B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

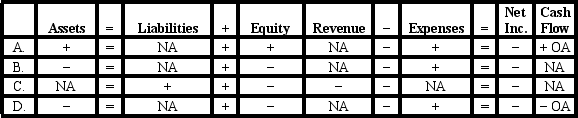

On January 1, Year 1, the Vanguard Company purchased a copyright for $12,000. Vanguard estimated the remaining useful life of the copyright to be 6 years. Which of the following correctly shows the effect of the first year's amortization of Vanguard's copyright?

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The balance sheet of Flo's Restaurant showed total assets of $600,000, liabilities of $160,000 and equity of $540,000. An appraiser estimated the fair value of the restaurant assets at $680,000. If Alice Company pays $770,000 cash for the restaurant the amount of goodwill acquired would be:

A) $90,000.

B) $170,000.

C) $250,000.

D) $230,000.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1, Year 1, Friedman Company purchased a truck that cost $48,000. The truck had an expected useful life of 100,000 miles over 8 years and an $8,000 salvage value. During Year 2, Friedman drove the truck 18,500 miles. The amount of depreciation expense recognized in Year 2 assuming that Friedman uses the units-of-production method is:

A) $8,880.

B) $7,400.

C) $6,000.

D) $5,000.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be classified as a long-term operational asset?

A) Notes receivable.

B) Trademark.

C) Inventory.

D) Accounts receivable.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Harding Corporation acquired real estate that contained land, building and equipment. The property cost Harding $1,900,000. Harding paid $350,000 and issued a note payable for the remainder of the cost. An appraisal of the property reported the following values: Land, $374,000; Building, $1,100,000 and Equipment, $726,000. Assume that Harding uses the units-of-production method when depreciating its equipment. Harding estimates that the purchased equipment will produce 1,000,000 units over its 5-year useful life and has salvage value of $34,000. Harding produced 265,000 units with the equipment by the end of the first year of purchase. Which amount below is closest to the amount Harding will record for depreciation expense for the equipment in the first year?

A) $193,450

B) $125,200

C) $157,145

D) $165,890

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would most likely not be expensed using the straight-line method?

A) A copyright.

B) A building.

C) A timber reserve.

D) A patent.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following terms is applied to long-term assets that have no physical substance and provide rights, privileges and special opportunities to businesses?

A) Tangible assets

B) Intangible assets

C) Natural resources

D) Property, plant and equipment

F) C) and D)

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

On January 1, Year 1, Eller Company purchased an asset that had cost $24,000. The asset had an 8-year useful life and an estimated salvage value of $1,000. Eller depreciates its assets on the straight-line basis. On January 1, Year 5, the company spent $6,000 to improve the quality of the asset. Based on this information, the recognition of depreciation expense in Year 5 would:

A) increase total assets by $4,375.

B) reduce total equity by $4,375.

C) reduce total assets by $4,625.

D) increase total equity by $4,625.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1, Year 1, Phillips Company made a basket purchase including land, a building and equipment for $380,000. The appraised values of the assets are $20,000 for the land, $340,000 for the building and $40,000 for equipment. Phillips uses the double-declining-balance method of depreciation for the equipment which is estimated to have a useful life of four years and a salvage value of $5,000. The depreciation expense for Year 1 for the equipment is:

A) $17,000.

B) $20,000.

C) $9,500.

D) $19,000.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The term used to recognize expense for property, plant, and equipment assets is depletion.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1, Year 1, Missouri Co. purchased a truck that cost $57,000. The truck had an expected useful life of 10 years and a $6,000 salvage value. The amount of depreciation expense recognized in Year 2 assuming that Missouri uses the double declining-balance method is:

A) $9,120.

B) $11,400.

C) $10,200.

D) $8,160.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A copyright is an intangible asset with an indefinite useful life.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A substantial amount spent to improve the quality or extend the life of a long-term asset is called a revenue expenditure.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Madison Company owned an asset that had cost $44,000. The company sold the asset on January 1, Year 4, for $16,000. Accumulated depreciation on the day of sale amounted to $32,000. Based on this information, the sale would result in:

A) A $16,000 cash inflow in the investing activities section of the cash flow statement.

B) A $16,000 increase in total assets.

C) A $4,000 gain in the investing activities section of the statement of cash flows.

D) A $4,000 cash inflow in the financing activities section of the cash flow statement.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1, Year 2, Ballard Company spent $12,000 on an asset to improve its quality. The asset had been purchased on January 1, Year 1, for $52,000. The asset had a $4,000 salvage value and a 6-year life. Ballard uses straight-line depreciation. What would be the book value of the asset on January 1, Year 5?

A) $24,800.

B) $20,800.

C) $10,400.

D) $24,000.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Intangible assets include patents, copyrights, and franchises.

B) False

Correct Answer

verified

True

Correct Answer

verified

Multiple Choice

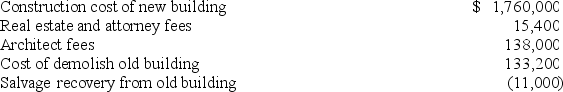

On January 6, Year 1, the Mount Jackson Corporation purchased a tract of land for a factory site for $1,500,000. An existing building on the site was demolished and the new factory was completed on October 11, Year 1. Additional cost data are shown below:  Which of the following correctly states the capitalized cost of the (a) land and (b) the new building, respectively?

Which of the following correctly states the capitalized cost of the (a) land and (b) the new building, respectively?

A) $1,637,600 and $1,898,000

B) $1,515,400 and $2,020,200

C) $1,648,600 and $1,887,000

D) $1,500,000 and $2,035,600

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Title search and document costs incurred to purchase a building are expensed in the period the building is acquired.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

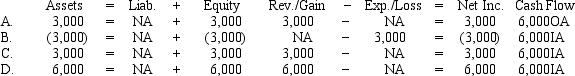

On September 10, Year 5, Farmer Company sold a piece of equipment for $6,000. The equipment had an original cost of $34,000 and accumulated depreciation of $31,000 at the time of the sale. Which of the following correctly shows the effect of the sale on the Year 5 financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) B) and D)

Correct Answer

verified

C

Correct Answer

verified

Showing 1 - 20 of 97

Related Exams