A) Assessing past performance.

B) Assessing the prospects for future performance.

C) Analyzing how a company finances its operations.

D) All of these answers are correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Working capital is current assets minus current liabilities.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Jenkins Company's current ratio is higher than the average for its industry, while its quick ratio is below the industry average. One possible interpretation for these results is that Jenkins carries less inventory than most companies in its industry.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which ratio compares the earnings per share of a company to the market price for a share of the company's stock?

A) Price-earnings ratio

B) Dividend yield

C) Book value per share

D) Return on equity

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding ratio analysis is incorrect?

A) Ratio analysis is a specific form of horizontal analysis.

B) There are many different ratios available for evaluating a firm's performance.

C) Some ratios involve an account from the balance sheet and one from the income statement.

D) Ratio analysis involves making comparisons between different accounts in the same set of financial statements.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which ratio measures the percentage of company's assets that are financed by debt?

A) Debt to assets ratio

B) Asset turnover

C) Debt to equity

D) Return on investment

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Short-term creditors are usually most interested in assessing:

A) Liquidity.

B) Solvency.

C) Managerial effectiveness.

D) Profitability.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are considering an investment in Facebook stock and wish to assess the company's position in the stock market. All of the following ratios can be used except:

A) Dividend yield.

B) Earnings per share.

C) Working capital.

D) Price-earnings ratio.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

While horizontal analysis examines one item over many time periods, vertical analysis examines many items in the same interval of time.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The accounting profession assumes that financial statement users have an expert knowledge of business.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that you are considering purchasing some of a company's long-term bonds as an investment. Which of the company's financial statement ratios would you probably be most interested in?

A) Debt to assets ratio

B) Debt to equity

C) Plant assets to long-term liabilities

D) All of these answers are correct.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Benson Company received cash of $1,000,000 from issuing common stock at par value. As a result of this transaction, the company's debt to equity ratio will:

A) Decrease.

B) Increase.

C) Remain the same.

D) Cannot be determined.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As of December 31, Year 1, Gant Corporation had a current ratio of 1.29, quick ratio of 1.05, and working capital of $18,000. The company uses a perpetual inventory system and sells merchandise for more than it cost. On January 1, Year 2 Gant paid $3,600 on accounts payable. Which of the following statements is incorrect?

A) Gant's quick ratio will increase and its current ratio will decrease.

B) Gant's quick ratio will increase.

C) Gant's working capital will remain the same.

D) Gant's current ratio will increase.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding the information disclosed in financial statements is incorrect?

A) The costs of providing all possible information about a firm would be prohibitively high for the business.

B) Some information disclosed in financial statements may be irrelevant to some users.

C) Financial statements should be detailed enough to answer any financial-related question an investor might have.

D) When too much information is presented users may suffer from information overload.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Knoell Company paid its sales employees $15,000 in sales commissions. What impact will this transaction have on the firm's working capital?

A) No impact

B) Increase it

C) Decrease it

D) Not enough information is provided to answer the question.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

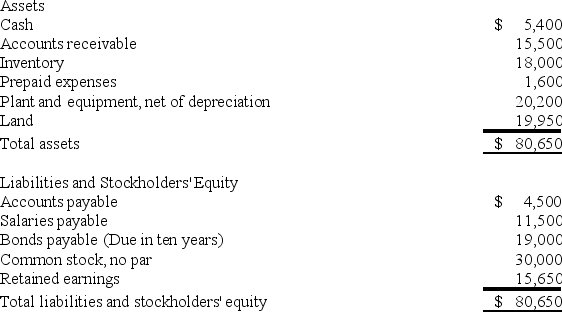

The following balance sheet information is provided for Santana Company for Year 2:  What is the company's debt to equity ratio? (Round your answers to the nearest whole percent.)

What is the company's debt to equity ratio? (Round your answers to the nearest whole percent.)

A) 42%

B) 130%

C) 43%

D) 77%

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Phibbs Company paid total cash dividends of $200,000 on 25,000 outstanding common shares. On the most recent trading day, the common shares sold at $80. What is this company's dividend yield?

A) 25%

B) 6.4%

C) 16.9%

D) 10%

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about financial statement analysis is incorrect?

A) In horizontal percentage analysis, an item from the financial statements is expressed as a percentage of the same item from a previous year's financial statements.

B) Vertical analysis compares two or more financial statement items within the same time period.

C) Horizontal analysis for several years can be done by choosing one year as a base year and calculating increases or decreases in relation to that year.

D) The reason behind a financial statement ratio or percentage analysis result is usually self-evident and does not require further study or analysis.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which type of approach should be used when evaluating corporate results using horizontal analysis?

A) Study of absolute amounts.

B) Percentages.

C) Trends.

D) All of these answers are correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

A limitation of financial statement analysis stems from the discretion of management to choose accounting procedures that cast the best light on the firm's performance.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 108

Related Exams