A) $16,800.

B) $23,700.

C) $21,000.

D) $26,400.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following correctly states the proper order of the accounting cycle?

A) Record transactions, adjust accounts, close temporary accounts, prepare statements.

B) Adjust accounts, record transactions, close temporary accounts, prepare statements.

C) Record transactions, adjust accounts, prepare statements, close temporary accounts.

D) Adjust accounts, prepare statements, record transactions, close temporary accounts.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

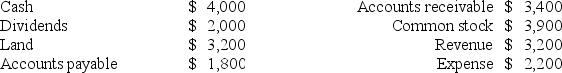

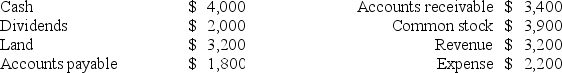

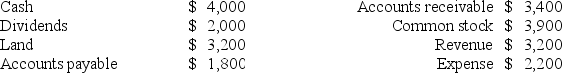

The following accounts and balances were drawn from the records of Carolina Company on December 31, Year 1:  The amount of Carolina's retained earnings after closing on December 31, Year 1 was:

The amount of Carolina's retained earnings after closing on December 31, Year 1 was:

A) $5,900.

B) $7,200.

C) $3,900.

D) $4,900.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following accounts and balances were drawn from the records of Carolina Company on December 31, Year 1:  Total assets on Carolina's December 31, Year 1 balance sheet would amount to:

Total assets on Carolina's December 31, Year 1 balance sheet would amount to:

A) $12,600.

B) $13,800.

C) $7,200.

D) $10,600.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Warren Enterprises had the following events during Year 1: The business issued $40,000 of common stock to its stockholders. The business purchased land for $24,000 cash. Services were provided to customers for $32,000 cash. Services were provided to customers for $10,000 on account. The company borrowed $32,000 from the bank. Operating expenses of $24,000 were incurred and paid in cash. Salary expense of $1,600 was accrued. A dividend of $8,000 was paid to the stockholders of Warren Enterprises. Assuming the company began operations during Year 1, the amount of retained earnings as of December 31, Year 1 would be:

A) $10,000

B) $8,400

C) $16,400

D) $42,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The recognition of an expense may be accompanied by which of the following?

A) An increase in liabilities

B) A decrease in liabilities

C) A decrease in revenue

D) An increase in assets

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Adjusting entries never affect a business's cash account.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A payment to an employee in settlement of salaries payable decreases an asset and decreases equity.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sheldon Company began Year 1 with $1,200 in its supplies account. During the year, the company purchased $3,400 of supplies on account. The company paid $3,000 on accounts payable by year end. At the end of Year 1, Sheldon counted $1,400 of supplies on hand. Sheldon's financial statements for Year 1 would show:

A) $1,600 of supplies; $200 of supplies expense

B) $1,400 of supplies; $2,000 of supplies expense

C) $1,400 of supplies; $3,200 of supplies expense

D) $1,600 of supplies; $3,400 of supplies expense

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The term "accrual" describes an earnings event that is recognized before cash is paid or received.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In the closing process, the amounts in temporary accounts are moved to net income, a permanent account.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Accounts that are closed include expenses, dividends, and unearned revenues.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following accounts would not appear on a balance sheet?

A) Service Revenue.

B) Salaries Payable.

C) Unearned Revenue.

D) Neither Service Revenue nor Unearned Revenue would appear on a balance sheet.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following accounts and balances were drawn from the records of Carolina Company on December 31, Year 1:  The amount of net income shown on Carolina's Year 1 income statement would amount to:

The amount of net income shown on Carolina's Year 1 income statement would amount to:

A) $2,200.

B) $3,200.

C) $1,000.

D) $200.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would cause net income on the accrual basis to be different from (either higher or lower than) "cash provided by operating activities" on the statement of cash flows?

A) Purchased land for cash.

B) Purchased supplies for cash.

C) Paid advertising expense.

D) Paid dividends to stockholders.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is true in regard to accrual accounting?

A) Revenue is recorded only when cash is received.

B) Expenses are recorded when they are incurred.

C) Revenue is recorded in the period when it is earned.

D) Revenue is recorded in the period when it is earned and expenses are recorded when they are incurred.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In uncertain circumstances, the conservatism principle guides accountants to:

A) accelerate revenue recognition and delay expense recognition.

B) accelerate expense recognition and delay revenue recognition.

C) recognize expense of prepaid items when payment is made.

D) delay both expense recognition and revenue recognition.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 77 of 77

Related Exams