A) suboptimization.

B) strategic planning.

C) lowballing.

D) goal alignment.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

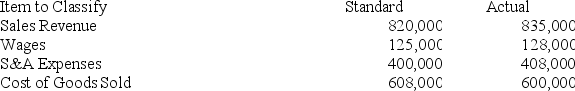

The sales revenue flexible budget variance was:

The sales revenue flexible budget variance was:

A) $15,000 unfavorable.

B) $7,000 favorable.

C) $15,000 favorable.

D) $7,000 unfavorable.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When would a variance be labeled as unfavorable?

A) When standard costs are more than actual costs

B) When expected sales are less than actual sales

C) When actual sales are equal to expected sales

D) None of these answers is correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Spark Company's static budget is based on a planned activity level of 45,000 units. At the same time the static budget was prepared, the management accountant prepared two additional budgets, one based on 40,000 units and one based on 50,000. The company actually produced and sold 49,000 units. In evaluating its performance, management should compare the company's actual revenues and costs to which of the following budgets?

A) A budget based on 40,000 units

B) A budget based on 45,000 units

C) A budget based on 49,000 units

D) A budget based on 50,000 units

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assuming actual volume is 10,000 units and planned volume is 12,000 units, the sales volume variance in units:

A) Equals 2,000 units unfavorable.

B) Equals 2,000 units favorable.

C) Cannot be determined without additional information.

D) None of these answers is correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The total sales variance includes both price and volume variances.

B) False

Correct Answer

verified

True

Correct Answer

verified

True/False

Sales volume variances are attributable to differences between planned and actual activity volumes, as well as differences in selling price.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding profit centers is correct?

A) A manager of a profit center has more responsibility than a manager of an investment center.

B) A manager of profit center is evaluated only on his/her ability to control costs.

C) A manager of a profit center is evaluated on his/her ability to control costs and generate revenues.

D) A manager of a profit center is responsible for assets, liabilities, and earnings.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When would a sales variance be listed as favorable?

A) When actual sales exceed budgeted or expected sales

B) When actual sales are less than budgeted or expected sales

C) When actual sales are equal to budgeted or expected sales

D) None of these answers is correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following reason(s) cause flexible budgets to be useful planning tools?

A) Flexible budgets allow managers to anticipate results under a variety of scenarios.

B) Flexible budgets can help determine if a company's cash position is adequate.

C) Flexible budgets can help managers judge if materials and storage facilities are appropriate for various production levels.

D) All of these answers are correct.

F) B) and D)

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

The New Products Division of Testar Company, has developed a potential new product that would require $8,500,000 in operating assets and would be expected to provide $1,400,000 in operating income each year. Testar has set a target return on investment (ROI) of 16% for each of its divisions. Which of the following statements is accurate?

A) The new product is acceptable because it will yield an ROI that is higher than the target ROI and will yield residual income of $40,000.

B) The new product will yield residual income of $45,000.

C) The new product will decrease the company wide ROI.

D) The new product is unacceptable because it will yield an ROI that is lower than the target ROI.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

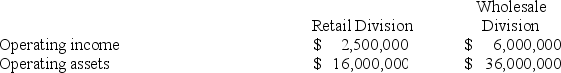

Terra Company has two divisions, the Retail Division and the Wholesale Division. The following information was gathered for the two divisions for the current year:  Terra Company has set a target return on investment (ROI) of 15% for both divisions Which of the following statements is accurate?

Terra Company has set a target return on investment (ROI) of 15% for both divisions Which of the following statements is accurate?

A) Residual income for the wholesale sales division was $100,000

B) Residual income for the wholesale sales division was $600,000

C) Residual income for the retail sales division was $600,000

D) None of these.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If Pascal Company's turnover (asset utilization) measure is 2.5 and its margin is 7.5%, its ROI is 18.75%.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If the master budget prepared at a volume level of 10,000 units includes direct materials of $40,000, a flexible budget based on a volume of 12,000 units would include direct materials of $48,000.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When would a sales price variance be listed as unfavorable?

A) When the actual sales price is less than the standard sales price.

B) When the actual sales price is equal to the standard sales price.

C) When the actual sales price is greater than the standard sales price.

D) When the actual sales volume is less than the budgeted sales volume.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

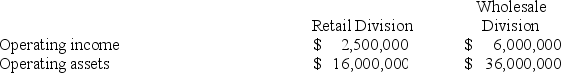

Retail Sales and Wholesale Sales are the only divisions of Terra Company. The following information was gathered for the two divisions for the current year:  The company has $1,200,000 in operating assets that are not assigned to either of the divisions and $500,000 in corporate expenses that are not reflected in the information above. Based on this information, what is the ROI for the company as a whole?

The company has $1,200,000 in operating assets that are not assigned to either of the divisions and $500,000 in corporate expenses that are not reflected in the information above. Based on this information, what is the ROI for the company as a whole?

A) 17.7%

B) 16.9%

C) 15.0%

D) The answer cannot be determined using the information provided.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Ferguson Company estimated that October sales would be 100,000 units with an average selling price of $6.00. Actual sales for October were 105,000 units and average selling price was $5.95. The sales revenue flexible budget variance was:

A) $5,000 favorable.

B) $5,000 unfavorable.

C) $5,250 favorable.

D) $5,250 unfavorable.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

When a comparison of static and flexible budgets shows an unfavorable sales volume variance, the variable cost volume variances will also be unfavorable.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

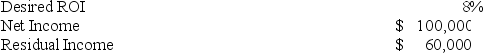

Fairpoint Products provided the following selected information about its consumer products division for the current year:  Based on this information, the division's investment amount was:

Based on this information, the division's investment amount was:

A) $500,000.

B) $1,250,000.

C) $750,000.

D) $2,000,000.

F) B) and D)

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

Which of the following statements regarding a balanced scorecard is correct?

A) A balanced scorecard includes several different performance measures that can be used to assess how well a business is accomplishing their mission.

B) A balanced scorecard includes financial performance measures such as ROI.

C) A balanced scorecard includes non-financial measures such as defect rates or on-time deliveries.

D) All of these are correct answers.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 116

Related Exams