present value can be found by subtracting the cost of the project from the total present value of the future cash flows generated by the project.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about postaudits is correct?

A) A postaudit should be conducted at the time a capital investment is purchased.

B) The postaudit of a capital investment project should be made using the same analytical technique that was used in deciding to make the investment.

C) The purpose of postaudits is to improve a company's cost-volume-profit analysis.

D) The postaudit process uses expected cash flows and the company's cost of capital.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cash outflows generated by capital investments include all of the following except:

A) depreciation expense

B) transportation costs

C) increased operating expenses

D) increase in the required amount of working capital

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If a project has a positive net present value, its internal rate of return will exceed the firm's hurdle rate.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For a capital investment project to be acceptable, it must generate a rate of return:

A) less than the hurdle rate.

B) equal to or greater than the cost of capital.

C) equal to the conversion rate.

D) none of these answers is correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Generally, the unadjusted rate of return should be calculated based on the average investment rather than the amount of the original investment in a depreciable asset such as equipment.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The instantaneous computation power of spreadsheet software makes it ideal for answering "what-if" questions regarding present values.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

George Company has the opportunity to purchase an asset that costs $40,000. The asset is expected to increase net income by $10,000 per year. Depreciation expense will be $5,000 per year. Based on this information the payback period is:

A) 4 years.

B) 2.5 years.

C) 2.67 years.

D) 8 years.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Connor has $300,000 to invest in a 5-year annuity. Assuming the time value of money is 10%, what amount will Connor receive in cash each year? . (Round your answer to the nearest dollar.)

A) $79,139

B) $60,000

C) $96,631

D) None of these answers is correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

When a capital investment is expected to provide unequal annual cash inflows, the payback period cannot be calculated.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The unadjusted rate of return is found by dividing the average incremental increase in annual operating income by the cost of the investment.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The compensation a company receives for investing in capital assets is referred to as a return on investment.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The cost of capital is sometimes referred to as the hurdle or discount rate.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cash outflows generated by capital investments include all of the following except:

A) annual depreciation of the capital asset.

B) initial investment in the capital asset.

C) increase in operating expenses.

D) increase in the amount of required working capital

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 116

Related Exams