A) $0.82

B) $1.00

C) $0.90

D) $0.75

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Grove Corporation had sales of $3,000,000, cost of sales of $2,250,000, and average inventory of $500,000. What was Grove's inventory turnover ratio for the period?

A) 1.6 times

B) 6 times

C) 4.5 times

D) 23 times

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The accounting concept or principle that is perhaps the greatest single culprit in distorting the results of financial statement analysis is the:

A) Matching principle.

B) Conservatism concept.

C) Historical cost principle.

D) Time value of money concept.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Benson Company declared and paid a cash dividend totaling $500,000 on its common stock. As a result of this transaction, the company's debt to assets ratio will:

A) Decrease.

B) Increase.

C) Remain the same.

D) Cannot be determined.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

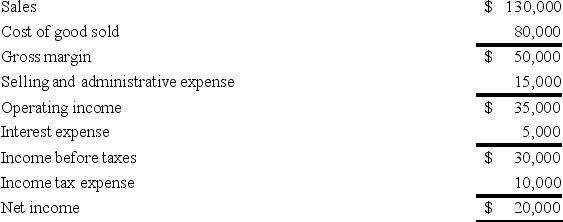

The Fortune Company reported the following income for Year 2:  What is the company's number of times interest is earned ratio?

What is the company's number of times interest is earned ratio?

A) 7 times

B) 6 times

C) 4 times

D) None of these answers is correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Benson Company received cash of $5,000,000 by issuing 20-year bonds payable. As a result of this transaction, the company's current ratio will:

A) Remain the same.

B) Increase.

C) Decrease.

D) Cannot be determined.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Profitability ratios attempt to assess the company's ability to generate earnings.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The only requirement involved in communicating useful information is that the information be accurate.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In terms of solvency, the larger the number of times interest is earned, the better.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The accounts receivable turnover ratio can be used to asses a firm's solvency.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the company purchased a $60,000 piece of equipment by paying $30,000 and having the rest financed with a short-term note from the bank, then immediately after this transaction what is the expected impact on the components of the current ratio?

A) Current assets decrease and current liabilities increase by the same amount.

B) Current liabilities decrease.

C) Current assets and current liabilities decrease by the same amount.

D) Current assets increase.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Milton Company has total current assets of $46,000, including inventory of $10,000, and current liabilities of $20,000. The company's current ratio is:

A) 0.4.

B) 1.8.

C) 2.8.

D) 2.3.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

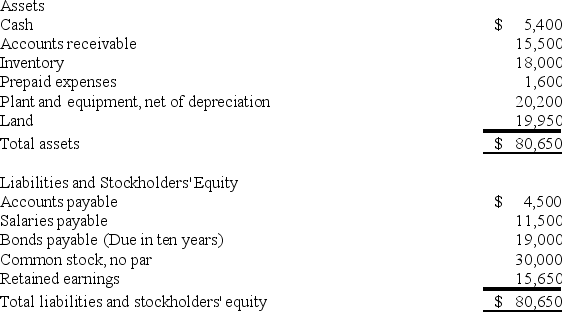

The following balance sheet information is provided for Duke Company for Year 2:  What is the company's current ratio?

What is the company's current ratio?

A) 1.16

B) 1.31

C) 2.53

D) 3.79

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As of December 31, Year 1, Gant Corporation had a current ratio of 1.29, quick ratio of 1.05, and working capital of $18,000. The company uses a perpetual inventory system and sells merchandise for more than it cost. On January 1, Year 2, Gant sold inventory on account. Which of the following statements is incorrect?

A) Gant's current ratio will increase.

B) Gant's quick ratio will increase.

C) Gant's working capital will increase.

D) None of these answers is correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a potential limitation of financial statement analysis?

A) Lack of comparability of firms in different industries

B) The impact of changing economic conditions

C) The impact of having more than one acceptable alternative accounting principle for accounting for a given transaction or economic event

D) All of these answers are correct.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

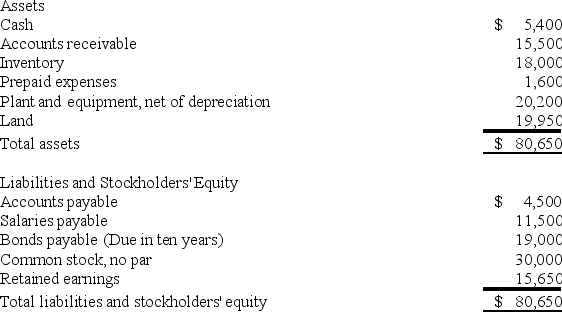

The following balance sheet information is provided for Apex Company for Year 2:  What is the company's working capital?

What is the company's working capital?

A) $20,300

B) $4,900

C) $22,900

D) $24,500

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Current financial reporting standards assume that users of accounting information:

A) Have an expert's understanding of economic and financial events and conditions.

B) Have a reasonably informed knowledge of business.

C) Have widely differing levels of knowledge about business, and that financial reporting must meet these differing needs.

D) Have only minimal knowledge of business.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

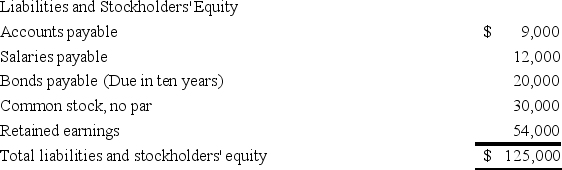

The following partial balance sheet is provided for Groome Company:  What is the company's quick (acid-test) ratio?

What is the company's quick (acid-test) ratio?

A) 49%

B) 16%

C) 33%

D) Cannot be determined with the information given.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Dennis Company reported net income of $50,000 on sales of $300,000. The company has average total assets of $500,000 and average total liabilities of $100,000. What is the company's return on equity ratio?

A) 10.0%

B) 16.7%

C) 12.5%

D) 50.0%

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The quick ratio although similar to the current ratio is more conservative.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 108

Related Exams