B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

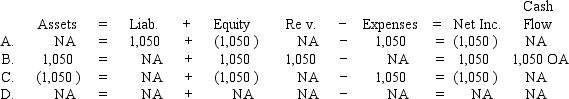

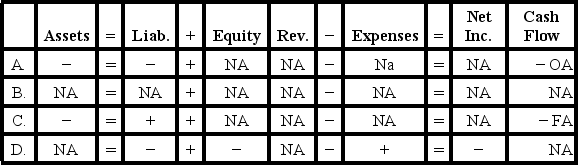

On December 31, Year 1, the Loudoun Corporation estimated that 3% of its credit sales of $112,500 would be uncollectible. Loudoun uses the allowance method of accounting for uncollectible accounts. In February of Year 2, one of Loudoun's customers failed to pay his $1,050 account and the account was written off. On April 4, Year 2, this customer paid Loudoun the $1,050. Which of the following answers correctly states the effect of Loudoun's recording the reestablishment of the receivable on April 4, Year 2?

A) Option A

B) Option B

C) Option C

D) Option D

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The longer an account receivable has been outstanding, the less likely it is to be collected.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following businesses is most likely to use a specific identification cost flow method?

A) Car dealership

B) Grocery store

C) Hardware store

D) Roofing company

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Willis Company had $200,000 in credit sales for Year 1, and it estimated that 2% of the credit sales would not be collected. The balance in Accounts Receivable at the end of the year was $38,000. Willis had never used the allowance method to account for its receivables till Year 1. The net realizable value of its accounts receivable at the end of the year was $34,000.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a company uses the FIFO cost flow method for its income tax return it must also use FIFO for financial reporting.

B) False

Correct Answer

verified

Correct Answer

verified

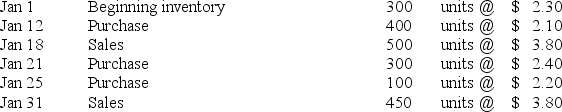

Multiple Choice

Chase Co. uses the perpetual inventory method. The inventory records for Chase reflected the following  Assuming Chase uses a FIFO cost flow method, the cost of goods sold for the sales transaction on January 31 is:

Assuming Chase uses a FIFO cost flow method, the cost of goods sold for the sales transaction on January 31 is:

A) $1,020.

B) $1,005.

C) $1,045.

D) $340.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The specific identification inventory method is not practical for companies that sell many low-priced, high turnover items.

B) False

Correct Answer

verified

Correct Answer

verified

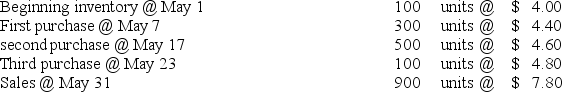

Multiple Choice

The inventory records for Radford Co. reflected the following  Determine the amount of gross margin assuming the weighted average cost flow method.

Determine the amount of gross margin assuming the weighted average cost flow method.

A) $3,015

B) $2,412

C) $1,314

D) $2,970

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tetra Company purchased 2,000 units of inventory that cost $4.00 each on January 1, Year 1. An additional 3,000 units of inventory were purchased on January 12, Year 1 at a cost of $4.20 each. Tetra Company sold 4,000 units of inventory on January 20, Year 1. Assuming that Tetra Co. uses the perpetual inventory method and a FIFO cost flow method, how would the entry to recognize the cost of goods sold affect the financial statements?

A) Increase inventory and increase cost of goods sold by $16,400

B) Decrease cost of goods sold and increase inventory by $16,600

C) Increase cost of goods sold and decrease inventory by $16,400

D) Increase inventory and increase cost of goods sold by $16,600

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How would accountants estimate the amount of a company's uncollectible accounts expense?

A) Consider new circumstances that are anticipated to be experienced in the future.

B) Compute as a percentage of credit sales.

C) Consult with trade association and business associates.

D) All of these answer choices are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Warner Company purchased two units of a product for $36 and later purchased one more for $40. If the company uses the weighted average cost flow method, and it sold one unit of the product for $60, its gross margin would be $22.00.

B) False

Correct Answer

verified

Correct Answer

verified

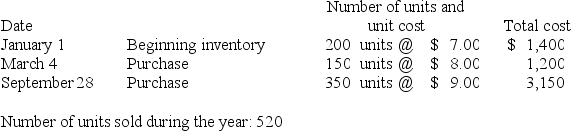

True/False

Singleton Company's perpetual inventory records included the following information:

If Singleton uses the weighted-average cost flow method, its weighted-average cost per unit would be $8.00.

If Singleton uses the weighted-average cost flow method, its weighted-average cost per unit would be $8.00.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The year-end adjusting entry to recognize uncollectible accounts expense will:

A) decrease assets and decrease equity.

B) increase assets and decrease equity.

C) increase liabilities and increase equity.

D) decrease liabilities and increase equity.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Barker Company paid cash to purchase two identical inventory items. The first purchase cost $18.00 cash and the second cost $20.00 cash. Barker sold one inventory item for $30.00 cash. Based on this information alone, without considering the effect of income tax:

A) cash flow from operating activities is $11.00 assuming a weighted average cost flow.

B) cash flow from operating activities is $12.00 assuming a FIFO cost flow.

C) cash flow from operating activities is $10.00 assuming a LIFO cost flow.

D) the amount of cash flow from operating activities is not affected by the cost flow method.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The net realizable value of accounts receivable decreases when an account receivable is written off.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The balance in Accounts Receivable at the beginning of the period amounted to $16,000. During the period $64,000 of credit sales were made to customers. If the ending balance in Accounts Receivable amounted to $10,000, and uncollectible accounts expense amounted to $4,000, then the amount of cash inflow from customers that would appear in the operating activities section of the cash flow statement would be:

A) $66,000.

B) $64,000.

C) $80,000.

D) None of these answers are correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

During a period of rising prices, the amount of ending inventory reported on the balance sheet will be lower using the LIFO cost flow method than with FIFO.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Buttercup Florist uses the allowance method to account for uncollectible accounts. Unable to collect a $150 account from a customer, Buttercup determined it was uncollectible. How would the write-off of this account affect the company's financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1, Year 2, Kincaid Company's Accounts Receivable and the Allowance for Doubtful Accounts carried balances of $31,000 and $500, respectively. During the year Kincaid reported $72,500 of credit sales. Kincaid wrote off $550 of receivables as uncollectible in Year 2. Cash collections of receivables amounted to $74,550. Kincaid estimates that it will be unable to collect one percent (1%) of credit sales. The net realizable value of receivables appearing on Kincaid's Year 2 balance sheet will amount to:

A) $29,075.

B) $27,725.

C) $28,950.

D) $28,400.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 120

Related Exams