B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The budgeting process that involves adding a month to the end of the budget period at the end of each month, thus maintaining a twelve-month planning horizon, is referred to as:

A) participative budgeting.

B) capital budgeting.

C) continuous budgeting.

D) zero-based budgeting.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hernandez Company expects credit sales for January to be $100,000. Cash sales are expected to be $60,000. The company expects credit and cash sales to increase 10% for the month of February. Credit sales are collected in the month following the month in which sales are made. Based on this information the amount of cash collections in February would be:

A) $166,000.

B) $160,000.

C) $170,000.

D) $176,000.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

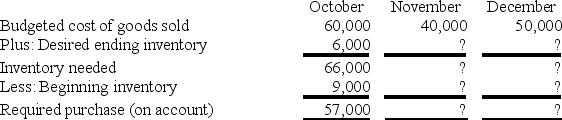

Sentra Sporting Company sells tennis rackets and other sporting equipment. The purchasing department manager prepared the inventory purchases budget. Sentra's policy is to maintain an ending inventory balance equal to 15% of the following month's cost of goods sold. January's budgeted cost of goods sold is $70,000.  What is the amount of cost of goods sold the company will report on its fourth quarter pro forma income statement?

What is the amount of cost of goods sold the company will report on its fourth quarter pro forma income statement?

A) $100,000

B) $50,000

C) $150,000

D) $162,300

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

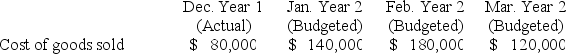

Payne Company provided the following information relevant to its inventory sales and purchases for December Year 1 and the first quarter of Year 2:  Desired ending inventory levels are 25% of the following month's projected cost of goods sold. The company purchases all inventory on account. January Year 2 budgeted purchases are $150,000. The normal schedule for inventory payments is 60% payment in month of purchase and 40% payment in month following purchase.

Budgeted cash payments for inventory in February Year 2 would be:

Desired ending inventory levels are 25% of the following month's projected cost of goods sold. The company purchases all inventory on account. January Year 2 budgeted purchases are $150,000. The normal schedule for inventory payments is 60% payment in month of purchase and 40% payment in month following purchase.

Budgeted cash payments for inventory in February Year 2 would be:

A) $132,600.

B) $152,600.

C) $99,000.

D) $159,000.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Select the incorrect statement regarding the cash budget.

A) The cash budget helps managers to anticipate cash shortages and excess cash balances.

B) Cash inflows and outflows indicated on the cash budget are reported on a company's pro forma statement of cash flows.

C) Cash payments may include outflows for inventory, selling and administrative expenses, and equipment purchases.

D) The total cash available is calculated by adding cash receipts and the ending cash balance.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Valley Farm Supply started the period with $80,000 cash. Cash receipts for January expected to total $350,000. Cash disbursements for January were expected to be $290,000. What is the expected cash balance at the end of January?

A) $290,000

B) $350,000

C) $80,000

D) $140,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a company's district managers submitted their preliminary budget proposals, top management discovered that the southern district manager had requested a new project management information system. Unfortunately, the system is incompatible with the system used at headquarters. Which of the following advantages of budgeting reduces the likelihood that the company will end up with two incompatible systems?

A) Planning

B) Coordination

C) Performance measurement

D) Corrective measures

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Select the correct statement.

A) The four advantages of budgeting include planning, coordination, performance measurement, and reporting.

B) In a participative budgeting system, budget information flows in one direction only, from bottom to top.

C) The three major categories of the master budget are operating budgets, capital budgets, and pro forma financial statements.

D) The accounting department normally coordinates the development of the sales forecast.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following accounts would appear on the sales budget and the pro forma income statement?

A) Selling and administrative expenses

B) Sales revenue

C) Accounts receivable

D) Both sales and accounts receivable are correct

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What information does the sales budget provide for pro forma financial statements?

A) Total budgeted sales to be used on the pro forma income statement

B) Cash collections from customers to be used on the pro forma balance sheet

C) The ending balance in accounts payable which appears on the pro forma balance sheet

D) All of the answers are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

If a company purchases its inventory on account, it need not prepare a schedule of cash payments for inventory purchases.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a benefit of participative budgeting?

A) Employees tend to be more motivated to achieve the budget.

B) A twelve-month planning horizon is maintained at all times.

C) Budget planning is highly centralized.

D) Communication is clearer because it flows in only one direction - upward.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

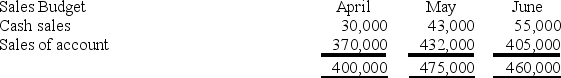

Bright Minds Toy Company prepared the following sales budget for the second quarter. Projected sales for each of the first three months of operations are as follows:  Bright Minds expects to collect 70% of the sales on account in the month of sale, and 20% in the month following the sale, and the remainder in the second month following the sale.

What is the ending accounts receivable balance that would be reported on the pro forma balance sheet prepared as of June 30?

Bright Minds expects to collect 70% of the sales on account in the month of sale, and 20% in the month following the sale, and the remainder in the second month following the sale.

What is the ending accounts receivable balance that would be reported on the pro forma balance sheet prepared as of June 30?

A) $164,700

B) $121,500

C) $283,500

D) $86,400

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would not be included in the cash budget?

A) Receipts from customers

B) Ending cash balance

C) Interest expense

D) Depreciation expense

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Budgeted sales commissions would appear on the:

A) selling, general and administrative budget and pro forma income statement

B) selling, general and administrative budget and pro forma balance sheet

C) sales budget and pro forma balance sheet

D) sales budget and pro forma income statement

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would represent the order in which most master budgets are prepared?

A) Sales, Income Statement, Cash, Purchases

B) Purchases, Cash, Sales, Income Statement

C) Purchases, Sales, Cash, Income Statement

D) Sales, Purchases, Cash, Income Statement

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would appear on a selling and administrative expense budget, but would not appear on a schedule of cash payments for selling and administrative expenses?

A) Cost of goods sold

B) Depreciation expense

C) Salary expense

D) Sales expense

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Interest expense is not included in the selling and administrative budget because a company cannot estimate interest expense until it prepares the cash budget and makes borrowing projections.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The budgeting technique that provides for employee input into the planning process is known as:

A) continuous budgeting.

B) perpetual budgeting.

C) participative budgeting.

D) zero-based budgeting.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 117

Related Exams