A) 0.755.

B) 1.600.

C) 2.500.

D) 1.325.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A postaudit should be performed at the end of a capital investment project to determine whether the expected results were actually achieved.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is incorrect?

A) The further into the future a cash receipt is expected to occur, the lower is its present value.

B) The return on investment measures the compensation a company expects to receive from investing in capital assets.

C) Most companies use their cost of capital to estimate the minimum return on investment required from capital investments.

D) When a company invests in capital assets, it sacrifices future dollars for the opportunity to receive present dollars.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The amount of the depreciation tax shield can be calculated by multiplying the amount of depreciation expense by the tax rate.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The process by which management evaluates long-term investment decisions involving long term operational assets is called:

A) capital investment analysis.

B) activity based management.

C) strategic business analysis.

D) fixed cost analysis.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kerwin Company is considering purchase of equipment that costs $50,000. If the useful life is expected to be 5 years and Crown's required rate of return is 12%, what is the minimum annual cash inflow that the equipment must offer for the investment to be acceptable? (Do not round your intermediate calculations. Round your final answer to the nearest dollar.)

A) $8,929

B) $13,870

C) $12,076

D) $17,623

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Capital investments differ from stock and bond investments in that stock and bond investments can be sold in organized markets.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The present value of an annuity of $1 table could be constructed using the factors contained in the present value of $1 table.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

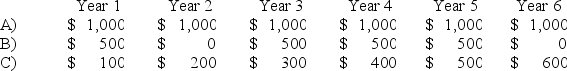

Assuming equal time intervals between the payments and a constant rate of return, which of the following cash flow patterns represents an annuity?

A) A

B) B

C) C

D) Any of the answers can represent an annuity.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The purposes of the postaudit for capital investments include all of the following except:

A) continuous improvement.

B) rewarding managers for increasing idle cash.

C) determining whether the project generated the results expected.

D) encouraging managers to closely scrutinize capital investment decisions.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which statement characterizes the time value of money concept?

A) The future value of a present dollar is greater than one dollar.

B) The present value of a future dollar is greater than one dollar.

C) The timing of cash flows is not relevant to decision making.

D) None of these answers is correct.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

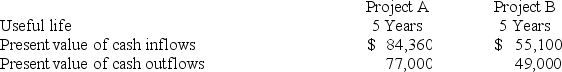

Findell Corporation is considering two projects, A and B, and it has gathered the following estimates for the project:  What is the present value index for project A?

What is the present value index for project A?

A) 1.096

B) 1.124

C) 0.889

D) 0.913

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

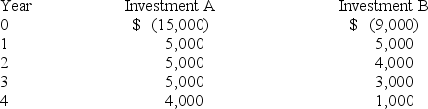

Shenandoah Springs Company is considering two investment opportunities whose cash flows are provided below:  The company's hurdle rate is 12%. What is the present value index of Investment B? Use Appendix Table 1. (Do not round your intermediate calculations. Round your answer to two decimal points.)

The company's hurdle rate is 12%. What is the present value index of Investment B? Use Appendix Table 1. (Do not round your intermediate calculations. Round your answer to two decimal points.)

A) 1.01

B) 1.16

C) 0.86

D) None of these answers is correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The future value of $1 table should be used to discount lump sum cash flows expected to occur in the future.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An investment that costs $40,000 will produce annual cash flows of $12,000 for a period of 4 years. Given a desired rate of return of 10%, what will the investment generate? Use Appendix Table 2. (Do not round your intermediate calculations. Round your answer to the nearest whole dollar.)

A) A positive net present value of $38,038.

B) A positive net present value of $1,962.

C) A negative net present value of $38,038.

D) A negative net present value of $1,962.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cash outflows from a capital investment project include:

A) increases in operating expenses.

B) the reduction in the amount of working capital.

C) terminal salvage value.

D) all of these answers are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When calculating the present value of an ordinary annuity, it is assumed that:

A) cash flows will be reinvested at the required rate of return.

B) cash flows occur at the end of each accounting period.

C) the investor will wait until the end of the investment period to withdraw cash flows.

D) cash flows will be reinvested at the required rate of return and cash flows occur at the end of each accounting period.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

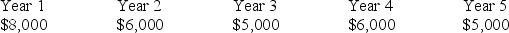

Mr. J's Bagels invested in a new oven for $14,000. The oven reduced the amount of time for baking which increased production and sales for five years by the following amounts of cash inflows:  Using the averaging method, the payback period for the investment in the oven would be:

Using the averaging method, the payback period for the investment in the oven would be:

A) 5.0 years.

B) 2.3 years.

C) 2.0 years.

D) 0.5 years.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

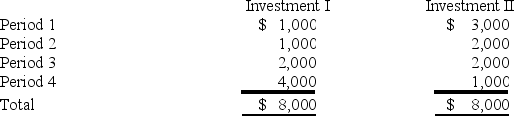

Evergreen Company has two investment opportunities. Both investments cost $5,000 and will provide the same total future cash inflows. The cash receipt schedule for each investment is given below:  Select the correct statement.

Select the correct statement.

A) Evergreen should choose Investment I because of the time value of money.

B) Evergreen should choose Investment II because it generates more immediate cash inflows.

C) Evergreen should be indifferent between the two investments because they provide the same total cash inflows.

D) Time value of money techniques are not useful for comparing these investments.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

If the net present value for a capital investment is equal to zero, the internal rate of return for the investment is equal to the required rate of return.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 116

Related Exams